Risk Management Business and IT Outlook 2017: Traversing the Politics of Identity, Industrialization, and Innovation

Key research questions

- What expectations lie ahead for the risk environment in the near term?

- What strategic risk management IT imperatives do firms need to focus on this year?

- What are the important strategies for success to navigate and exploit current market dynamics?

Abstract

Risk management and compliance capabilities are next in line to ride the innovation wave.

Celent has released a new report titled Risk Management Business and IT Outlook 2017: Traversing the Politics of Identity, Industrialization, and Innovation. The report was written by Cubillas Ding, a Research Director with Celent’s Securities & Investments practice.

The shift towards more intrusive, fragmented and data-intensive regulatory regimes requires firms to push the envelope to achieve economies of scale, operational consistency, and transparency to be embedded as much as possible in financial services business models. Alongside the weight of industry reform focused on risk, capital, and compliance requirements, financial institutions face a new world where the forces of industrialization and innovation intermingle, set against potential fallouts from the recent tide of identity politics around populism and nationalism. Macropolitical and social risks are now important considerations for risk managers.

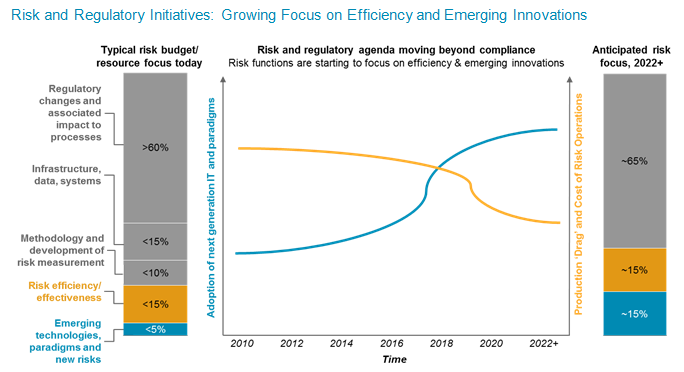

Not immune to the broader cost reduction agenda, risk and compliance functions are required to align to a bank’s strategic responses and contribute to firmwide efficiency and cost-cutting targets, with the near-term focus on keeping regulators at bay and keeping the lights on. More institutions are pursuing efforts to reduce inefficiencies in risk and compliance activities, and to optimize an institution's total cost of risk. The “industrialization of supply chains” — risk data, risk models, and information production and reporting processes — will require firms to invest in emerging innovations, technologies, IT paradigms, and fintech partnerships in order to achieve a meaningful step change.

“RiskTech and RegTech players are entering this space in earnest, while forward-thinking financial firms are looking for innovation-enabled change to respond to regulatory and risk management challenges and ongoing cost pressures,” says Ding.

“However, the road ahead entails being pragmatic in managing real tensions between regulatory conservatism around issues of risk and compliance, balancing business-as-usual commitments, and executing smart tactics in adopting new innovations,” he adds.

In this report, Celent provides an updated view on where firms stand at the current juncture around risk and regulatory initiatives, and how to respond in the near to mid-term horizon.