Dimensions: Latin America Wealth Management IT Pressures & Priorities 2024

Key research questions

- What priorities are driving wealth management technology spending in Latin America?

- What are the leading product and technology investment areas?

- How much focus are wealth managers putting on cloud infrastructure, AI, and generative AI?

Abstract

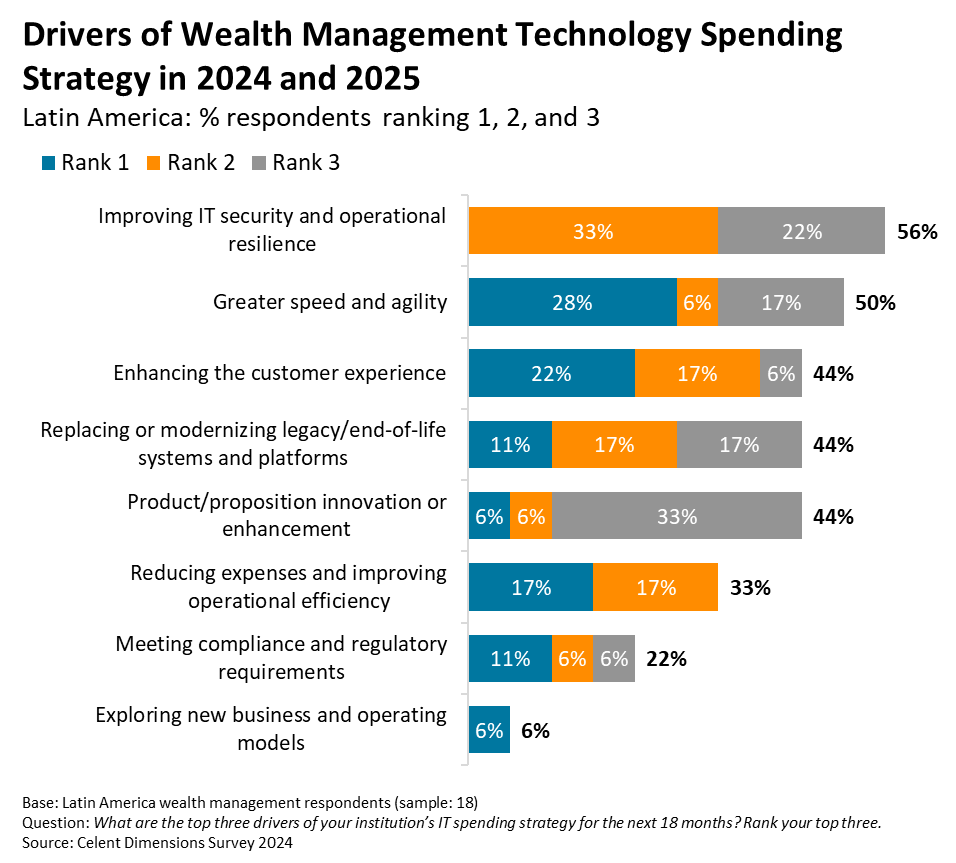

Wealth management executives across Latin America report accelerating technology budget growth in 2024 and 2025. Greater speed and agility, enhancing the customer experience, data analytics and insights, and targeting mass affluent clients are just a few of the most common technology and business priorities driving tech strategy in the region.

To shed light on the business pressures and technology priorities of the wealth management industry, Celent has completed its second annual global survey of senior wealth management executives: The Celent Dimensions Survey 2024. This Latin America edition captures the insights and opinions of 18 respondents from 5 countries in Latin America to provide an in-depth view into the drivers of IT spending across the industry, as well as the leading technology and investment priorities.

Key findings include:

- 67% of wealth management firms in Latin America report that delivering personalized client experiences is a core priority in 2024.

- 44% of firms are either live, piloting, or experimenting with generative AI.

- 43% of wealth managers' IT budgets go to the front office—the largest allocation area.

- 28% of executives report that greater speed and agility is their single biggest driver of IT spending strategy—the most of any answer (see the blue bars in the chart below).

- 5.8% year-over-year growth in IT budgets is projected for the region in 2025, on average, which will be the third consecutive year of elevated spending growth.