Personal Financial Engagement Solutions for Holistic Wealth Management: Moving Beyond PFM to Embrace Financial Wellbeing

Abstract

Celent takes a fresh look at the concept of personal financial engagement (PFE) in light of the growing emphasis on the convergence of financial institutions offering “holistic financial wellbeing” solutions. Customer expectations and vendor offerings have evolved significantly in recent years. Celent’s Retail Banking team updated their perspective by evaluating 13 solution offerings across several global regions. The report, Personal Financial Engagement Solutions for Retail Banking, provides vendor profiles and Celent’s opinions of those providers.

Celent’s Wealth Management report leverages the banking team's report findings to expand on the idea of capturing next-gen clients and creating a comprehensive financial wellbeing solution for wealth managers. PFE solutions play a crucial role in wealth management solutions, particularly against the background of the democratization of wealth management. Further research on the topic is discussed in Celent’s webinar, “Converging on Financial Wellbeing: Building a Competitive Technology Strategy Across Insurance, Wealth Management, and Banking Solutions.”

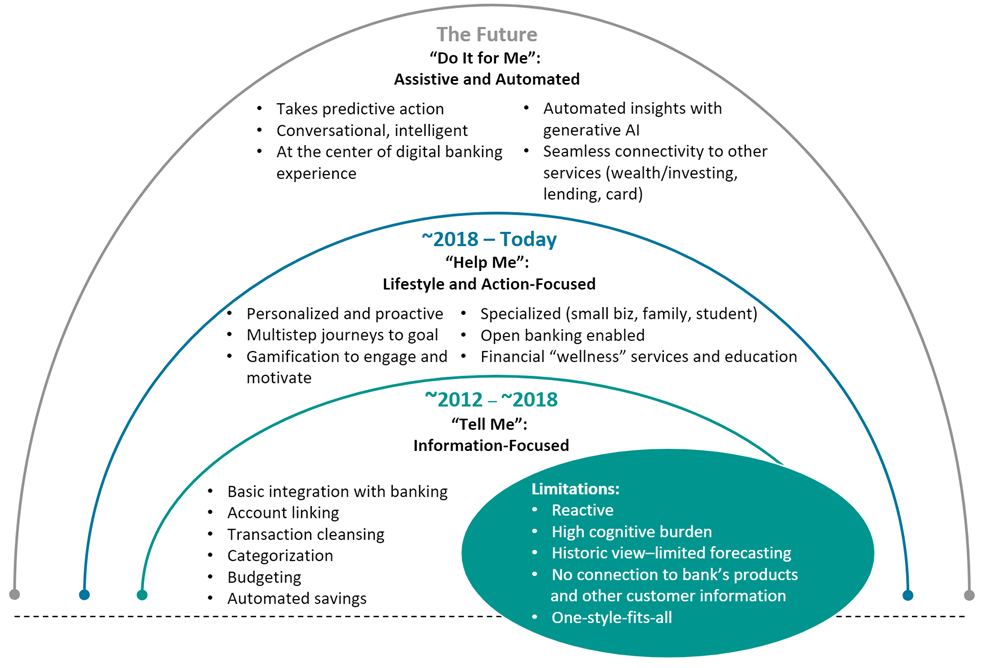

The central aspects of PFE that we have previously written about still stand. What’s changed is the breadth of capabilities we consider essential, the number of vendors offering compelling solutions for FIs, and the deeper integrations into the everyday banking experience. Just as we surmised in previous analyses, personal financial engagement offerings have moved far beyond account and transaction-focused tools. Today, FIs can incorporate more customer data, personalization, deeper in-context presentation, and specialized features that provide value to segments of customers with unique needs. Most significantly, offerings have broadened to support wider financial needs, including additional aspects of financial health and even introduction to wealth building.