パブリック・クラウドの導入は、多くの業界で順調に拡大している。しかし、金融機関のクラウド導入は遅れている。その理由は、金融顧客の大量の機密情報を保有しているため、金融機関は厳しい規制の下に置かれているからである。情報セキュリティ、リスクとコンプライアンス、エコシステムの管理/ 統合/ 管理に対する金融機関の優先度は非常に高い。その結果、現在パブリック・クラウド上の多くの銀行アプリケーションは、ミッション・クリティカルではなく、コア・システムやデータベースを直接公開していない。

金融機関のコンピューティング環境のごく一部に過ぎなかったクラウド・コンピューティングが、主流のコンピューティング・パラダイムへと成長するにつれ、企業全体への影響が大きくなっている。業務プロセス、人材要件、テクノロジーの構造的な変化により、ステークホルダーはテクノロジーを通じて価値を提供する方法を再考する必要がある。

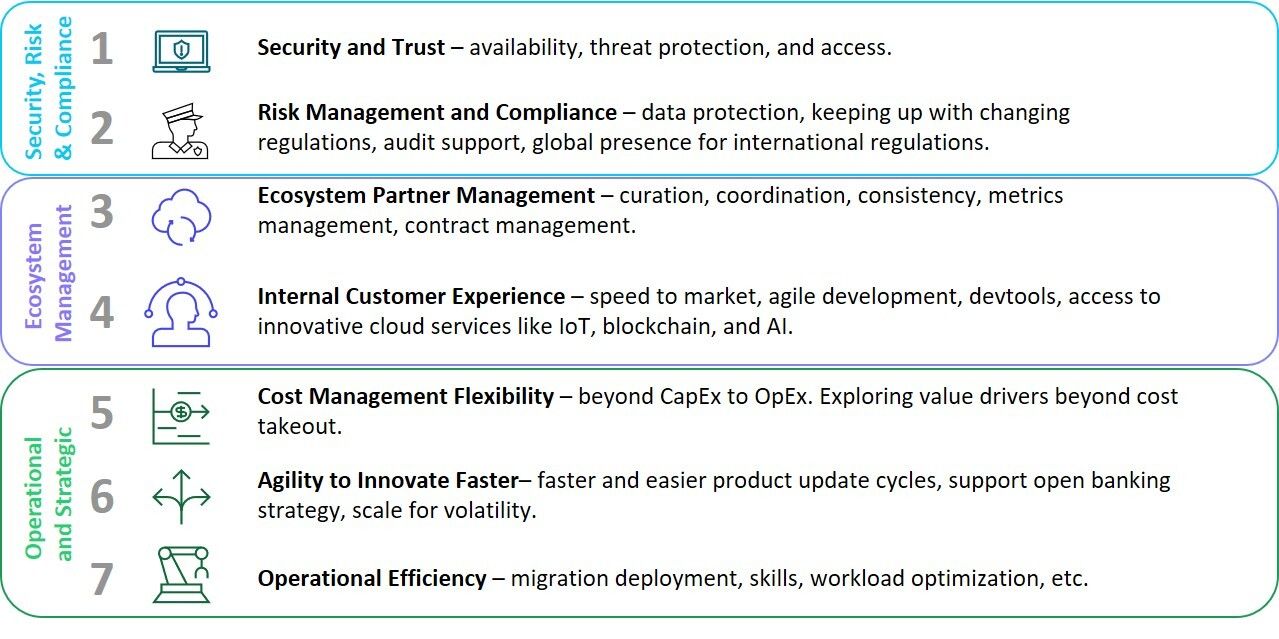

このように変化する戦略的転換に対応するため、セレントはCIO、CISO、CRO、事業部門のステークホルダーが考慮すべき7つの重要事項を明らかにした。以下の図では、「セキュリティ、リスク、コンプライアンス」「エコシステム管理」「現在の運用と戦略計画」の3つのカテゴリーに分けて、これらの検討事項の概要を示している。

クラウド導入には多くのルートがあり、特定の重要でないアプリケーションをゆっくりと導入する金融機関もあれば、アプリケーション・エコシステム全体を対象に全面的なクラウド移行戦略を実施する金融機関もある。導入ルートに関わらず、移行プロセスの成功を左右する検討事項がある。ビジネスケースは明確であり、銀行はこのレポートを出発点として、最終的にパブリック・クラウドへの移行作業を最大限に成功させる課題に取り組むべきである。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)