Clouds on the Horizon for Insurers

Insurance Cloud Kings Series

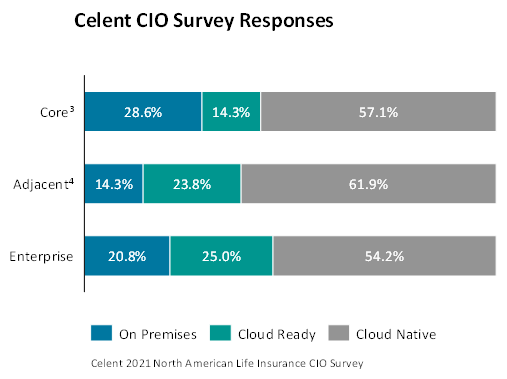

Not long ago insurers were resistant (or, at best hesitant) to move legacy data and applications to any place outside of the control of their own firewalls. But today, things are rapidly changing (let’s just say, a black-swan event intervened). Celent’s survey results are capturing the changes—our 2021 Life Insurance CIO Pressures And Priorities 2021 report reflects a significant a change from 2020, when less than 40% of CIOs would consider cloud native core solutions. The 2021 results for adoption readiness are shown in the chart below—today, well over 50% of CIO’s are ready to pursue cloud-ready or cloud-native applications.

The pandemic created perfect storm conditions for easy to buy protection, and cloud native, or “full-stack” insurance platforms vaulted into action driven by the window of opportunity to capture a new cohort of digitally-savvy customers who demand instant service (at low cost), with easy access to simple products. Without the shackles of on-prem and legacy encumbrances, new, cloud-native players have entered the industry with extreme customer focus and fresh marketing appeal.

In response, incumbents must pursue cloud infrastructure for their own critical strategies driven by more effective and efficient collaboration of internal and external data and systems to increase productivity and keep pace. In short, cloud has become the fulcrum for digital transformation for incumbents to remain competitive. However, for those taking their first steps, migration to the cloud can be overwhelming—it requires more than just a compelling desire to keep up—there are skill and process changes required for success. A recent Celent Snap Poll for Life Insurers and Cloud Deployment, in which we asked, “What has been your biggest challenges?” highlights this point.

Resource and skill gaps are challenges but should not be insurmountable roadblocks. It is important for insurers to approach cloud migration in stages and to avoid the pressures to immediately add new functionality which could exacerbate skill issues. Incrementalism is key allowing the IT staff the opportunity to both learn and return business value. Insurers should, first, focus on migrating existing, on-premise systems, and only consider upgrades or new functionality after the systems are running optimally on the new infrastructure.

An additional consideration are interfaces. The level of their change is a common underestimation. There is a risk in assuming that most infrastructures can simply be “lifted-and-shifted” to the cloud. Interfaces rarely port. Once moved, however, cloud-based data management tools provide significant benefits for automating data flows and their controls.

If you are still asking today “why cloud?”, then you may be at serious risk of not preparing for the future. Leveraging the variety of “as a service” offerings is a marque example of how to benefit from a new technology built for flexibility, speed, and scale. The good news is that you don’t have to go it alone. Working with an experienced partner can both mitigate risks and help address the skill gaps highlighted above. And Celent can help—we realized that you’ll get valuable insights if you hear directly from key players involved in the insurance cloud ecosystem. As a result, Celent has launched a series of interviews with a diverse set of service providers, available through our Cloud Kings Hub page (https://www.celent.com/topics/cloud-hub). Starting in January, we will begin a series of interviews with key providers offering a differentiated cloud migration approach for insurance companies. Please check back to the hub page frequently for updates on the insurance Cloud Kings.