In my previous blog, I wrote about the usage of alternative data for health insurance and how this can be enabled by the partnership of the government, the medical profession, and the insurer. I have also looked at data-focused design for machine learning and mobile user experience, to set the perspective of putting the user at the heart of design.

Data as an Enabler

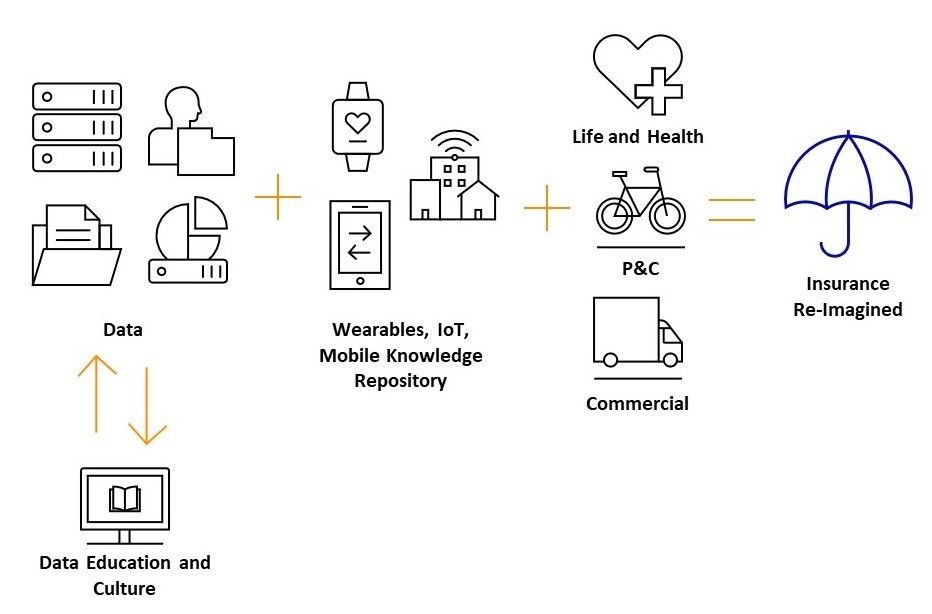

In this blog, we will discuss the ingredients in designing a good user experience through data. Insurance is about data and with the increased usage in cloud, the delivery has been cheaper and more accessible. This leads to data initiatives that are closer to the customer, which will complement the legacy source, such as claims-based pricing for life and health insurance and on-demand recommendations for P&C insurance. In commercial insurance, aggregation of quotes from various insurers on a single portal has enabled financial advisers to increase productivity. Underlying such systems is data and the goal of using technology to improve workflow and customer experience.

Omnichannel and Integrated Ecosystem

Delivering a good customer experience requires understanding individual line-of-business customer engagement process. For instance, life insurance has low customer interaction and occurs at the start of purchase and at claims. How can we ensure that customers stay engaged with their insurer? Or how can we offer a customer-first proposition through premium adjustments or re-allocation?

Pushing forward in the industry now is the deliverance of an omnichannel strategy, which echoes the sentiment from this Celent conceptual model of an integrated ecosystem. Through an omnichannel, insurers can enable more touchpoints to reach and serve customers, leading to relevancy with the younger demographics and ensuring loyalty with existing customers. In an agent dependent market like Asia, the agents need to be integrated into the omnichannel experience too.

And moving further down the insurance value chain to underwriting, an integrated ecosystem with health providers and government can lead to a stronger risk engine with inclusion of additional health data points. Data points can help assess the feasibility of rewarding healthy policyholders with premium adjustments when no claims are made.

A Platform Based Experience

The future of insurance should not be a silo approach, be it embedded insurance recommending health insurance through wearables, insurance-as-a-service for personalized and contextual service, or an agent or broker armed with product knowledge on a mobile device. We can advocate an insurance model where data and technology power innovation.

However, for the platform to work, insurers need to be foster partnerships and have data literacy flowing through the organization. Partnerships will enable collaboration with insurtechs, who tend to drive the innovation, and established insurers an provide the arena for growth. Data literacy will breed an appreciation for data and the ability to choose the right methods or product for the right problem. With the right partnership and data science experience, insurance can further benefit from data, leading to a richer user experience that serve customers and the insurance organization within.

Data as the Foundation for User Experience

A data approach might seem like an obvious choice in today’s digital world but the planning and execution of implementing a data-focused strategy must be carefully thought of. In conclusion, user experience is the service or front-end layer presented to customers (policyholders and insurers alike), and the fuel to drive an omnichannel, integrated ecosystem, personalized and contextual experience is data. Culture and education would play an important role in developing a new approach in the industry as well, and an enlightened mindset is the catalyst to re-imagine how insurance can be.

--------------------------------------------------------------------------------------------------------------

To learn more, please pick any publication you like (list of recent reports here) and we can discuss over video calls, walking through any reports/blogs, exhibits, provide additional insights or perspectives. Email me at mang@celent.com.

Below are related reports/blogs to this blog:

The Data Force: Cultivating a Data-ready Organization

Integrated Insurance Ecosystem: The Next Generation Insurer

At the Heart of Design – Care for Customers

At the Heart of Design - Adopting Machine Learning with a Data-focus Design