Social Media at Chinese Banks

Abstract

Celent has released a new report titled Social Media at Chinese Banks written by Hua Zhang, an Analyst with Celent’s Asian Financial Services practice.

Key Research Questions | |||||

1 |

How does the banking industry use social networks? |

2 |

Which banks in the Asia-Pacific region are pure social network banks? |

3 |

How will traditional banks transform into social banks? |

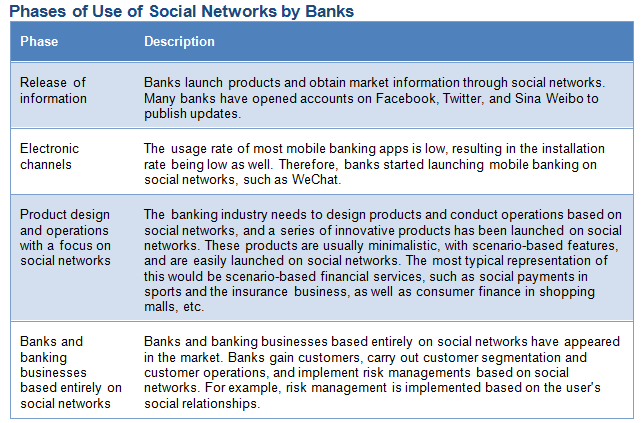

Social networks enable banks to come into closer contact with customers and carry out effective customer segmentation, thus allowing them to provide better consumer finance, payment, and other services; social networks also enable banks to provide improved means of risk management, which allows them to offer financial services relevant to low-end users.

Nowadays, social networking has become an entry point to user behaviors such as payments, shopping, e-commerce, and more. To a certain extent, social networks understand their users more than banks. Based on such an understanding, a series of business models and innovations are emerging. In the report Social Media in Banking in Asia, Celent examines the social network-based financial services, cases and trends.

“Social banking is not simply about having traditional banking businesses on Facebook — it involves fundamental changes in banks' approaches toward customer acquisition, marketing, customer segmentation, product design, customer operations, and other business aspects.” says Zhang.