Around €10 trillion is held by EU citizens in bank deposits, and while the European Commission (EC) notes that “bank deposits are safe and easy to access, they usually earn less money than investments in capital markets”. Industry experts have raised concerns that European capital markets are losing their competitiveness, threatening to hold Europe back as capital market are fundamental to finance innovation.

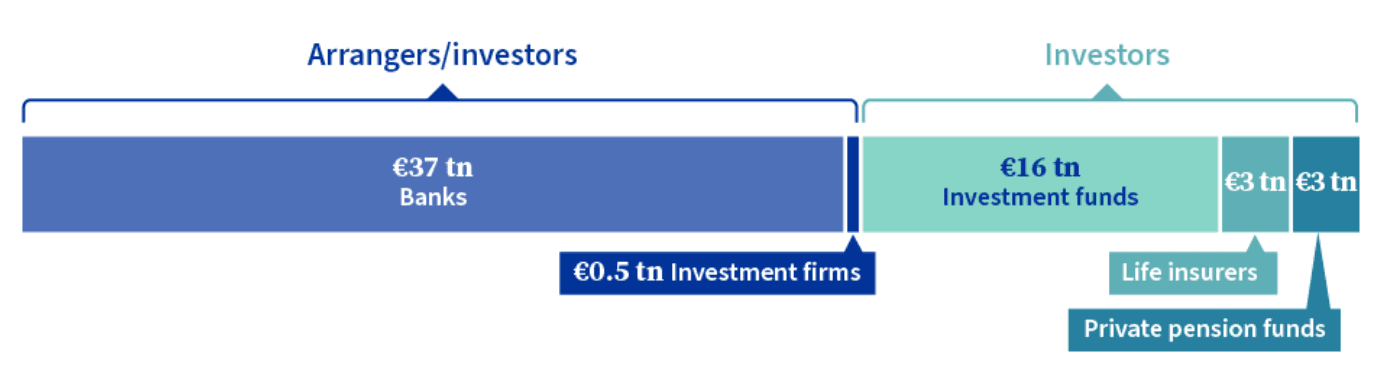

Today Europe is a nationally fragmented, bank-financed economy with banks and insurance companies providing most of the savings and investment offerings to retail investors (see figure 1) and over 70% of company financing coming through banks. But banks’ lending capacity is held back by low rates of securitization issuance, which stands at only 0.3% of GDP in the EU versus 4% in the US. Similarly foreign investment dominates scale-up funding rounds and there is significantly less venture capital (VC) in the EU than US.

Figure 1: The EU's Financial Market Infrastructure/Euro Area

source: European Council

source: European Council

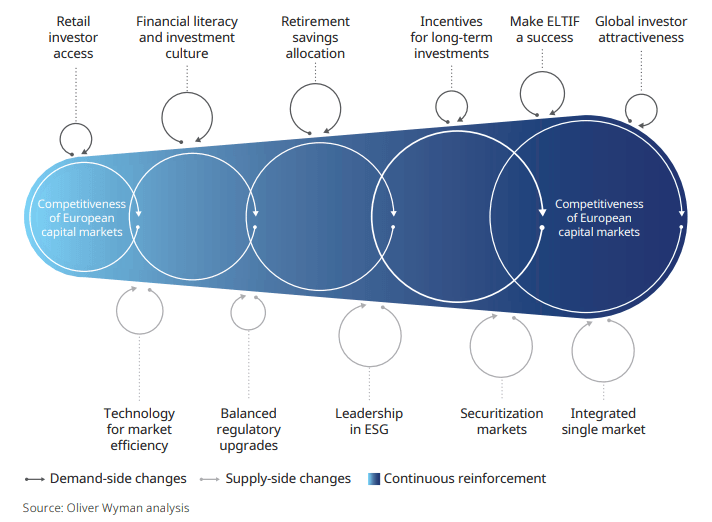

The EC sees significant scope to fully unlock the potential of investors’ savings to bring better returns for investors and increase investment in capital markets by enabling companies to draw from the significant pots of savings funds. A report by management consultancy Oliver Wyman noted that capital markets benefit from scale and a “flywheel effect” exists (see figure 2). Launching this flywheel requires achieving the demand side of capital markets.

Figure 2: Capital Flywheel for Europe

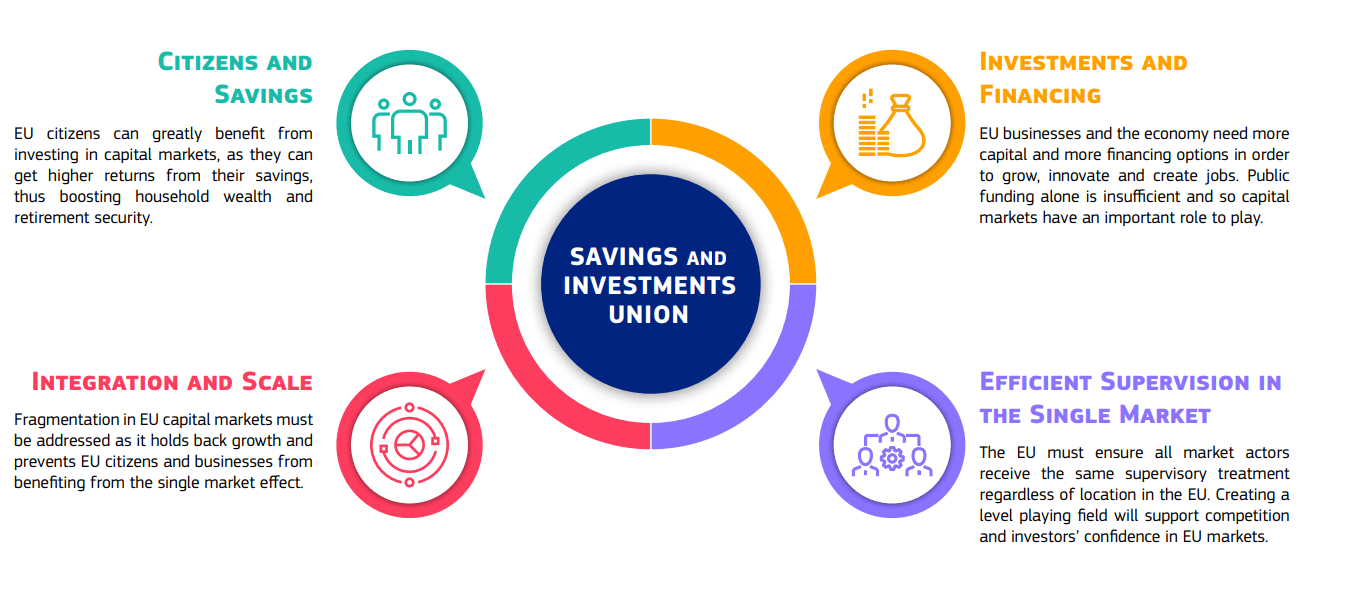

The recently adopted Savings and Investments Union (SIU) aims to improve the way the EU financial system channels savings to productive investments with the aim of fostering citizen’s wealth while boosting EU economic growth and competitiveness. The initiative has taken an integrated approach, spanning the entire EU financial system, both capital markets and banking sector, and building on progress already made under two Capital Markets Union (CMU) Action Plans and the parallel efforts to develop the Banking Union. The EC says this initiative is particularly important in the current economic climate, shaped by geopolitical shifts, climate change and rapid technological advancements. The CEO of the European Banking Federation (EBF) says it “is a game changer for Europe’s financial ecosystem.”

Delivering the SIU is a shared responsibility of EU institutions, Member States and key stakeholders. Key strands of work impacting the institutional end of capital markets include:

-

Integration and Scale: Efforts to remove regulatory or supervisory barriers to cross-border operations of market infrastructures, asset management and distribution of funds will help businesses scale efficiently across the EU by reducing inefficiency due to fragmentation. This strand of work will be of particular interest to trading and post-trading infrastructures in the EU as it will address barriers to realizing a frictionless single market.

-

Efficient Supervision in the Single Market: Measures will be proposed to ensure all financial market participants receive similar treatment regardless of their location in the EU. This strand of work has the potential to be somewhat political – with the European Fund and Asset Management Association (EFAMA) already voicing objections to granting supervisory powers to ESMA over large asset managers.

Figure 2: SIU's Four Strands of Work in Connecting Savings with Productive Investment

Source: European Commission

Source: European Commission

The initial package of measures focuses on activities clear link to boosting competitiveness of the EU economy. For 2025 key measures include:

- Encouraging retail participation in capital markets

- Developing the supplementary pension sector

- Market integration and supervision

For 2026 planned measures include work in the banking sector and promoting equity investment. The Commission will publish a mid-term review of progress in Q2 2027.

Note that the work by the European Council on an EU-level “consolidated tape” or centralized data feed for market data across different assets, is also seen to be an important element in improving Europe’s capital markets. The European Securities and Markets Authority (ESMA) the EU’s financial markets regulator and supervisor has already launched a selection procedure for a consolidated tape provider (CTP) for bonds and plans to make a decision by July.

Entities tendering to become CTPs include both coalitions e.g. EuroCTP a JV of 14 European exchanges and individual companies, e.g. Etrading Software (who has already launched a free offering, called ETS Connect, offering integrated, validated and cleansed feed of UK/EU bond market data).

"Navigating Tactics, Risk and Strategy across Regulatory Regimes" is one of five business trends Celent has identified has driving technology investment across wholesale capital markets for 2026. For more information on on this or other tech investment drivers please see our Previsory and Dimensions webinars. Celent research clients can access more in-depth data via our reports and advisory access by contacting your account manager.