In light of significant themes emerging in alternative investments and private markets, as highlighted in Celent's recent Alternatives and Private Markets Tech report, asset managers are facing a landscape of changing client demand, structural retirement investing dynamics, and technology-enabled innovations. Moreover, there have been discussions and announcements of alternative asset managers exploring partnerships, mergers and acquisitions, and initial public offerings (IPOs) this year (General Atlantic, CVC Capital Partners), with the expectation that actual transactions will materialize in 2024. From my perspective, there is an irony of sorts here that during a period where public markets are facing ongoing headwinds and volatility, alternatives and private markets managers are filing for IPOs.

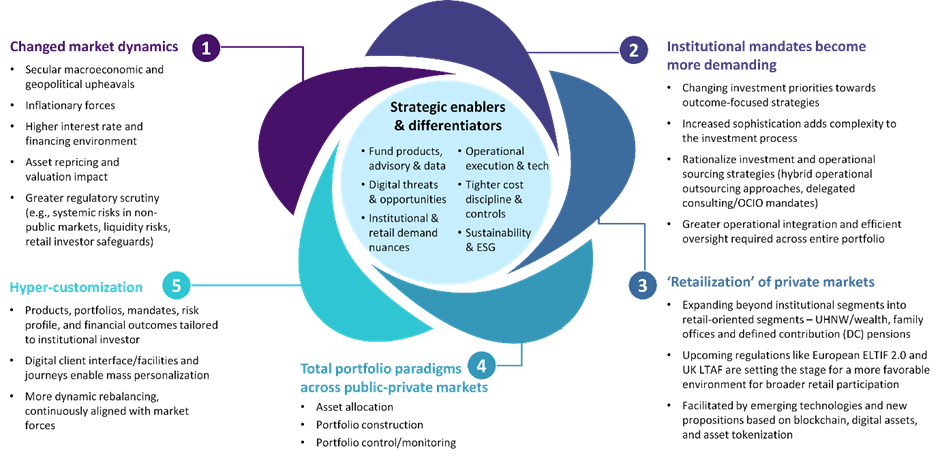

Why the ongoing interest in going public? Celent sees a number of drivers here, underpinned by the natural evolution of private markets and accelerated by post-pandemic effects.

- Financing strategic growth options. Firstly, IPOs provide an opportunity for privately owned asset managers to raise public capital through equity financing. This enables them to expand their capacity to fund acquisitions and maintain a financially stable balance sheet. Despite near-term headwinds, alternatives and private markets represent an important pillar of investments for asset managers and investors.

- Evolving investor demand: Limited partners (LPs), including sovereign wealth funds, high-net-worth investors, family offices, pension funds, fund-of-funds allocators, and insurance firms, are seeking broader and more comprehensive relationships with a smaller number of fully-integrated investment solutions providers. By asset managers and outsourced chief investment officer (OCIO) providers organising themselves as a total solutions providers with multi-strategy capabilities, they are in a more formidable position to attract, grow and deepen large strategic LP relationships. Consolidation of alternative managers across broader assets/strategies will result in more established, larger GPs with expanded offerings raising a greater portion of capital within alternatives. This is evident in recent joint ventures, divestures and acquisitions e.g., TPG acquiring Angelo Gordon, Janus Henderson/Privacore, Abrdn/Patria.

- Shifting business models towards diversified private asset investment houses, and potentially towards 'all weather' public-private managers for the largest players: This theme of adopting more diversified business models is driving strategic consolidation among managers and expansions into untapped whitespace in complementary asset classes, such as private credit. This is evident in the high levels of M&A and consolidation activities, which have reached their highest levels in over a decade e.g., Neuberger Berman Alternatives/ Minority Stake in Entrust Solutions, TPG/Angelo Gordon, Mercer/Vanguard US OCIO, PGIM/Deerpath Capital, Manulife Investment Management/ CQS, Franklin Templeton/Alcentra-BNY Mellon.

- Pursuing the next leg of growth: Alternative and private asset managers are preparing for the next phase of AuM growth through the retail and insurance segments. While pension funds will remain the largest client group for private markets, the adoption of private markets by insurance and retail investors is expected to accelerate significantly in the coming years, driving AuM and revenue growth. It is projected that private markets will comprise 13% of global industry AuM and contribute 25% of revenue to the investment sector by 2027.

- Flexing nextgen technology muscles: Firms will require technology capital to drive smarter allocations into 'differentiated operational alpha' initiatives that accelerate data, software and solutions enablement in order to achieve greater operating leverage as new products scale. Emerging technology paradigms will create strategic ‘next wave’ opportunities for managers and investors, promoting the widespread adoption of private markets investing. At the same time, the significant uplift from technology and data enablement across all stages of private markets activities are increasing. Forward-looking firms are adopting a lifecycle-oriented approach to tackle operational and data challenges across front, middle and back-office operations. General partners (GPs) also need to build and enhance access to distribution channels to retail / high net worth and insurance clients (more likely than not, to leverage and embrace more extensive digitization paradigms).

Looking into the new year, we expect to see 'stop-start' dynamics in IPO and M&A ambitions. Apart from getting the timing right — battling through turbulent macroeconomic and political crossfires — the path to public markets will require traditional and alternative investment firms to prepare for greater regulatory oversight, more transparency and stronger operational industrialization and resilience. To what degree are alts and private asset managers and institutional investors technologically ready from a business and operational standpoint?

These are the key themes that Celent's latest forward-looking reports are delving into: Buyside IT spending/operational priorities, Buyside 2024 priorities, Celent financial services 2024 previsories, Gen AI use cases and implementation, and next generation alternatives and private markets technology playbooks.

----------

Subscribing clients can access full reports through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.