A Shift in Portfolio Construction: Rebalancing Technologies, Zero Commission Trading, and AI

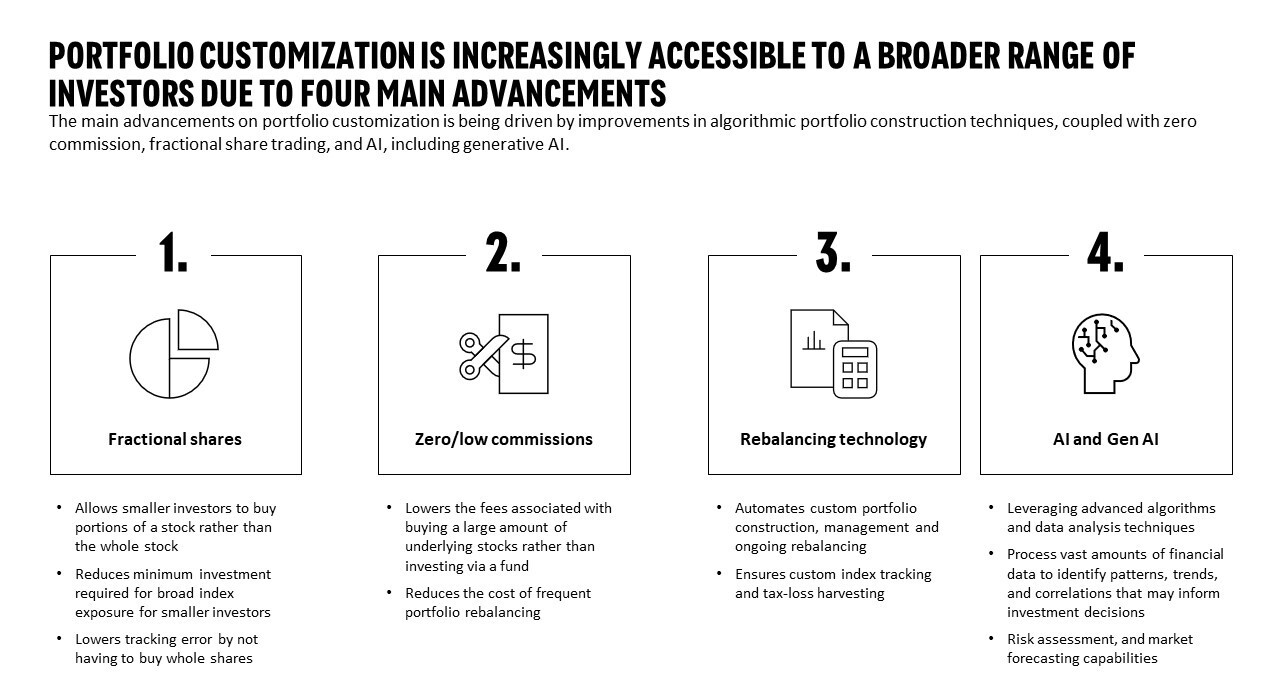

The shift in portfolio customization capabilities is primarily driven by advancements in algorithmic portfolio construction techniques, the advent of zero commission trading, and the integration of artificial intelligence (AI), including generative AI. These developments have changed the way investors tailor their portfolios to meet their unique financial goals and risk preferences; customized portfolios are a core expectation for today’s investor to align with their expectations in adjacent industries for personalized products.

Zero Commission and Fractional Share Trading: The emergence of zero commission and fractional share trading is significant and has broadened the accessibility of the financial markets for the retail investor. Historically, trading stocks and other securities incurred substantial transaction costs, making it challenging for small investors to build diversified portfolios. Investors today can buy and sell securities without incurring any trading fees - this democratization of trading has expanded the profile of the typical retail investor who is also able to access a wider range of investment opportunities. Fractional share trading allows investors to purchase a fraction of a share, by indicating the dollar amount that he or she would like to trade, thereby enabling them to invest in high-priced stocks with smaller amounts of capital. These innovations have made portfolio customization more accessible and affordable for individual investors.

Algorithmic Portfolio Construction Techniques: One of the key drivers behind the advancements in portfolio customization is the refinement of algorithmic portfolio construction techniques. Note: with its ability to extract insights from large data sets, AI has been used in investment management for decades, for example, in algorithmic trading and has honed its ability over time. Traditionally, constructing a well-diversified portfolio required extensive research, analysis, and manual rebalancing. However, with the advent of sophisticated algorithms, investors and traders can now leverage powerful computational models to optimize their portfolios. These algorithms consider various factors such as risk tolerance, investment objectives, and market conditions to generate portfolios that maximize returns while minimizing risk.

AI and Generative AI: The integration of AI, including generative AI, has further propelled the advancements in portfolio customization. AI-powered tools and platforms can analyze vast amounts of data, identify patterns, and generate insights that aid in portfolio construction and optimization. AI can adapt to changing market conditions and provide real-time recommendations for portfolio adjustments by leveraging ML algorithms. Generative AI algorithms can create unique investment strategies by simulating various market scenarios and generating portfolios that align with specific risk-return profiles. These AI-driven solutions empower investors with data-driven insights and enhance the precision and efficiency of portfolio customization. It is important to note that while Gen AI is expected to play an increasingly valuable role in shaping the future of portfolio construction, we are lightyears away from using the technology to provide financial advice to retail investors. The ethical and regulatory considerations are substantial.

The above tech developments have empowered investors with greater control, accessibility, and efficiency in tailoring their portfolios to meet their financial goals and risk preferences. As technology continues to evolve, we can expect further innovations in portfolio customization, enabling investors to make more informed and personalized investment decisions. As such, many of the core entry barriers to financial markets have been removed or minimized thereby resulting in increasing accessibility to trading and in the number of retail investors.