The central role of the US economy, its currency, and its financial institutions have for a long time played a central role in facilitating trade and payments globally. In recent years, advancements in technology are making payments, including cross border financial flows, more and more frictionless. It also makes the US a prime target of money laundering. Up north, Canada has challenges of its own in combatting money laundering due to its relatively underdeveloped anti-money laundering (AML) regime and illicit flows from across the globe especially China.

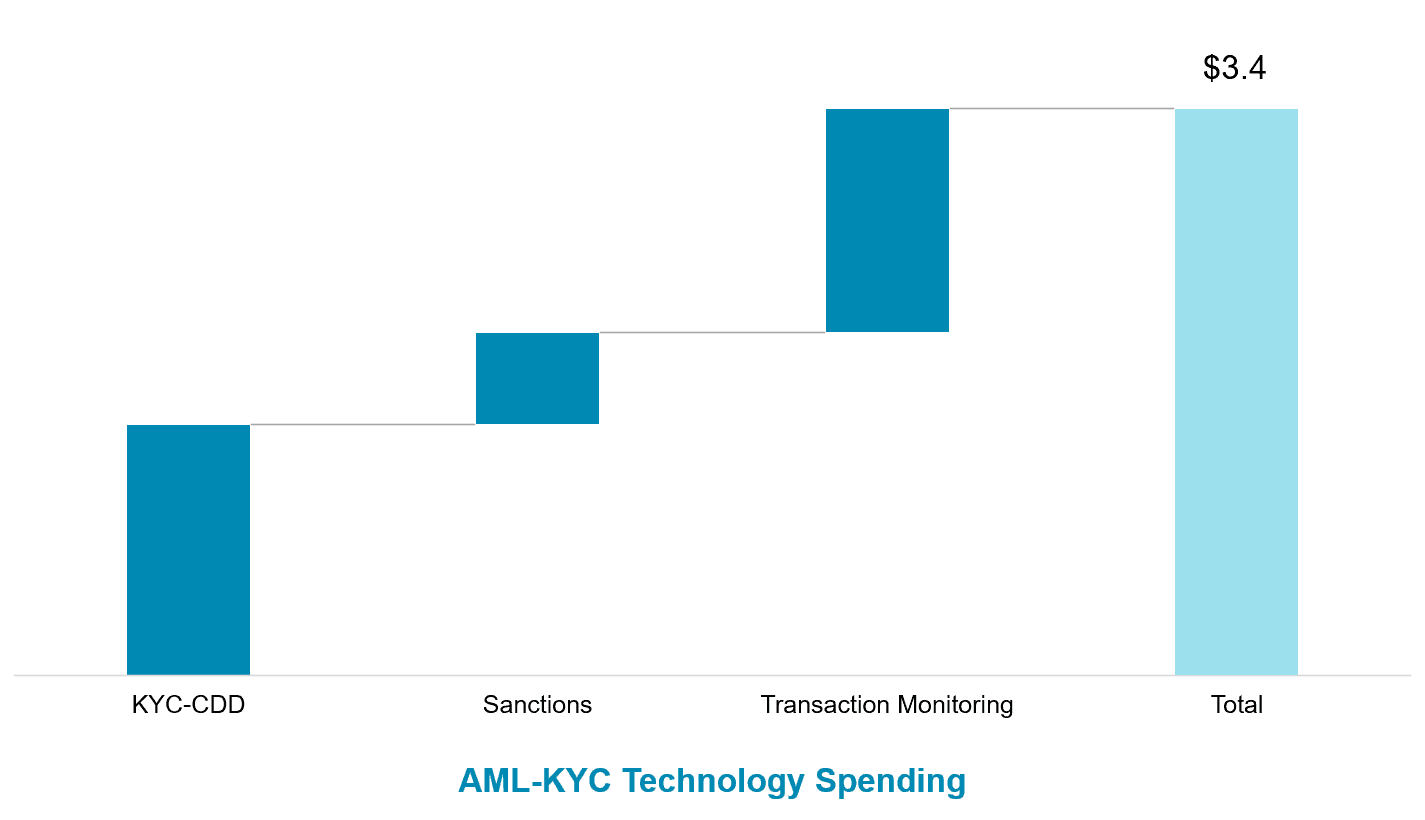

As regulators and political authorities in North America seek to reform and strengthen AML frameworks, financial institutions are facing new compliance requirements that are driving spending on AML and Know Your Customer (KYC) technology and operations. Celent estimates that spending on technology for AML-KYC compliance by North American financial institutions reached US$3.4 billion in 2019 ; spending on operations reached US$9.8 billion in 2019.

The future of North American AML operations will be driven by the regulatory and legislative agenda of modernizing the AML frameworks both in the US and in Canada. On the other hand, new technology will play a pivotal role in modernizing AML systems and processes at large banks. Smaller banks and non-banks will also grow their spending as regulatory scrutiny grows on those segments.

KYC-CDD Is The Biggest Driver of Technology Spending

Source: Celent. Figures in US$ billions.

This report provides Celent’s estimates of spending on AML-KYC technology and operations by North American financial institutions, including banks, insurance companies, broker-dealers, and wealth and asset management firms. The report presents North American spending estimates as well as detailed breakdowns of:

- Spending by global region: North America, Europe, Asia, and the rest of the world.

- Functional distribution of North American spending with focus on three key AML-KYC components: KYC-CDD, sanctions screening, and transaction monitoring.

- North American technology spending breakdown by: internal spending, hardware, external software, and external services.

- North American operational spending trends (in addition to technology spending).

- North American spending according to the type and size of financial institution.

- North American spending on new initiatives vs. run-the-bank maintenance activities.

- Historical spending growth trends in North America and estimates for future growth.

This is the fourth in a series of Celent reports analyzing spending trends in AML-KYC.

- The first report in this series titled IT and Operational Spending in AML-KYC: A Global Perspective was published in September 2019.

- The second report titled IT and Operational Spending in AML-KYC: A European Perspective was published in November 2019.

- The third report titled IT and Operational Spending in AML-KYC: An Asian Perspective was published in November 2019.