IT Services Vendors in Insurance: 2024 Property & Casualty Edition

2024 Services Scape, Powered by VendorMatch

Abstract

In recent years, the P&C insurance industry has witnessed a significant transformation driven by technological advancements. As insurers strive to enhance operational efficiency, improve customer experience, and stay competitive in a dynamic market, the role of IT services has become increasingly crucial. The insurance industry widely adopts the practice of leveraging IT service vendors to optimise IT operations, harness the power of data analytics, and adopt emerging technologies, such as policy administration systems, claims management platforms, and other related solutions.

This report analyses the current landscape of IT services vendors within the P&C insurance sector, highlighting key trends, challenges, and opportunities that insurers face in this rapidly evolving digital era.

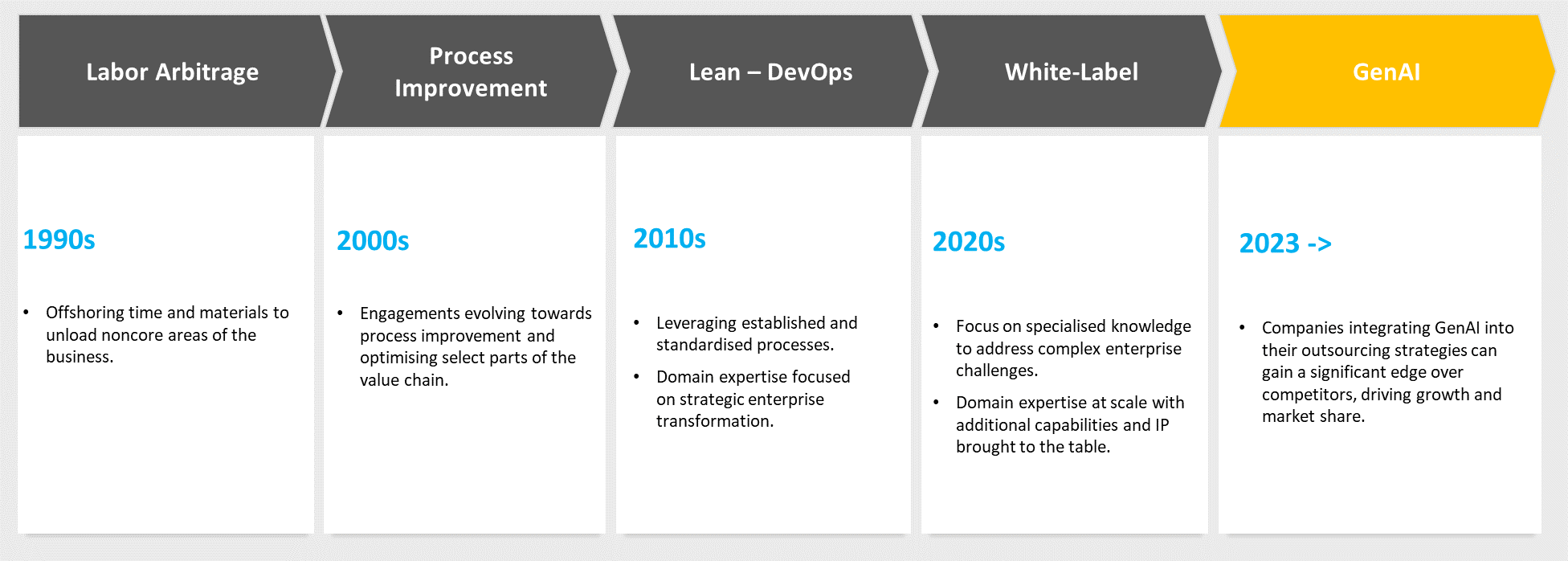

Over the years, the IT services industry has shifted significantly towards focusing on high-value engagement areas, moving away from the traditional staff augmentation approach. The emergence of Generative Artificial Intelligence (Gen AI) is poised to impact the industry profoundly. With its ability to generate human-like text, images, and even code, generative AI can revolutionise software development by rapidly generating code snippets, prototypes, and even complete applications based on user requirements. This capability enables faster software development and delivers solutions more efficiently than ever.

This is Celent’s fifth report profiling IT service vendors for the insurance industry. It covers 21 vendors around the globe who support property & casualty insurance companies: Avos Tech, BDT Global, Capgemini, CGI, Coforge, Cognizant Technologies, Comarch, DXC Technology, EPAM, EXL, GFT, Hitachi Digital Services, HTC IT services, LG CNS, Mphasis, NTT Data, Softtek, TCS, UST Global, Vega IT, Zensar.