コロナウイルス・パンデミックの中、規制、経済、テクノロジー要件の変化により、アドバイザーとクライアントの関係は根底から変化した。顧客が物理的にアドバイザーと関わることで、効率性や快適性が増すという時代は終わった。デジタルチャネルへの移行が余儀なくされる中、信頼、個人的なつながり、ケアなど、顧客が人間のアドバイザーに価値を見出す感情的な属性の多くは、提供することが難しくなった。

パンデミックと市場のボラティリティにより、不確実な状況の中で疲弊している投資家に重大な知識のギャップが生じており、顧客はこれまで以上に知識の吸収に時間を割いている。それは曖昧な経済・政治環境により促進された情報の非対称性の結果であり、顧客の個人生活や金融生活のあらゆる側面に影響を及ぼしている。アドバイザーは、顧客や見込み客に継続的にエンゲージするために、デジタルコンテンツマーケティング(DCM)に注目し始めている。

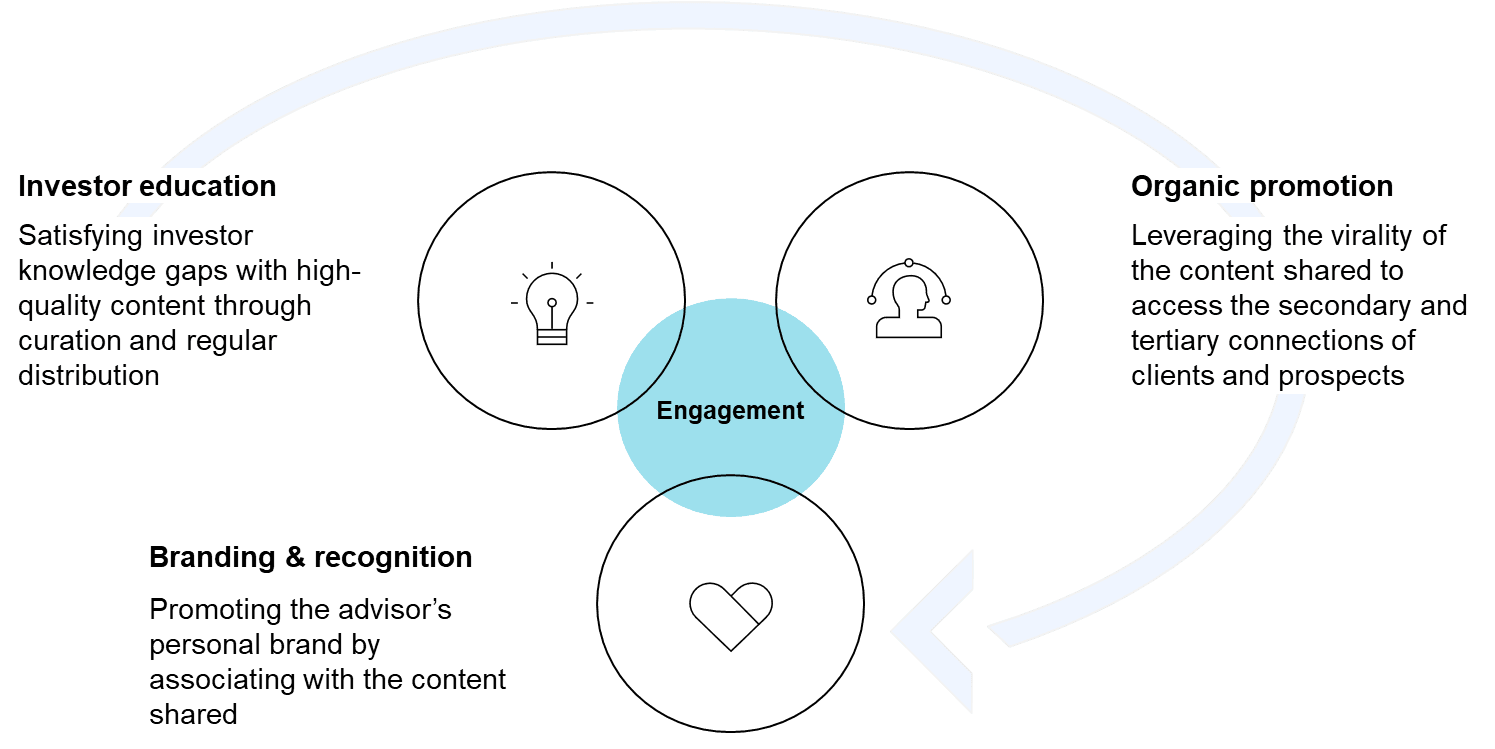

DCMが提供する戦略としての価値提案は、他のアドバイザーのマーケティング戦略とは大きく異なる形で提供される。DCMは、顧客や見込み客に教材を提供し、彼らが有機的に共有することで、アドバイザーのリーチを拡大するという価値に重点を置いている。その核心となるのは、DCMは共有されるコンテンツと同等の価値があり、共有されるコンテンツは読者に提供される教育的有用性と同等の価値があるという考えである。