Insurers have been modernizing their legacy systems, increasing their presence in cloud, and finding innovative use cases driven by emerging technologies. As a result, insurers are improving their customer experience (CX) and operational efficiencies, introducing new and innovative products, generating impactful insights, and growing their businesses.

The evolving insurance and technology use cases were highlighted at the recent AWS Financial Services Cloud Symposium and Industry Analyst event in New York City. As expected, generative AI (GenAI) and large language models (LLMs) were a hot topic at the event. Combining GenAI and LLMs in a cloud environment is giving rise to innovative use cases in the insurance industry.

Nvidia, which is powering GenAI, presented at the symposium. It was interesting to hear the company’s view on GenAI’s financial services and insurance use cases. From an insurance perspective, Nvidia touched on Know Your Customer (KYC), fraud detection, underwriting, claims, and analytics.

Cloud provides a backdrop to test various foundational models. Amazon Web Services (AWS) recently released Bedrock, a foundational model API service, stating Bedrock is “the easiest way to build and scale generative AI-based applications using FMs [foundation models].”

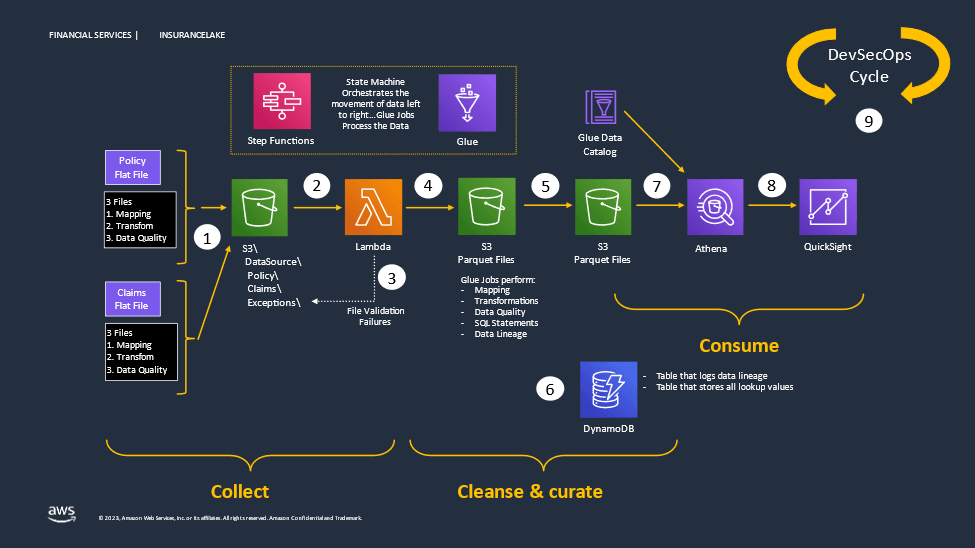

At the end of the day, it is all about data to take advantage of cloud, AI, and any form of emerging technology. Celent’s recently published report, Data-First Transformation for Value Realization in Insurance, focuses on creating a cloud-based data repository as a primer for innovative and transformative initiatives. AWS’ insurance team has created InsuranceLake for this very purpose, as summarized in Figure 1.

Figure 1

InsuranceLake creates an auditable, secure source of trusted data to fuel innovation. Data is collected, cleansed, and curated by InsuranceLake. Setup includes DevSecOps, infrastructure, and pre-built solutions.

We heard various innovative use cases at the AWS Financial Services Cloud Symposium and Industry Analyst event. Principal Financial Group (PFG) discussed combining enterprise data, AI, business intelligence (BI), and analytics foundations in cloud. PFG’s Chief Data and Analytics Officer Karthik Balakrishnan provided an overview that included modeling and generating insights from the voice of the customer. Another intriguing use case was from The Hartford, which found an innovative way to improve the claims experience for customers. The Hartford imagined a 55-year-old person being in an accident and then worked backward to model various scenarios in cloud. This resulted in creating a streamlined, efficient, and futuristic claims solution.

FOXO Technologies’ use case involved epigenetics and insights to enable next-generation underwriting. The company also offers supervised machine learning and artificial intelligence technologies to identify epigenetic biomarkers that measure current states of health and aging.

Not all use cases were about modern platforms. We heard a use case from John Hancock that involved moving 14 million policies running on DXC Technology’s legacy system to the cloud in 13 months. This was a lift-and-shift operation performed by the carrier with the help of DXC. Together, they moved about 2 million lines of code to AWS EKS (Elastic Kubernetes Service). This helped generate APIs, which resulted in CX improvements and cost savings. It also helped John Hancock to retire its old print systems and generate real-time quotes. This was mostly a closed block of business.

Cloud and AI are changing the business landscape. The insurance sector, which historically has been legacy oriented, is seeing a massive evolution of use cases. At the heart of it all is data. This is a great time for insurance companies to undertake a data-driven transformation. By combining data, cloud, and AI, insurers can create innovative products, improve operational efficiencies, reduce costs, increase revenues, and enhance policyholder touchpoints and experience.

Recently, news emerged about major insurance carriers stopping to underwrite homeowner policies in California due to inflation and unpredictability of wildfires. Innovative usage of emerging technologies should enable carriers to effectively underwrite in populous states like California.