プライベート市場への継続的な資本流入と拡大によって、公的セクターと民間セクターの境界が曖昧になっている今日の投資環境は変化し続けている。プライベート市場の運用資産(AUM)は、2023年から年平均成長率(CAGR)11.4%で成長し、2028年には25兆ドルを超えると予想されている。

個人投資家の需要が、これからのプライベート市場の成長の主要原動力となることが予想されており、製品イノベーションによるアクセス向上、テクノロジーの強化、高効率のディストリビューション戦略が、市場の流れに乗るために不可欠な要素であり続けることは確かである。次の成長段階においてプライベート市場が成功するためには、信頼性の高い運用基盤、データ機能の強化、革新的なテクノロジーアプローチが必須となる。

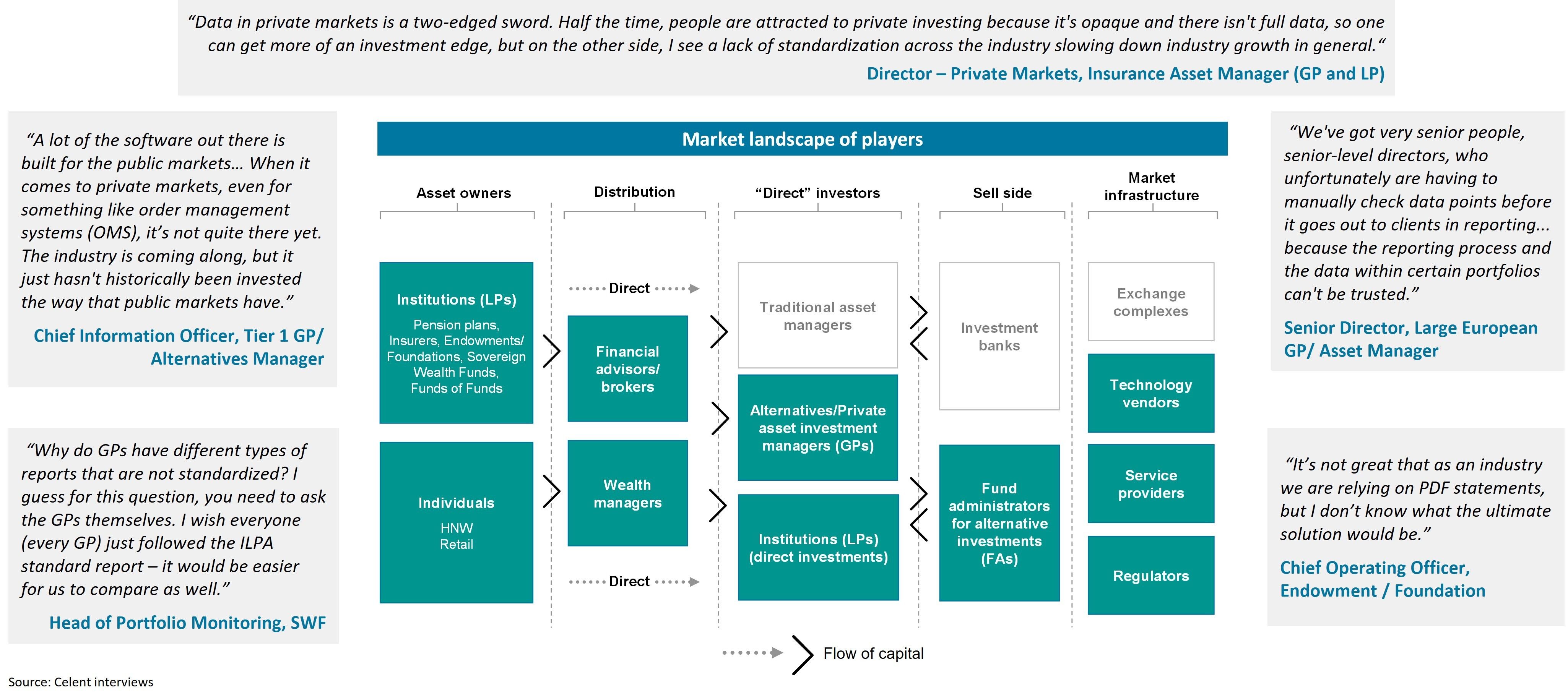

本調査における市場についての情報から、企業が力を入れているのが、効率性の向上と次世代技術ソリューションの採用であることが分かる。しかし、それらの実践を妨げているのが、構造化されていないデータの取得、レポートの質のばらつき、運用の難しさなどの幅広い課題を含む、業界で「偉大なるデータチェーン問題」と呼ばれている問題である。

将来を見据えた企業が、プライベート商品や投資手段などをよりカスタマイズできるようにしたり、新しい顧客層やチャネルに参入したり、データからの知見をタイムリーに提供したりするなどの取り組みに力を入れていることからも、業務のデジタル化とデータ活用能力の強化がますます求められていることが示される。広範にわたる金融業界だけでなく、代替市場企業やプライベートマーケット企業もAIの利用拡大について前向きな期待感を持っている。しかし、プライベート市場業務の多くの分野において、大規模な生成AIや機械学習(ML)の導入に必要な基本のデータ管理基盤がまだ十分に成熟しておらず、まだ「千里の道も一歩から」という状況であることが分かる。

この最新レポートでは、デジタルトランスフォーメーションを実現するためのデータ問題を解決するためのさまざまな方法や業務の効率性を上げるための最新のフィンテックソリューションの役割について検証する。プライベート市場は、慢性化している非効率性を克服し、「フライホイール効果」による成長を目指し、多様な投資家層にアピールしながら長期的な成功を確実にすることが大切である。業界における成長と事業拡大の追求がますます激しくなるについて、規制当局の監視の目もますます厳しくなっている。信頼性の高いデータと業務基盤を備えた企業は、変わり続ける環境において新たな機会を見極め最大限に活用することができるだろう。

本レポートは、世界全体で4兆7,500億ドルを超える資産を管理運用するプライベート市場業界のシニアエグゼクティブの意見を基にしている。

----------------------

セレントのサブスクリプション購入者は、キャピタルマーケッツリサーチ会員として全レポートの閲覧が可能。キャピタル・マーケッツページには、バイサイド、セルサイド、マーケットインフラの今後のトレンドやテクノロジーに関するより詳細なリサーチを掲載。

関連レポート:

- TOP TECHNOLOGY TRENDS PREVISORY 2025: キャピタルマーケッツ / バイサイド編

- オルタナティブ投資とプライベートマーケッツ:メガトレンド、新規株式公開および次の波

- オルタナティブ投資とプライベートマーケッツ:アナログからデジタルへ移行するために次世代技術の作戦計画書を活用する (ソリューションについての現状)

- PEPPER INVESTMENT DATA PLATFORM:プライベートマーケット投資の運営に不可欠なデータ要素の提供(ソリューションについての概要)

- SOLUTIONSCAPE:ウェルスマネジメント向け代替投資プラットフォーム

- プライベートクレジット、サステナブル投資、資産運用のアウトソーシングが引き続き注目を集める

- 次世代の投資会計ソリューションについてのガイド:成功のためのプレイブック

- 厳しい視線が注がれるESGの達成:「約束を実行」し、信頼性ギャップを解消

- キャピタルマーケッツにおけるESGデータ管理:ESG投資の好機

- 2025年エンタープライズ・データ・マネジメントの展望 : パート1 and パート2