What Makes USAA Unique?

12 November 2012

Bart Narter

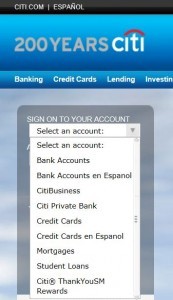

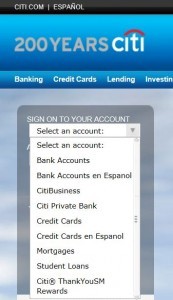

USAA was kind enough to invite me with other opinion leaders to spend a couple days at their headquarters in San Antonio at their expense. I was impressed, not by the hotel, but by the way USAA punches above its weight, especially on digital channels. They were the among the first out with mobile remote deposit capture, and do an outstanding job of integrating across lines of business. Why is this?  Citi lines of business[/caption] Capital One

Citi lines of business[/caption] Capital One  First Republic [caption id="attachment_3205" align="alignleft" width="300"]

First Republic [caption id="attachment_3205" align="alignleft" width="300"] First Republic Lines of Business[/caption] USAA

First Republic Lines of Business[/caption] USAA  The difference is telling. I’ve heard rumors that USAA may open up its membership to a much broader audience. On one hand I hope it is true. I think it would raise the game. On the other, I hope it’s not, because it would dilute the culture that drives USAA to really excel in its chosen niche.

The difference is telling. I’ve heard rumors that USAA may open up its membership to a much broader audience. On one hand I hope it is true. I think it would raise the game. On the other, I hope it’s not, because it would dilute the culture that drives USAA to really excel in its chosen niche.

- USAA feels more like a credit union than a bank. Actually it is more of an insurance company than a bank, but that is different tangent, and one in which I have no expertise. Customers are called members and surplus profit is returned to the member owners, much like a credit union. As Bob Meara has documented in his excellent report on branch transformation, credit unions tend to invest more in automation than banks. When banks ask, “What is the ROI?”, credit unions ask, “Does it improve member service?”

- In order to be a member, one must have some sort of tie to the US military: either active duty, honorably discharged, or a close relative. So USAA has a clear target market, which has specific needs. Their members are geographically dispersed across the globe, which places some unique requirements on USAA. And USAA understands these requirements viscerally; nearly one in five employees is a Veteran. USAA’s celebration of Veterans Day goes above and beyond what you would find at most other institutions, by an order of magnitude. While I don’t generally write about such non-technical topics such as corporate culture, it is absolutely palpable at USAA. Providing financial services, to members of the US armed forces is a mission, and pursued with a missionary like zeal.

- USAA has no, or today, very few branches. The difficulty in setting up a USAA branch near members stationed in Afghanistan, for example, forces USAA to think about how to serve their members via digital / non-branch channels. I say non-branch because USAA allows members to deposit checks at around 2,000 UPS stores. It is a non-branch channel, but involves brick and mortar. Since USAA isn’t investing in brick and mortar, they can invest more in digital.

- Active duty soldiers don’t bring PCs with them on deployments. They do have smart phones. It is my perception that the active duty service member is the most revered customer, though likely the least profitable. This drives innovations in mobile.

- LOB silos are much less pronounced due to the strong member service culture. USAA has an integration layer across the banking, insurance, and investment product lines and ties this all together with a single CIF. Now we get to the techie side and what it means for products and customers. Let’s compare what Citi, Capital One, First Republic, and USAA—all respected financial institutions --- are able to do to achieve the 360 degree view of the customer on their Internet sites.

Citi lines of business[/caption] Capital One

Citi lines of business[/caption] Capital One  First Republic [caption id="attachment_3205" align="alignleft" width="300"]

First Republic [caption id="attachment_3205" align="alignleft" width="300"] First Republic Lines of Business[/caption] USAA

First Republic Lines of Business[/caption] USAA  The difference is telling. I’ve heard rumors that USAA may open up its membership to a much broader audience. On one hand I hope it is true. I think it would raise the game. On the other, I hope it’s not, because it would dilute the culture that drives USAA to really excel in its chosen niche.

The difference is telling. I’ve heard rumors that USAA may open up its membership to a much broader audience. On one hand I hope it is true. I think it would raise the game. On the other, I hope it’s not, because it would dilute the culture that drives USAA to really excel in its chosen niche.