Technological change within the capital markets industry is inevitable. The question is how are firms coping with this everchanging environment and what is driving their IT investments? Celent’s Dimensions survey captured the views of more than 200 executives across the capital markets sell-side and buy-side. The survey covered a plethora of topics, including IT investment drivers, AI/GenAI adoption, and how financial institutions’ IT budget priorities are evolving year after year.

On the latter note, Celent’s latest research found IT budgets are expected to grow for yet another year, with the average change in IT budgets in 2024 estimated at +4.1%. Keep an eye out for our upcoming Dimension reports, including a more in-depth analysis of these budget changes.

Top strategic drivers for IT investment

We asked the survey respondents to rank their top three drivers of IT strategy in 2024. The survey results showed that there was not a great deal of consensus across answers with only “meeting compliance and regulatory requirements” being selected by a majority (57%) of sell side respondents. However, it could be argued that firms do share common goals due to the limited differences between the top three drivers overall. It is no surprise that meeting compliance and regulatory requirements remains a top driver, with numerous initiatives underway, for example, T+1 in North America, EMIR Refit and Mifid 3 across Europe, and Basel 3 endgame globally. The technology landscape is ever evolving, requiring firms to be agile and implement flexible technology solutions.

The buy side’s leading strategic driver of IT investment is enhancing customer experience, 46%. This is likely driven by increased customer demand for personalized/customizable products and services. The industry is developing innovative solutions to meet these needs, such as the initiative created by Fidelity International which won Celent’s Model Buy Side Award this year.

Both of the top overall drivers for the buy and sell side, regulatory change and enhanced customer experiences, align with research by Celent, and were both identified as key business themes driving technology investment in our Tech Trends Previsories earlier this year. The previsory analyzes five key trends we predict will shape the industry this coming year.

Gen AI in Capital Markets

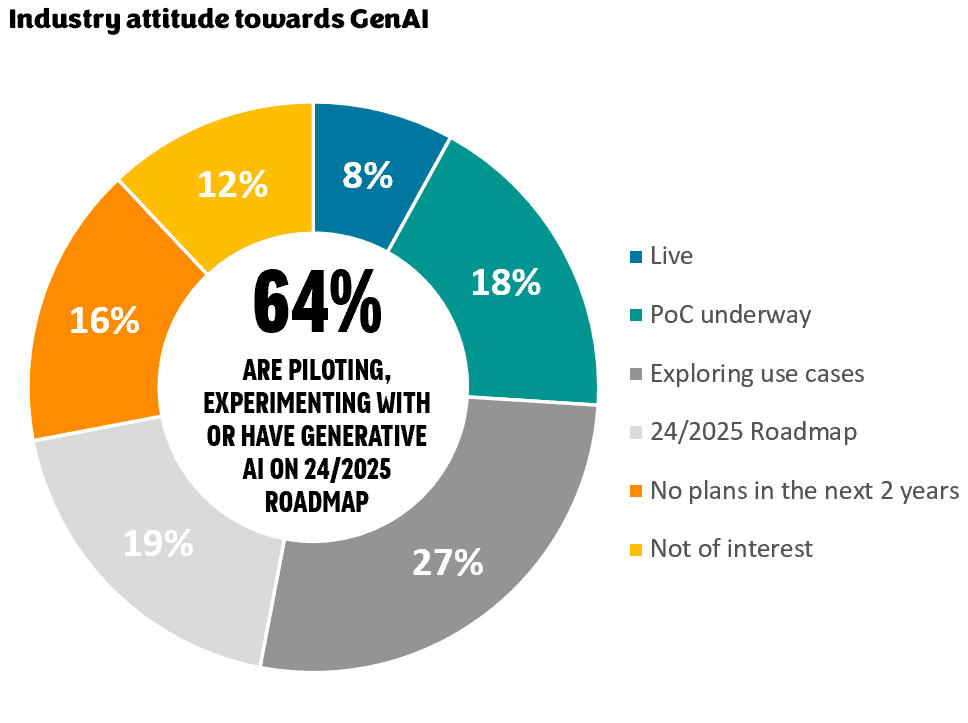

Given the current interest in Gen AI, we thought it necessary to investigate respondents' attitudes towards the implementation of Gen AI in their organization. The survey contained various questions regarding Gen AI to help us better illustrate and analyze the industry’s view.

The survey results showed Gen AI to be in the top three of technology priorities for both the buy and sell side (#1 buy side and #3 sell side). Although there are limited ‘live’ use cases of Gen AI across the industry, the data shows a keen interest in exploring this technology with 64% of survey respondents stating that they are experimenting with, have PoC’s underway, or have Gen AI on their 2024/25 roadmap.

If you are interested in learning more about the implementation and impact Gen AI is set to have on the capital markets industry, take a look at GenAI-oneers in Capital Markets.

For more insights from our Dimensions survey, watch the Capital Markets webinar recording and download the presentation. Detailed reports are coming soon.