Bad News on the Street: Insurance IT Strategy and the Financial Crisis

Abstract

A new Celent report looks at the global financial crisis and what it means for insurers’ IT strategies.

A tidal wave of bad news has swept Wall Street and Main Street, and debris is coming ashore across the globe. This crisis is sure to affect insurers the world over for years to come. Celent believes that the unprecedented breadth and intensity of issues currently facing the insurance industry will severely constrain future growth but also provide an opportunity for carriers that position themselves correctly.

A new report, , examines the fundamentals of the crisis and highlights the likely impact on insurance carriers across several critical dimensions.

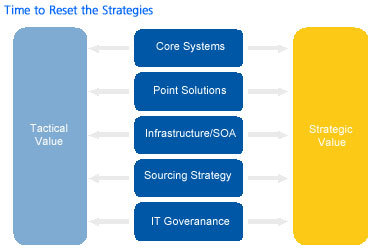

This report examines how the current economic crisis will impact the insurance industry’s financial results, capitalization, and competitive positions. It describes how insurers’ operational strategies may shift, and how those shifts make this the right time to reexamine the tactical and strategic value that current and new IT initiatives will provide.

"The world has changed, but not ended," says Donald Light, senior analyst with Celent’s insurance practice and coauthor of the report. "Insurers, their technology groups, and technology vendors need to recognize this change and adapt to it."

"Adapting includes an examination of implementation plans and budgets with an eye toward short-term, tactical payback," says Mike Fitzgerald, senior analyst with Celent’s insurance practice and coauthor of the report.

The report is 22 pages and contains four tables and one figure. A table of contents is available online.

Members of Celent's Life/Health Insurance and Property/Casualty Insurance research services can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.