規制とマクロ経済の進化は、伝統的なキャピタルマーケッツビジネスの収益性と資本利益率(ROC)に影響を与え、最終的にはビジネスモデルそのものを変えようとしています。一方、テクノロジーの進化は、新しいビジネスモデルや新規事業参入者の台頭を後押ししています。

本レポートでは、キャピタルマーケッツ業界におけるこれまでの変化の歴史を振り返りながら、銀行やブローカーによる市場取引テクノロジーの未来についても考察します。

キャピタルマーケッツ事業を手がける金融機関は、金融危機以来、事業戦略の転換(トランスフォーメーション)に取り組んできました。金融危機は金融機関に対し大幅な変化を強い、結果として多くの銀行は2011-2012年から大規模な変革に取り組んできました。そして今、トランスフォーメーションの次フェーズに金融機関が取り組む中で、変化の要因やけん引役となるツールも変わりはじめています。

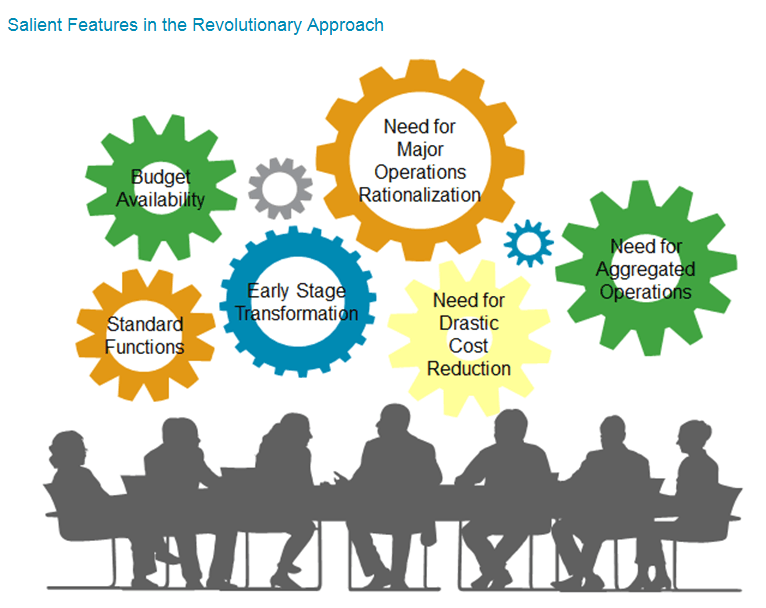

トランスフォーメーションの妨げになりそうな問題は既に対処済みであり、金融機関の期待感はいまやイノベーティブな考え方やアジャイルな実行力へと移っています。こうした中で金融機関は、先進的(*)で、フレキシブルなアプローチを取り込もうとしています。(*訳注: Evolutionary。Revolutionary=大規模な改革との対比)