Managing Sustainability Risk Across Your Firm through Technology and ESG Analytics

Celent recently hosted an in-person event, Navigating Turbulence, in New York City. I had the great opportunity to lead the ESG and Sustainability session: Managing Sustainability Risk Across Your Firm through Technology and ESG Analytics.

The global interest in ESG and Sustainability has gained substantial momentum in recent years, despite having these investing frameworks around for decades. What is important to note, is that this interest is against the backdrop of a new era of financial services:

Firstly, the way we invest (e.g., through direct indexing, fractional shares, zero commissions) and what we invest in (e.g., crypto, alts, sustainable products), and how we do it (e.g., self-directed, hybrid, or full service), are challenging the industry to evolve.

Secondly, there is a change in the core client base (e.g., the democratization of wealth management, and to a certain extent, the convergence across asset management and wealth management, and wealth management with banking products and services). The demand for personalization across the client base is a dominating narrative.

Lastly, these tectonic shifts are underpinned by the implementation of modernized technology, which is facilitating connectivity, operational efficiencies, scalability, and transparency.

Celent’s parent company, Oliver Wyman, determined that global ESG AuM is expected to grow at a rate of 25% from 2022-2025. To put this into context, the growth rate for other asset classes is around 5% for the same period. There are also regional differences within the ESG and Sustainability market, with the US market growing faster than the EU, but the US market is significantly smaller than that of the EU. ESG-driven investing is an evolving space; there are best practices that can be learned from other regions, financial institutions, and service providers.

The industry has made good progress navigating the challenges related to ESG and Sustainable investing. However, the industry struggles with Greenwashing and a lack of global, cohesive regulatory frameworks. Emerging and sophisticated technologies are helping to mitigate some of those challenges by moving the needle on transparency and data objectivity. Examples of these technologies include:

The industry has made good progress navigating the challenges related to ESG and Sustainable investing. However, the industry struggles with Greenwashing and a lack of global, cohesive regulatory frameworks. Emerging and sophisticated technologies are helping to mitigate some of those challenges by moving the needle on transparency and data objectivity. Examples of these technologies include:

-AI and machine learning for document handling, data management, transparency of analytics

-Cloud for highly scalable computing power, e.g., to support scenario forecasting simulation

-Integration of technology to make an end-to-end platform: data, analytics, compute, compliance

-Future use cases for LLMs to enhance data contextualization

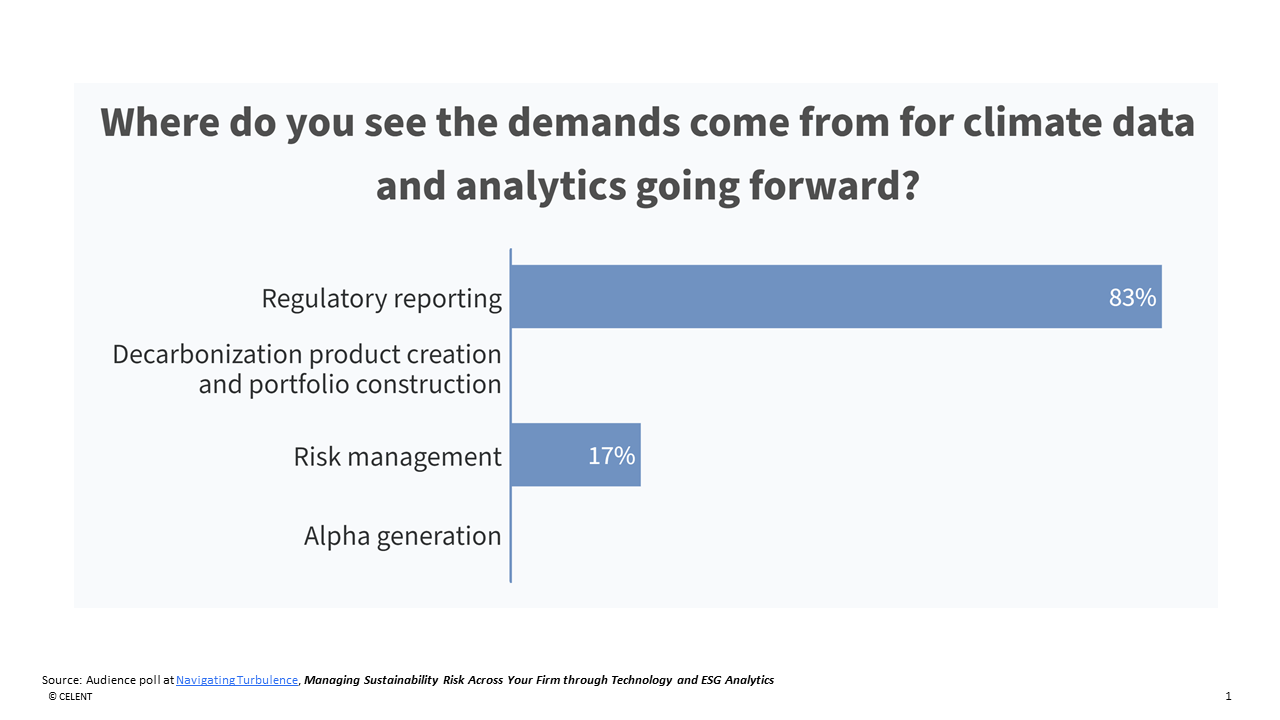

The lack of standardized ESG regulations pose a serious challenge for the adoption of ESG-driven investing. ESG data has been available for decades, but there is a lack of a common approach on how to emphasize materiality, such as the financial impact or social impact. Much reporting is self-reported, unaudited, untimely, and based on estimates. Another critical hurdle is the polarization of ESG and Sustainability in the US, making it hard to agree on common standards at a global level. Reputational risk is a key driver for firms, and it could possibly help create a common standard for ESG and Sustainability reporting.

The future of ESG and Sustainability hangs in the balance as the industry waits for regulatory standardization at a global level. I will be writing a Vendor Analysis report on this topic later this year, which is available to Celent wealth management subscribers.

The future of ESG and Sustainability hangs in the balance as the industry waits for regulatory standardization at a global level. I will be writing a Vendor Analysis report on this topic later this year, which is available to Celent wealth management subscribers.