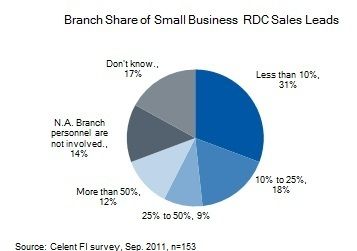

What do remote deposit capture (RDC) and remote cash capture (RCC) have in common? Among other things, both RDC and RCC, treasury management products in most banks, can contribute much needed retail bank cost reductions. But, remarkably few banks are enjoying the benefits. Is it because the right hand doesn’t know what the left hand is doing? In conducting research for an upcoming report, I interviewed a number of treasury management product managers responsible for remote cash capture initiatives. RCC describes the deployment of secure, validating currency accepting and recycling equipment (a.k.a. smart safes) at merchant locations coupled with information reporting and provisional credit mechanisms. Merchants deposit excess cash into smart safes and receive daily, provisional credit on the deposits. There are a bevy of merchant benefits by so doing. One benefit is the reduction in deposit activity. An individual store might go from daily, manual deposits to once per week under an RCC scenario. Most merchant locations make cash/coin deposits to a local branch. RCC invites the use of armored couriers instead. Thus, RCC can siphon considerable cash volume away from participating bank branches (where cash is handled manually for the most part) into cash vaults (where cash handling is highly automated). From a cash logistics perspective, RCC represents the best of both worlds. Cash is processed where it can be done most efficiently, branch personnel can focus on sales and service activity, and the bank receives fee income to offset its loss of working capital. Yet, only one bank of the nine interviewed recognized the retail bank benefits of RCC in developing its business case. Only one articulated RCC’s place in its overall currency management plan. The others viewed RCC through the narrow lens of its product P/(L) and nothing more. I’m not here to criticize these product managers. They’re doing exactly what they are paid to do. My criticism lies with senior management for failing to leverage synergies between the retail and wholesale lines of business. This is not an isolated occurrance. RDC offers a slightly less odious example. In a Celent survey among US financial institutions in September, 2011, the vast majority indicated that they offered RDC to treasury management and small business customers alike. So far, so good. Small businesses aren’t known to be great wholesale lockbox clients. Instead, most deposit at the local branch, and many do so simply to make check deposits. Perfect RDC candidates in other words, who self-select by their frequent visits to the local branch. Seldom are product prospects so accommodating. One would think most banks train tellers to recommend RDC to these clients. I wish it were so. Among those who utilize branch staff as part of RDC sales efforts, nearly half indicated that branch originated sales leads accounted for less than 25% of all RDC leads. And, like RCC, rare is the bank that connects the dots between small business RDC usage and the opportunity to reduce branch infrastructure costs.  I don’t suggest that the primary strategic intent in either RDC or RCC lies in cost reduction. Far from it. These examples simply serve to highlight lost opportunity through myopia. We all do it to varying degrees. As small as Celent is, we fail to leverage synergies among our banking, insurance and securities practice areas. We need to train ourselves to look for these opportunities by regularly stepping back to gather a larger view of our businesses and operating practices. Along with occasionally seeking the help of a third party who might provide a fresh perspective. Celent is rather good at that. We just need to learn how to do it for ourselves.

I don’t suggest that the primary strategic intent in either RDC or RCC lies in cost reduction. Far from it. These examples simply serve to highlight lost opportunity through myopia. We all do it to varying degrees. As small as Celent is, we fail to leverage synergies among our banking, insurance and securities practice areas. We need to train ourselves to look for these opportunities by regularly stepping back to gather a larger view of our businesses and operating practices. Along with occasionally seeking the help of a third party who might provide a fresh perspective. Celent is rather good at that. We just need to learn how to do it for ourselves.