Managing OTC Derivatives Risk: Building Capabilities to Tame the Giant

Abstract

Managing OTC Derivatives Risk: Building Capabilities to Tame the Giant

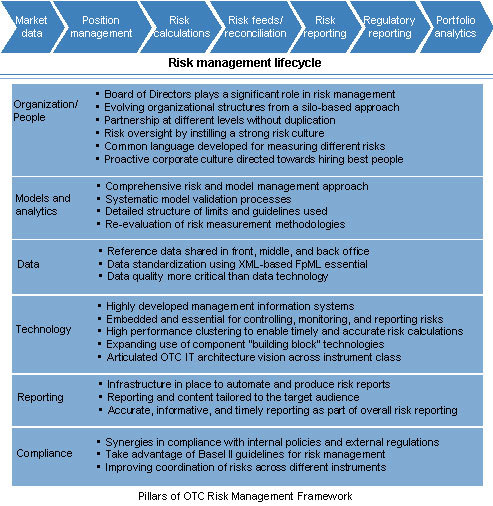

Celent presents best practices in managing OTC derivatives risk and urges firms to develop capabilities beyond current operational infrastructure improvement efforts.

Financial engineering as a discipline has grown in scope, application, and visibility in recent years, driven by rapid innovations in financial instruments, a growing appetite by investors for tailored deals in the form of structured derivative-based products, and advances in the use of active portfolio risk techniques (e.g., risk transfer, securitization). Innovative risk management methods that financial engineering have unleashed in capital markets through over-the-counter (OTC) derivatives wield a double-edged sword: although derivatives are seen as tools for financial risk management, the instruments themselves expose firms to risks.

The recent woes in the financial services industry have undoubtedly resulted in stronger risk management frameworks becoming a more pressing issue to be tackled by both buy-side and sell-side firms. While progress is being made, it is imperative for firms to adopt a risk management framework to deal not only with risks associated with operational infrastructures but also with other risk factors and dimensions. In a new report, Managing OTC Derivatives Risk: Building Capabilities to Tame the Giant, Celent makes recommendations for best practice frameworks to be applied in tandem with implementing OTC solutions to tame this giant.

If there is anything to be learned from the 2007 credit crisis, it is that firms need to pay sufficient attention to the more speculative, wild west parts of the business, such as OTC derivatives (where product innovation and complexity are rampant, and operational controls comparatively less defined). Otherwise, the consequences could be dire...in many cases throughout the subprime crisis, a relatively small section of the business has generated a disproportionately large bulk of losses for the entire firm.

"So far, firmwide and industrywide initiatives have largely been focused on plugging gaps in operational infrastructures in areas such as trade flow processing, matching, and settlement," says Cubillas Ding, Celent senior analyst and author of the report.

"Although derivative instrument risks cannot be eliminated, firms can build capabilities to reduce and control unintended risks," he adds. "The hot spots specific to OTC derivatives encompass areas such as data management, model management, valuation and pricing, collaterization, reporting, limits management, payments, and portfolio reconciliations."

In this report, Celent also highlights the considerations and guidelines that need to be taken into account when selecting and implementing solutions in this area of OTC derivatives risk management.

The 70-page report contains 15 figures and 5 tables. A table of contents is available online.

of Celent's Finance & Risk research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.