Throughout history, insurance has provided protection to countless individuals and businesses. However, alongside the insurance industry, insurance fraud has also existed as its "evil twin." In recent times, leveraged by technology, fraudsters have become more sophisticated, leading to significant financial losses for insurance companies and negative impact on policyholders.

Types of Fraud

Insurance fraud can be categorized roughly into two main types: soft fraud and hard fraud. Hard fraud involves intentionally faking accidents, injuries, thefts, arsons, or other losses to illegally obtain money from insurance companies. On the other hand, soft fraud occurs when policyholders overstate losses to receive higher compensation or provide false information to get reimbursed. Soft fraud is often justified by individuals to maintain their self-image as "honest" people. Some players in the industry may look at it from a premeditated, opportunistic, and organized fraud classification types.

The Cost of Fraud

According to the Coalition Against Fraud, insurance fraud costs consumers in the United States a staggering $308.6 billion annually. Auto premium fraud alone accounts for $35.1 billion, while auto theft fraud amounts to $7.4 billion. According to this same organization, fraud occurs in approximately 10% of property and casualty insurance losses.

In Latin America, according to a report by FIDES, the Inter-American Federation of Insurance Companies, insurance fraud generates significant annual losses of around $50 billion. Argentina ranks as the leading country in the region for fraud, while Chile ranks last. Brazil falls within the average of the 18 associated countries, with frauds representing an impact on approximately 14% of insurers' revenues.

In the United Kingdom, as reported by ABI (Association of British Insurers), insurers identified 72,600 fraudulent insurance claims worth £1.1 billion in 2022. It is approximated that an equivalent amount of fraud remains undetected annually. This is the reason why insurers allocate a minimum of £200 million per year towards fraud detection efforts, according to ABI.

The Double-Edged Sword

Technology plays a vital role in both preventing and uncovering insurance fraud, and numerous insurers have effectively implemented digital procedures to combat fraudulent activities. For instance, the annual fraud report from AXA in Spain reveals that in 2013, the company identified 97% of fraud cases through manual processes. However, by 2023, this figure decreased to 67%, with the remaining 33% being detected through digital methods. Another example is Allianz Commercial, which reported a 10% increase in overall claims fraud detection in 2023 compared to 2022, thanks to the utilization of the Allianz machine learning tool, Incognito. This, combined with the dedicated efforts of the claims validation teams, resulted in significant application fraud savings of £1.95 million, according to the company.

However, technology can also enable fraudsters to create more sophisticated schemes. For example, AI-driven fraud can involve the use of fake content, known as deep fakes, such as manipulated videos and audios, to support fraudulent accidents, injuries, and property damages. Additionally, as insurance companies adopt technology to automate processes and enhance the customer experience, they may inadvertently create vulnerabilities for fraudulent claims. Reducing human touchpoints in the claims process can increase susceptibility to fraud.

Solutions Available in the Market

Although insurers can utilize functionalities present in their core claims management solutions for fraud detection in some cases, these solutions often do not offer sufficient capabilities to counter the sophistication of fraudulent claims. At Celent, we have recently published four regional reports reviewing around 60 claims management solutions. The functionality related to fraud detection found in those systems is usually basic and based on scoring methods and business rules. Furthermore, not all solutions have these capabilities. For example, in the Latin American edition of the report, which analyzed 20 claims management solutions available in the region, we found that 55% of the solutions include out-of-the-box functionality for fraud detection, such as the ability to track common clients across multiple claims through multiple search and reporting criteria. Additionally, 30% of the solutions provide out-of-the-box basic functionality for SIU (Special Investigation Unit) operations. Therefore, insurers seeking advanced capabilities for fraud prevention and detection should consider specialized software solutions. These tools go beyond simply providing basic information for an adjuster or an employee of the SIU to interpret. They utilize advanced techniques such as machine learning models, connection analysis between parties, anomaly detection, and predictive analysis, enabling them to make automated and intelligent decisions.

In 2022, Celent published a series of three reports analyzing these solutions specifically by line of business, namely one for P&C insurance, one for life insurance, and another for health insurance. We are currently updating the research on these specialized solutions for fraud prevention and detection, aiming to showcase the evolution that has occurred since our last evaluation, especially regarding GenAI-based capabilities. The new editions of Celent's evaluation of fraud detection solutions for insurance are expected to be published by the end of Q2 2024.

In addition, solutions that leverage Distributed Ledger Technology (DLT) can be an alternative to fight the battle against deep fakes. More details on that can be found in another blog published here at Celent.com by Juan Mazzini, titled “The Third Time's a Charm: A New Opportunity for Distributed Ledger Technology (DLT)”.

The Importance of Data

We cannot overlook the importance of data. To ensure the effectiveness of machine learning models in fraud detection, it is crucial to have access to high-quality data from various sources. Fraud detection tools are incorporating new data sources and using data innovatively to enhance detection. By integrating with internal and external data sources, a comprehensive view of claims can be obtained, enabling more informed decisions about their validity. Real-time access to this data allows for prudent decision-making and improved customer experience.

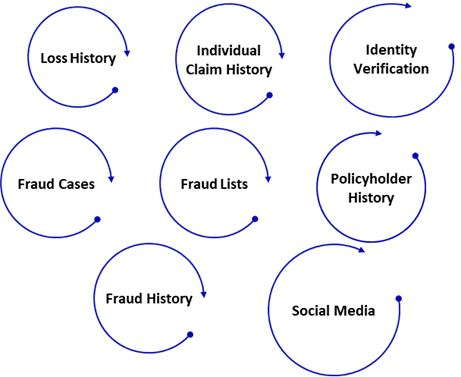

Data Points that May Inform Fraud Detection

Source: Celent

Furthermore, as AI models continuously learn from data, they improve over time, leading to more effective prevention and detection strategies. Providers are recently adding GenAI-based functionality, which is expected to have a significant impact.

The Competitive Impact

As technology advances, cases of fraudulent claims become more sophisticated, increasing the vulnerability of insurers to significant negative impacts. To address this situation, it is essential to have specialized software solutions that utilize advanced techniques and have access to high-quality data. These tools are key to enhancing fraud prevention and detection capabilities.

By leveraging these solutions, insurers can gain a competitive advantage by making more informed decisions, improving their customers' experience, and continuously optimizing their fraud prevention processes. Additionally, if we take the 14% impact on premium by fraud in Latin America to illustrate better the financial impact of improving fraud detection capabilities, effectively detecting and preventing fraudulent activities provides insurers with the opportunity to achieve significant cost savings and improve profitability.

Therefore, the ability (or lack thereof) to prevent and detect fraud becomes a crucial competitive differentiator for insurers.