Small Business Digital Banking Platforms: North America Edition - Solutions for Community Financial Institutions

2022 xCelent Awards, Powered by VendorMatch

Abstract

The sun has been rising on the small business front. New data from the Small Business Administration Office shows that the number of small businesses increased 7% since 2020, up to 33.2 million. Celent research shows that small business loans grew 13% (2019-2021 CAGR). The game is on to win these new businesses through superior digital engagement.

Digitalization of small business engagement has come a long way over the past two years. While commoditization has marched on, Celent finds that there is still room for banks to differentiate. For those banks that are striving to raise their digital bar, we have undertaken a robust vendor analysis of small business digital banking platform vendors serving community financial institutions.

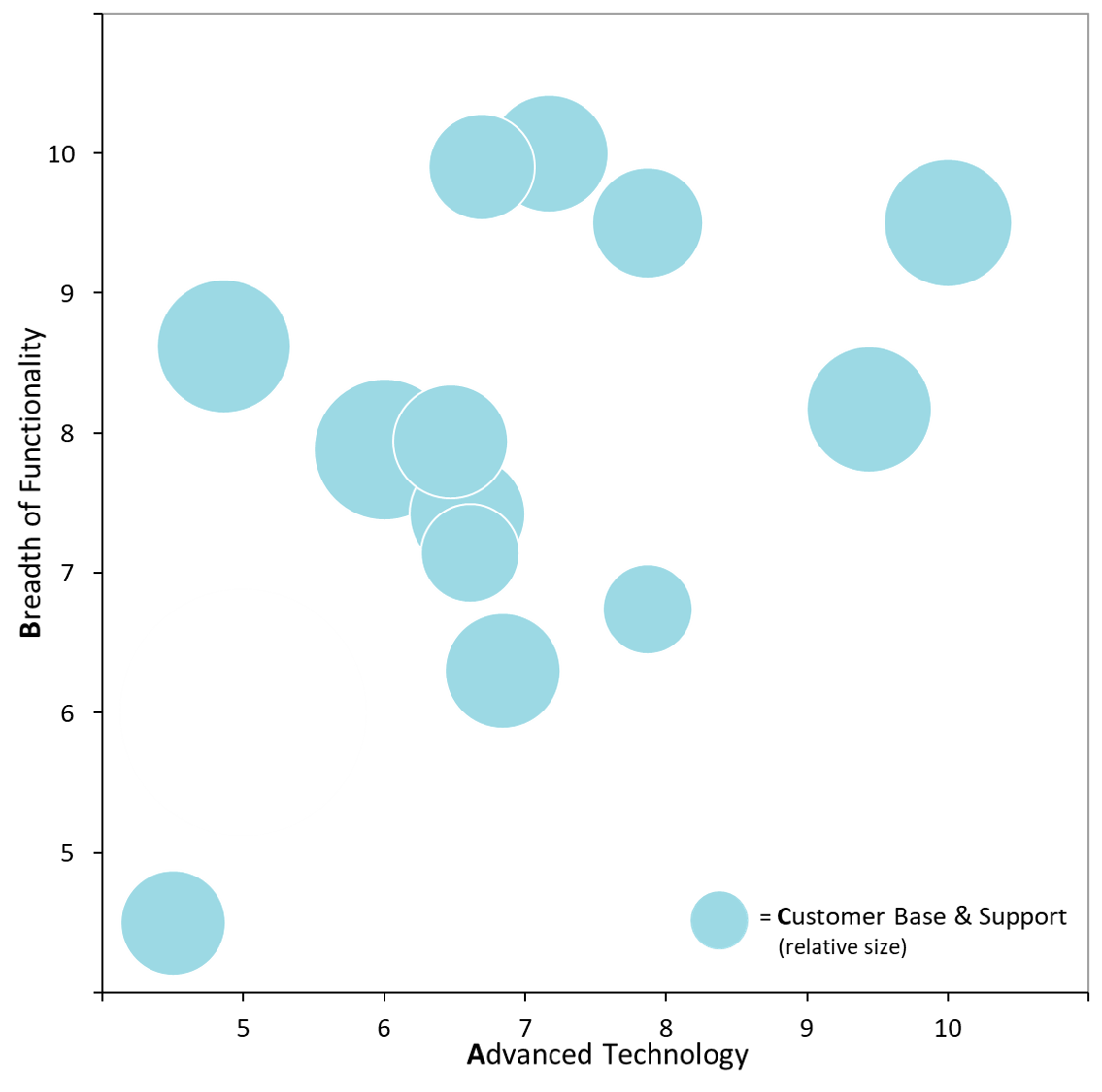

To help financial institutions better understand the vendor landscape and compare vendors, Celent developed its ABC methodology, which positions and awards vendors across three dimensions: Advanced Technology, Breadth of Functionality, and Customer Base and Support. Our methodology offers unrivaled comparative analysis across these critical decision dimensions. The figure below arrays the vendors that are included in this Edition along the A, B, and C (bubble) dimensions.

Leveraging Celent’s VendorMatch to gather extensive RFI information from each vendor, this Celent report evaluates 13 vendors and 14 solutions: Access Softek, Alogent, Apiture, Bottomline Technologies (partial analysis), CSI, Dragonfly Financial Technologies, Finastra, FIS, Fiserv (Architect and Corillian/Mobiliti), Narmi, NCR, Q2, and TCS.