Leveraging Cooperative Development for Insurance: Learnings from R3 Applied to Insurance

Abstract

A central theme in technology is speed. With cooperative development, another emerges — “You must be present to win.” Insurers have an opportunity to leverage the learnings obtained by banks and securities in cooperative development. However, they must be at the table in order to harvest these benefits.

Celent has released a new report titled Leveraging Cooperative Development for Insurance: Learnings from R3 Applied to Insurance. The report was written by Mike Fitzgerald, Senior Analyst in Celent’s Insurance practice.

The opportunity to implement new technologies in financial services creates new challenges in adoption and automation. In order to meet these needs, new development patterns are emerging. Agile technique use is on the rise. Firms invest in innovation labs to increase their experimentation capability and accelerate their learning and innovation. Organizations often partner with fintech and/or insurtech startups to codevelop solutions and share the resulting intellectual property (rather than build it themselves from scratch). Prototyping with traditional system integrators is rising.

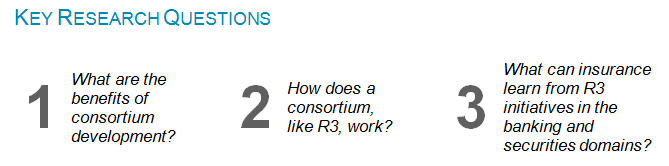

This report makes the case for collaborative development as a response to new technology opportunities. It also explores distributed ledger technology (DLT, aka blockchain) and the particular affinity this technology has with a cooperative approach. In order to give practical meaning to these points, R3, a DLT consortium, has provided Celent with an explanation of their model. Two R3 member projects are described in detail. This research analyzes the results and identifies how insurance can leverage learnings by other financial services industries.

Cooperative development in a consortium model reduces risk and strengthens design through diversity of opinion. For DLT, consortia facilitate network effects, mutualization of costs, consensus, and platform choice.

R3 is a fee-based membership organization which facilitates the exploration of DLT using a structured development approach. Solutions developed for banking and securities firms in the areas of identity management and reference data management have direct applicability to insurance use cases.

“If insurers choose not to pursue cooperative development, they will need to determine how to obtain the insights and efficiencies of such models on their own. Otherwise, they will fall behind their competitors,” Fitzgerald said.

“The full results from consortium experiment to implementation are, as of now, still emerging; installing new industry business models which employ emerging technology is nontrivial. It remains to be seen if, going forward, global learnings can be successfully generalized on completed projects. However, the journey is underway, and insurers are encouraged to participate,” he added.