Markets among largest allocation, modernization efforts doing well, Securities Services sees significant decrease in cost per trade

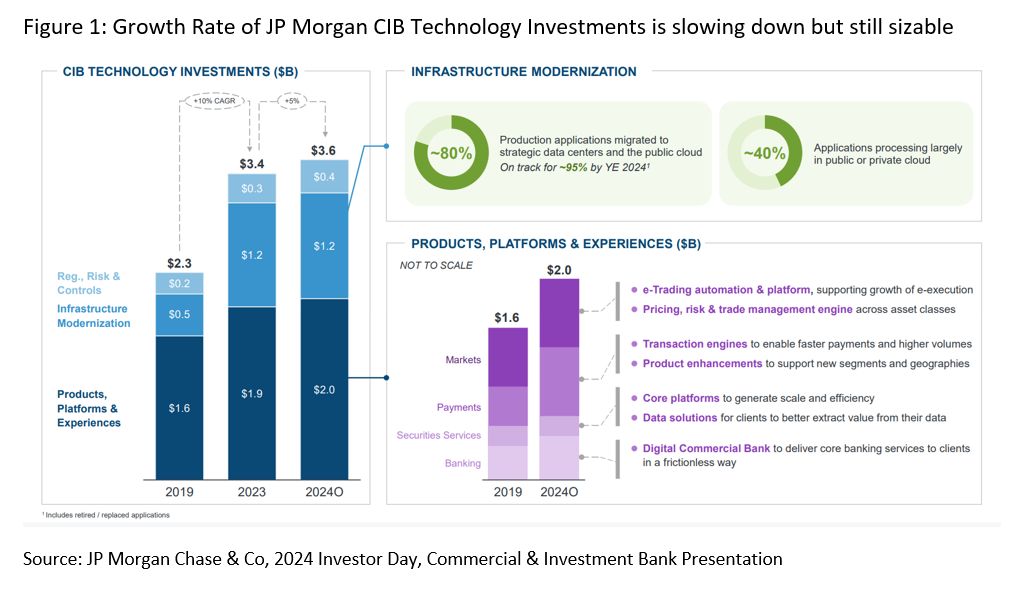

Despite uncertain macroeconomic conditions, JP Morgan Chase is committed to increasing technology investment for its Commercial & Investment Banking (CIB) division and is seeing a ROI. Across CIB, where Markets sit, the bank is increasing annual technology investment by ~5.9% to a total of $3.6B for 2024. While tech investment has been increasing for some time, its growth rate has slowed as compared to the 2019-23 CAGR of +10%. This continued growth around tech spend aligns with Celent’s 2024 Dimensions survey findings for sell side firms, with respondents telling us they expect to increase technology budgets this year by a global average of 4.5%.

The bulk (~$2B) of JPM’s CIB technology investment this year is on “Products, Platforms and Experiences”, which serves a mix of business divisions across CIB, including Markets, Payments, Securities Services, and Banking (Investment Banking and Lending). Of the remaining investment, $1.2B is focused on “Infrastructure Modernization” and $0.4B on “Reg., Risk & Controls”.

Although JPM did not release detailed breakdowns of technology investment across its CIB subdivisions, a slide shared in connection with its 2024 Investor Day (see Figure 1 below) indicated that Markets and Payments receive the biggest allocation of technology investment, followed by Banking and then Securities Services.

For the Markets division, “Products, Platforms and Experiences” support the growth of e-execution (e-trading automation & platform) and its pricing/risk/trading management engine across asset classes. Meanwhile, Securities Services’ tech investment is focused on core platforms to generate scale and efficiency and data solutions, for clients to better extract value from their data.

Tech investment appears to be paying off. JPM’s infrastructure modernization investments are progressing well across both CIB and Asset & Wealth Management (AWM) divisions. The company is on track to have ~95% of production applications across CIB and ~99% across AWM migrated to strategic data centers and the public cloud by year end 2024. Application processing in public or private cloud is currently at about ~40% for CIB and 60% for AWM. This also aligns with Dimensions findings indicating Tier 3 firms are playing catch up around legacy modernization while Tier 1 firms (and to lesser extent Tier 2s) can prioritize focus (and resources) elsewhere.

For Securities Services, standout metrics included a reduction in cost per trade across trading services (lending & collateral solutions for portfolio optimization and management) of 74% between 2019 and 2023, and AUA up 95% in the same period across its alternatives offering. A "refocus on ROI" was one of Celent's key business themes driving technology investmetn for 2024 (see Celent's Capital Markets 2024 Previsory Webinar here)

The Markets offering services a variety of client types globally including asset and wealth managers, hedge funds, banks/insurance/public sector, and corporates. Most of its clients (~60%) are trading 4+ products.

Markets FY 2023 revenue ($28B) is the largest across the CIB sub-divisions, contributing over half of overall CIB revenues of $49B. This division is looking to financing, e-Trading, energy, and private credit for growth.

Securities Services’ (which offers custody, fund services, trading services, data solutions) had revenue of $4.8B FY2023. Securities Service’s sees growth around alternatives, middle office, and Fusion, its data management and analytics platform, a cloud-native solution for institutional investors.Fusion hosts the recently launched Securities Services Data Mesh for institutional investors which leverages Snowflake Financial Services Data Cloud as well as other cloud-native channels such as REST APIs and Jupyter notebooks.

By comparison, Asset Management (which sits outside CIB as part of JPMC’s AWM division, representing Global Funds and Global Institutional), had revenues of $9B.

Strategic priorities for growth at JPMC include expanding product offerings. The company also highlighted its investment in modern infrastructure and practices as positioning the bank to benefit from opportunity with Generative AI; priority AI/ML use cases across CIB include risk management, workflow automation, fraud detection and client intelligence.

For highlights of Celent’s Dimensions: IT Pressures & Priorities survey-based reports, register for free webinars here. Celent subscribers will soon be able to access reports sharing more insights across both buy side and sell side capital markets respondents, with additional reports focused on post trade results and geographic cuts (buy side only). Celent has also recently published several reports on GenAI use cases across capital markets, and insights around the embrace of nextgen tech in the alternatives and private markets space.All of these, and more can be found on the Celent website.