Two months have passed when Clearwater announced their intention to acquire Enfusion on 13 January 2025. Celent saw this as a significant milestone for the industry but our view is that success will depend on the combined entity’s ability to navigate the distinct needs of buyside segments and create synergistic data enabled capabilities.

On March 12, 2025, Clearwater once again stirred up ripples of change by announcing its acquisition of Beacon and Blackstone’s Bistro. We view Beacon as a rapid app building platform that provides a workbench environment for quantitative researchers, analysts and developers to consolidate, develop and deploy asset and risk analytics, models, applications, and dashboards. Bistro is a portfolio BI/visualization that was build in-house by Blackstone to deliver portfolio dashboards and intelligence (leveraging Beacon’s platform facilities). Although both these acquisitions are less pronounced in terms of scale compared to Enfusion, they are no less significant.

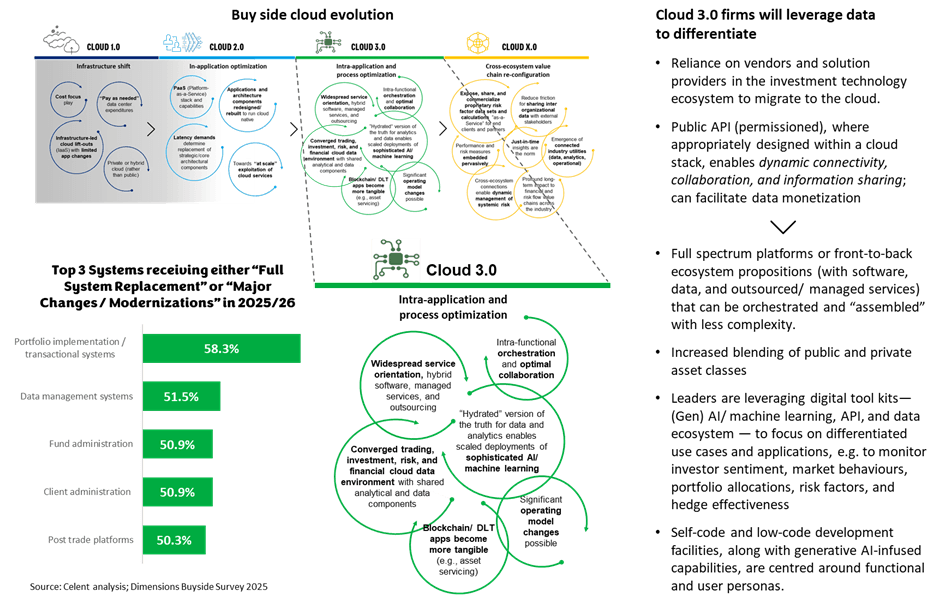

With pressures on margins and operating costs, significant operational overhauls are continuing at many investment management firms. In our latest 2025 Dimensions Buyside IT Pressures and Priorities study, 63% of buyside firms plan to replace or significantly upgrade one or more critical systems this year, favoring end-to-end technology solutions over best-of-breed approaches.

Front-to-back investment platforms and propositions continue to gain traction, with the largest growth in technology budgets expected to be directed toward various core areas, including transactional lifecycle, data enablement, performance, risk, and regulatory systems. Concerted efforts are being made to consolidate functional capabilities into fewer applications and to offer these functionalities “as a service” for reuse, thereby reducing costs and increasing flexibility. These sorts of initiatives are still a work in progress, particularly for active managers focused on public assets and markets.

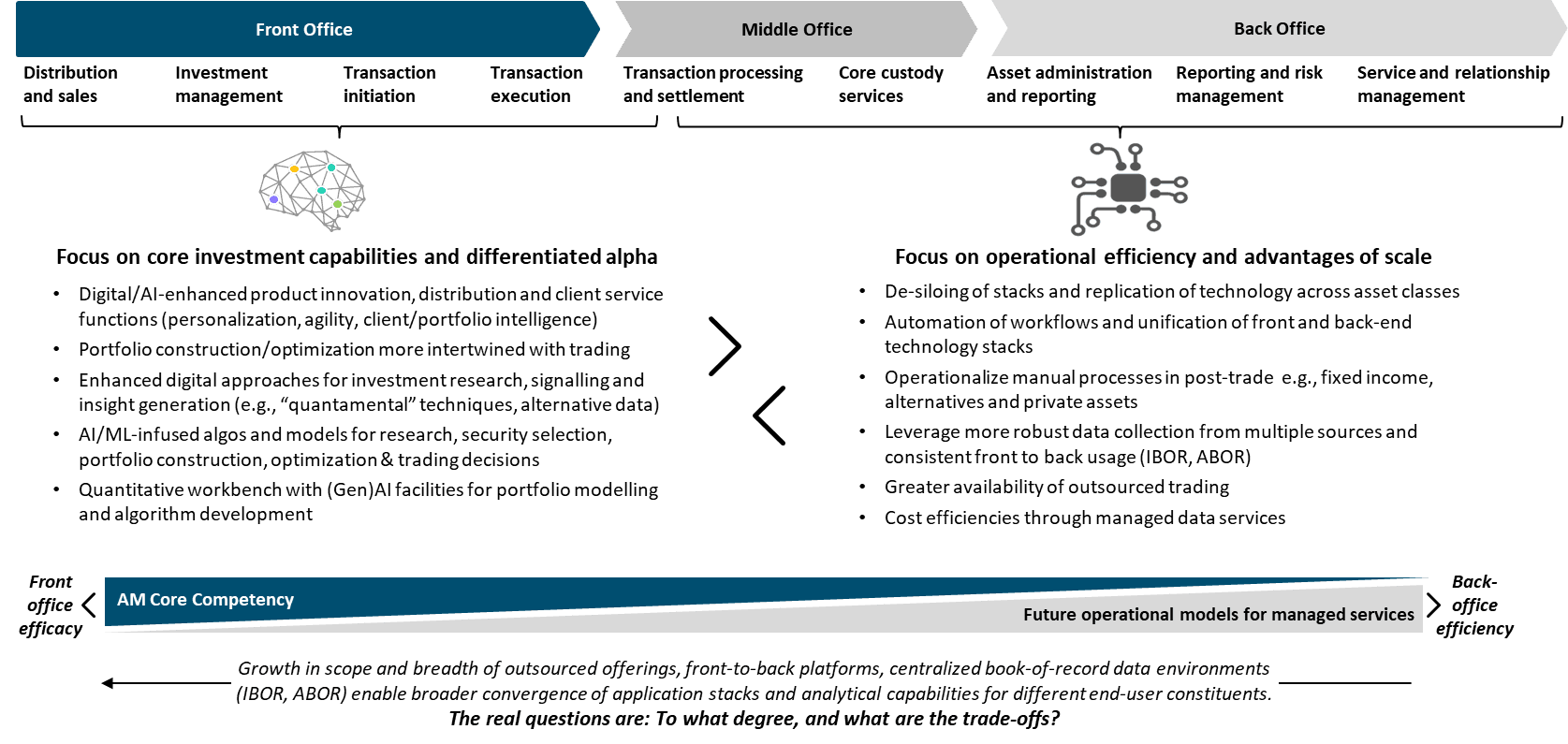

Addressing the Twin Challenge: Front Office Alpha and Middle-Back Office Scale

The ongoing quest for change in the asset management industry emphasizes two critical themes: “front office efficacy” and “back-office efficiency.” These concepts are essential for firms aiming to enhance their overall performance and competitiveness in a rapidly evolving market landscape. While the focus on these areas is not new, it has gained renewed urgency and significance due to increasing pressures on margins, the need for operational agility, and the rise of advanced technologies.

In one sense, the future model of asset management is already becoming apparent as various front-to-back operational solutions are already available in the market. This evolution reflects a holistic approach to investment management, where firms aim to integrate their front office (client-facing activities) with their middle and back office (operational and administrative functions) to create a seamless and efficient operational framework.

In one sense, the future model of asset management is already becoming apparent as various front-to-back operational solutions are already available in the market. This evolution reflects a holistic approach to investment management, where firms aim to integrate their front office (client-facing activities) with their middle and back office (operational and administrative functions) to create a seamless and efficient operational framework.

It is in this context, Clearwater’s recent acquisitions—Wilshire Analytics, Enfusion, Beacon and Bistro—come to the forefront. The company is taking bold steps to enhance the investment industry’s ability to deliver differentiated investment propositions, as well as improve margin economics and operational scalability—areas where tangible results have, until now, remained elusive.

An example of Cloud 3.0: Bold ambitions for the next evolution

The rationale behind Clearwater’s acquisition, from a service provider’s perspective, is evident: it aims to expand capabilities for a future end-to-end platform, integrate public and private asset classes—including portfolio dashboards that provide insights into investment, risk, performance, and accounting (Beacon, Bistro, Wilshire Analytics)—and accelerate the development of applications and models (Beacon, Bistro).

All acquired assets are cloud-native offerings, which signals the onset of Cloud 3.0 dynamics for the investment management. We first highlighted this broader cloud evolution in our 2019 buyside market studies, where we anticipated that 3 to 5 key technology players would shape the future of investment operations. Since the pandemic, the adoption of cloud technology, data, and AI/advanced analytics capabilities has accelerated significantly. We believe that Clearwater’s ambitions, if executed as planned, will usher in the Cloud 3.0 era for the investment sector.

We are entering a phase where investment firms that lead will be organizations that can leverage Cloud 3.0 paradigms to assemble and orchestrate the "right componentry" to reconfigure their value chain and deliver optimal outcomes:

We are entering a phase where investment firms that lead will be organizations that can leverage Cloud 3.0 paradigms to assemble and orchestrate the "right componentry" to reconfigure their value chain and deliver optimal outcomes:

- Leaner operating models: There is a strong emphasis on automating workflows and unifying front and back-end technology stacks. The industry is concentrating on streamlining operations for scale, enhancing efficiency, and reducing processing costs for routine data tasks, such as trading flows, execution/clearing connectivity, and transaction lifecycle processing.

- Flexible cost structures and outsourcing: A significant portion of asset managers’ costs are fixed, allowing larger firms to benefit from lower average unit costs. For instance, the cost per asset under management (AuM) for firms with over $500 billion in AuM is, on average, half that of their smaller counterparts. However, this advantage may diminish as smaller firms gain increased access to large-scale outsourcing providers. There is now a broader range of enhanced offerings from service providers for middle and back office outsourcing, driven by next-generation technologies, particularly those improving the economics of cloud-based solutions.

- Leveraging AI/machine learning infused algorithms: Asset managers are embracing agile nextgen analytical approaches that can capture and generate alpha in the front office. This includes mobilizing and leveraging alpha-generating data into actionable insights for portfolio construction, risk management, and investment decision-making. Techniques such as AI/ML-based news screening, derived insights, and idea generation are being employed to enhance data aggregation and utilization for trading across equities, derivatives, and increasingly fixed income and credit (e.g., for liquidity searching and scoring).

We are watching this space very closely to see if the bold “Clearwater WEBB” vision will manifest and match the reality on the ground.

Relevant companion studies from Celent's body of research insights include:

- Top Technology Trends Previsory (Capital Markets): Buy Side 2025 Edition

- Investment Data Ecosystems: Sharpening the Data Enablement Edge in an Age of AI

- Beacon Platform For Capital Markets Innovation And Development

- NextGen Investment Accounting Solutioning Guide: A Playbook for Success

- Field Guide to GenAI Hyperscalers: Capital Markets Edition

- GenAI-oneers in Capital Markets: FI Survey on adoption and impact

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets

- Pivoting to the Front: The Quest for Greater Differentiation as the Alpha Race Intensifies

- Private Credit, Sustainable Investing & Outsourced Management Remain in Focus

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap