Insurers and investment management firms are striving to optimize their portfolios while considering solvency and capital requirements, tax constraints, and the impact of different tax and accounting rules on their realized profits and losses. In addition to these considerations, firms face the challenges of expanding into private markets, pursuing ambitious business goals, and navigating difficult market conditions. To support growth and profitability, firms are seeking ways to improve efficiency and reduce costs in middle and back-office operations, particularly in investment accounting. The increasing complexity of regulatory, tax, and accounting requirements, combined with various factors such as strategy, fund type, investor segment, and asset class, is making it more challenging for firms to collect and aggregate investment data, and to reconcile investment data on a continuous basis. However, outdated technology and legacy operations can hinder new product development and geographical expansion efforts by limiting agility, speed-to-market, and flexibility.

In recent years, there have been advancements in next-generation technology solutions and a wider range of sourcing options for the buyside. Managed services, hosted solutions, and outsourcing have become more prevalent, offering opportunities for operational enhancement beyond core software. As a result, next-generation investment accounting solutions have emerged as a viable option for transitioning away from legacy systems and embracing modern technology for middle and back-office investment and accounting operations.

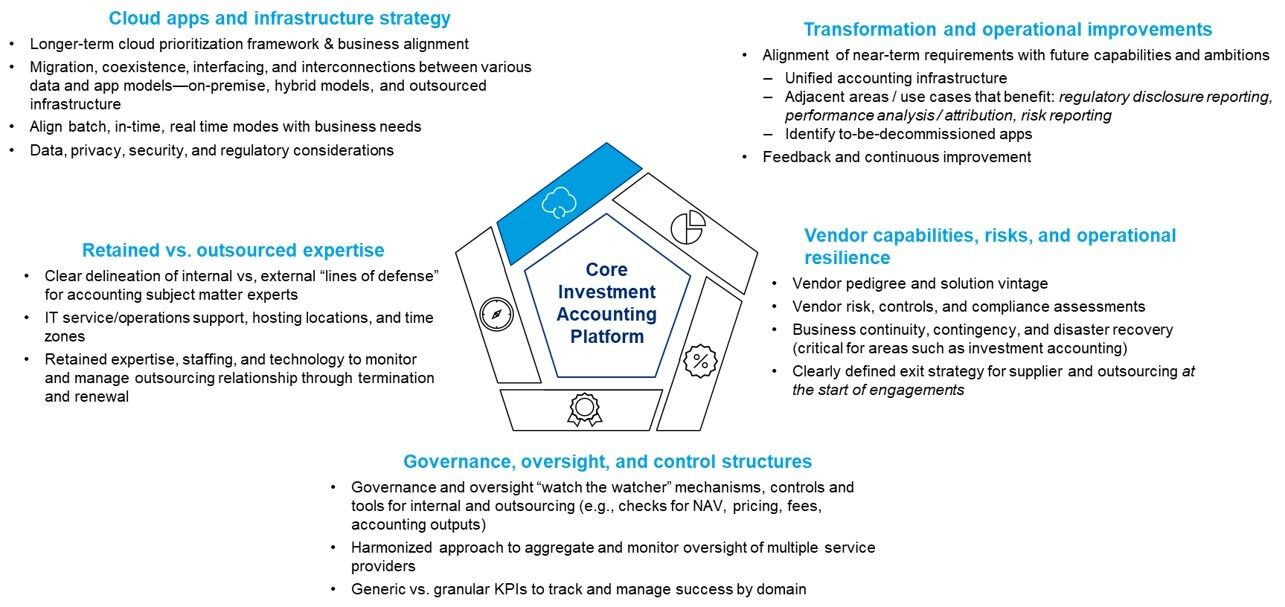

To achieve long-term operational benefits and maximize return on investment, firms need to adopt a strategic approach to their operational and applications ecosystem. In addition to addressing specific considerations related to post-trade investment operations and accounting, it is important to consider broader factors that can facilitate sustainable change and significant improvements in a firm's operational foundation.

This study builds upon previous research conducted by Celent, incorporating practical insights and guidance gathered from client engagements. These new insights and learnings provide valuable information for evaluating and selecting systems in the investment accounting space.

----------

Celent clients can also access other relevant studies:

- Global Buy Side IT Priorities and Strategy 2024

- Alternatives and Private Markets: Charting new technology frontiers and digital pathways for next-gen operational ecosystems

- Pivoting to the Front: The Quest for Greater Differentiation as the Alpha Race Intensifies

- Private Credit, Sustainable Investing & Outsourced Management Remain in Focus

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

For more in-depth research around buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.