Family banking delivers win-win value to families and their financial institution primarily through ongoing digital customer engagement. It is an example of engagement banking.

Much more than a financial services product, family banking centers the customer experience around family rather than each individual. At its core, family banking brings role-based capabilities to everyday banking in the form of a shared experience built around two use cases: parents and their young children (youth); and seniors and their caregivers (senior).

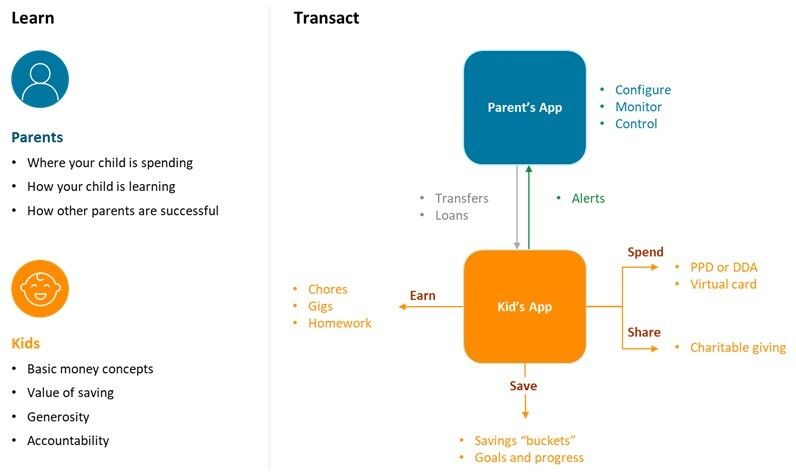

Family Banking in a Nutshell

The premise driving both use cases is that both the young and old benefit from the oversight and occasional intervention of a trusted guardian. This is true broadly and is certainly true in financial matters. Youth-oriented family banking puts digital banking and payments capability in the hands of youth via their own mobile apps, while providing parents the control and oversight they need to coach their kids in wise money management through their own apps.