Data from recent survey of DB Pension Funds Aligns with Recent Celent Research, With Impacts on Platform Decisions

Private credit along with investment grade debt, are expected to generate the highest risk-adjusted return in the market in the coming 12 months. Meanwhile, sustainable investing and outsourcing of asset management are intensifying trends for European defined benefit pension funds. These findings by Goldman Sachs Asset Management (based on a survey conducted between November and December 2023 of 126 senior fund managers and executives), align with recent insight from Celent’s Capital Markets Team.

Cubillas Ding, a Research Director with Celent’s Capital Markets Team, has found that the wider category of private markets investing will continue to contribute to the growth of assets under management (AUM) at a compound annual growth rate (CAGR) of over 13% in the next five years. His recent report found that forward thinking general partners (GPs) and limited partners (LPs) are now recognizing the importance of embracing new imperatives with key themes driving these changes including:

- Upcoming regulations in Europe, such as ELTIF 2.0 and UK LTAF are setting the stage for a more favourable environment for broader retail participation.

- Beyond the already sizable institutional space, the retail Wealth/ High-Net-Worth-Investor (HNWI) segment represents an important ~$1.5TN AUM global opportunity by 2025. This is coming from a relatively modest base where proportion of retail client assets currently invested in private markets are much lower compared to institutional segments.

- Institutional investors continue to be demanding, pushing for more sophisticated investment solutions, while ‘retailization’ trends will attract greater regulatory scrutiny, protection, and accountability. Increased sophistication and outcome-focused priorities will add complexity to the investment process and push for greater operational integration towards total portfolio management approaches across private and public markets.

- Retail demand for alternatives and private markets will be facilitated by the confluence of developments across several fronts: Modern distribution ecosystems, digitization of fund operations, and tokenization.

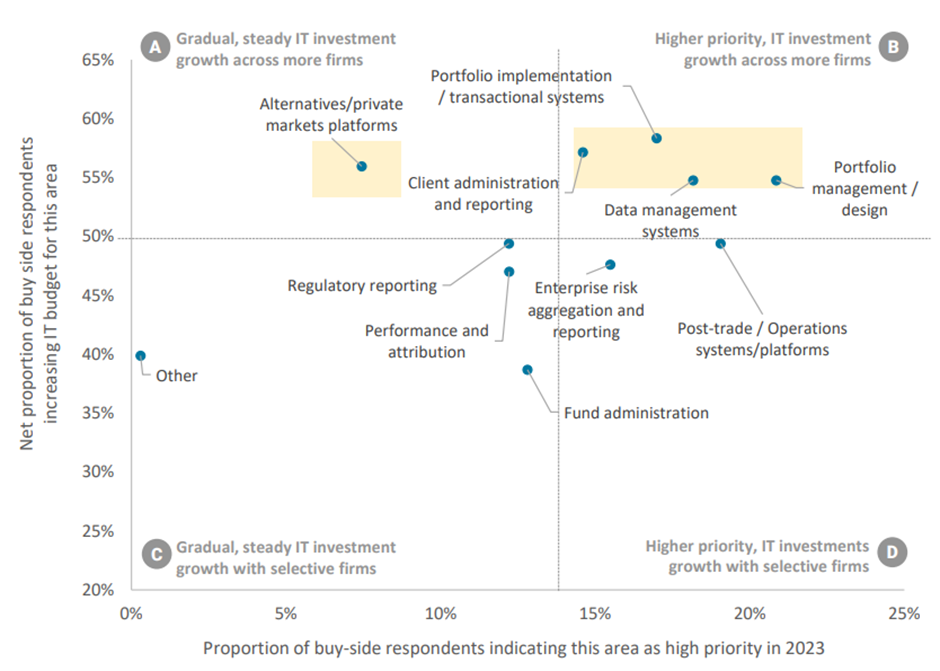

Additionally, in Celent’s 2023 survey of IT strategy and priorites across 168 global buy side executives, “alternatives/private markets platforms” was selected as a leading area experiencing increasing IT budgets (see figure below). We have just closed our 2024 survey – join us May 29 for highlights of results (with new reports to follow).

Source: Celent Dimensions Survey 2023

Across the GAM surveyed group, the commitment to both private credit and sustainable investments is high with nine of 10 respondents plan to increase or maintain their allocations to private credit and nearly half the respondents (45%) plan to allocate more than 20% of their total portfolio to sustainable investments.Among the sustainability themes shaping policy and portfolio decisions, climate transition risks ranked first. Additionally, when asked what is having the largest impact on their strategic asset allocation decisions, “ESG/Force for Good Considerations” tied for top spot along with “Increasing Yield, Given Opportunities to Invest in Current Environment” (selected by 48% of respondents). There is similar commitment to outsourcing with seven in 10 respondents saying they delegate the running of some or al of their portfolio to an external manager with top drivers for this including a desire to broaden and improve the investment expertise driving portfolio management.

The full report available from Goldman Sachs here includes sections with detail data and insight based on survey results discussing market and allocation outlook, sustainable investing, and outsourcing asset management. Respondents includes chief investment officer, trustee, head of asset management and pensions managers from countries across continental Europe and the UK. The AUM varied but 80% of respondents had $1 billion or more in AUM

Celent subscribers can find information on technology solutions landscape and trends supporting alternative assets and sustainable investing across the buy side, as well as overall tech themes and drivers here:

- Alternatives and Private Markets: Mega Trends, IPOs, and the Next Wave

- Alternatives and Private Markets: Emerging NextGen Technology Playbooks to Transition from Analog to Digital (Solution Landscape report)

- Pepper: Serving Up the Essential Data Ingredients for Private Markets Operations (Solutions Briefing Report)

- ESG Delivery Under Scrutiny; “Walking the Talk” to Resolve the Credibility Gap

- ESG Data Management in Capital Markets: A Time of Opportunity

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- Global Capital Markets – Buy Side IT Priorities and Strategy in 2023