Dimensions: Middle East and Africa Wealth Management IT Pressures & Priorities 2024

Key research questions

- What priorities are driving wealth management technology spending in the Middle East and Africa?

- What are the leading product and technology investment areas?

- How much focus are wealth managers putting on cloud infrastructure, AI, and generative AI?

Abstract

Wealth management executives in the Middle East and Africa report accelerating growth in technology budgets in 2024, at 4.9% year-over-year. Wealth managers in the region are prioritizing product innovation, cloud technologies, and data platforms and management.

To shed light on the budget drivers and technology priorities of the wealth management industry, Celent has completed its second annual global survey of senior wealth management executives: The Celent Dimensions Survey 2024. This Middle East and Africa edition captures the insights and opinions of 17 respondents from 5 countries to provide an in-depth view into the drivers of IT spending across the industry, as well as the leading technology and investment priorities.

Key findings include:

- 88% of wealth management firms in the Middle East and Africa believe they are agile in responding to new market opportunities—the highest share of respondents of any region in the world.

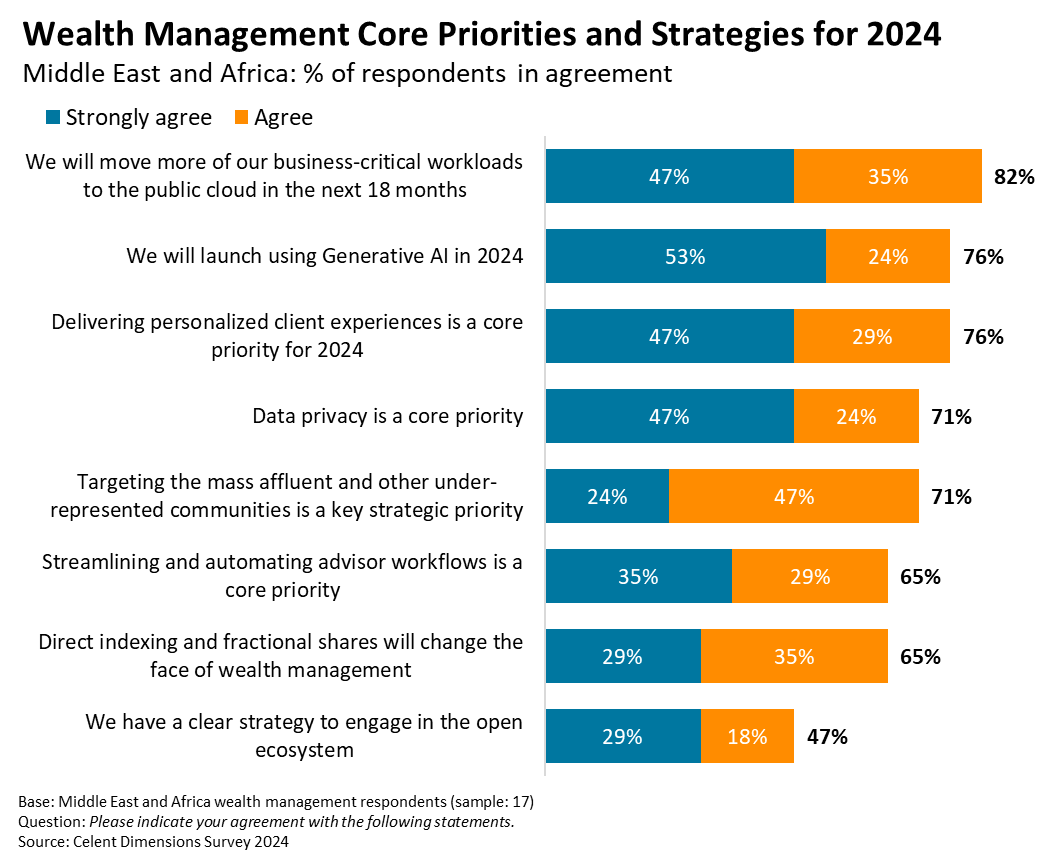

- 82% of firms will move more business-critical workloads to the public cloud in 2024 and 2025 (see the chart below).

- 59% of firms are either live, piloting, or experimenting with generative AI.

- 49% of wealth managers' IT budgets are allocated to "change the business" spending—the most of any region in the world.

- 41% of executives believe cryptocurrencies will have a top three impact on the wealth management industry over the next five years.