As investment firms and investors contemplate how to integrate environmental, social, and governance (ESG) issues into their investing decisions, the passage toward realizing a coherent vision of one sustainability agenda for positive change has become more convoluted. Optimism around ESG and sustainability has been bruised and battered with widespread “greenwashing” concerns arising. This is resulting in a credibility gap in the industry’s ongoing transition efforts, requiring firms to “talk the talk,” but also “walk the talk.” How can this be achieved?

“Walking the talk” for ESG now implies the need for firms to demonstrate a stronger industrialization of ESG data management practices — requiring firms to consider, align, and triangulate multiple consumption scenarios when extending capabilities for technology and data enablement.

To increase the chances of success, firms must make strategic technology decisions regarding boundaries of functionality across various “ESG-relevant domains”, with associated considerations paid to anticipated business demands, data centralization/ownership, governance of development lifecycle, controls, and levels of standardization across different investment units/ groups.

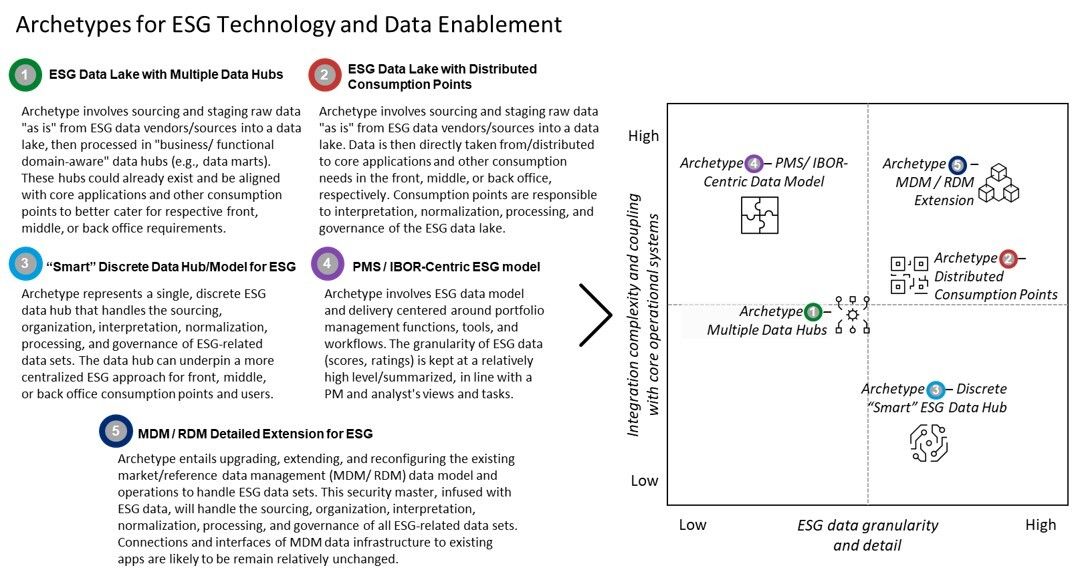

In this research series, Celent presents a spectrum of ESG ecosystem archetypes with different characteristics to help inform and direct the strategic choices that firms can adopt, and to realise on-target outcomes for ESG data enablement efforts.

In the coming years, Celent believes that the quest to solve data enablement imperatives is one vital part of this broader equation toward differentiated insights, data-driven decisions, and stronger operating efficiencies for investment management firms. We are already seeing astute firms looking to pursue more deliberate and cohesive approaches when formulating and executing a vision to achieve a lean, fit-for-purpose technology and data operating model.

In the context of ESG and sustainability, developing the ability to effectively circumnavigate the universe of information “black holes,” assemble proprietary datasets, and rapidly customize for portfolio decisions will create an information advantage that will distinguish leaders from laggards.

Our study delivers insights for asset managers and solution providers exploring strategic options to industrialize ESG technology and data management practices in order to underpin stronger (more sustainable) credentials when delivering on their ESG promises.

This Celent report, was done in collaboration with Chris Perks, a Solution Architect with Oliver Wyman's Digital and Data & Analytics Practices.

-----------

For more in-depth research around buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Celent clients can also access relevant studies:

- Technology Trends Previsory: Capital Markets, Buy Side 2023 Edition

- Celent Model Award Case Study: Western Asset Management - Accelerating Screening for Greater Impact

- Asset Managers' ESG Delivery Is Under Regulatory Scrutiny: Here's How Technology Can Help

- It's Not Easy Being Green: Developing the Optimal ESG Portfolio Engine

- ESG Data Management in Capital Markets: A Time of Opportunity

- Operational Alpha on the Buyside: Riding New Waves from Front-to-Back Technology, Data, ESG and Outsourcing

- Enterprise Data Management Visions and Trajectories for Investment Managers