The Results are In: Celent’s IT Spend Survey Analyzes Top Priorities for Global Wealth Managers

Our Wealth Management (WM) team recently published the results from Celent’s TechnologyInsights and Strategy Survey (CTISS).

The WM survey asked over 200 wealth managers from across the globe about their IT spending priorities for 2023. Two key takeaways from the WM edition are highlighted in this blog; the webinar (available to the public) and report (available to Celent WM subscribers) contain more insights and analyses.

Strategic Drivers of IT Investment

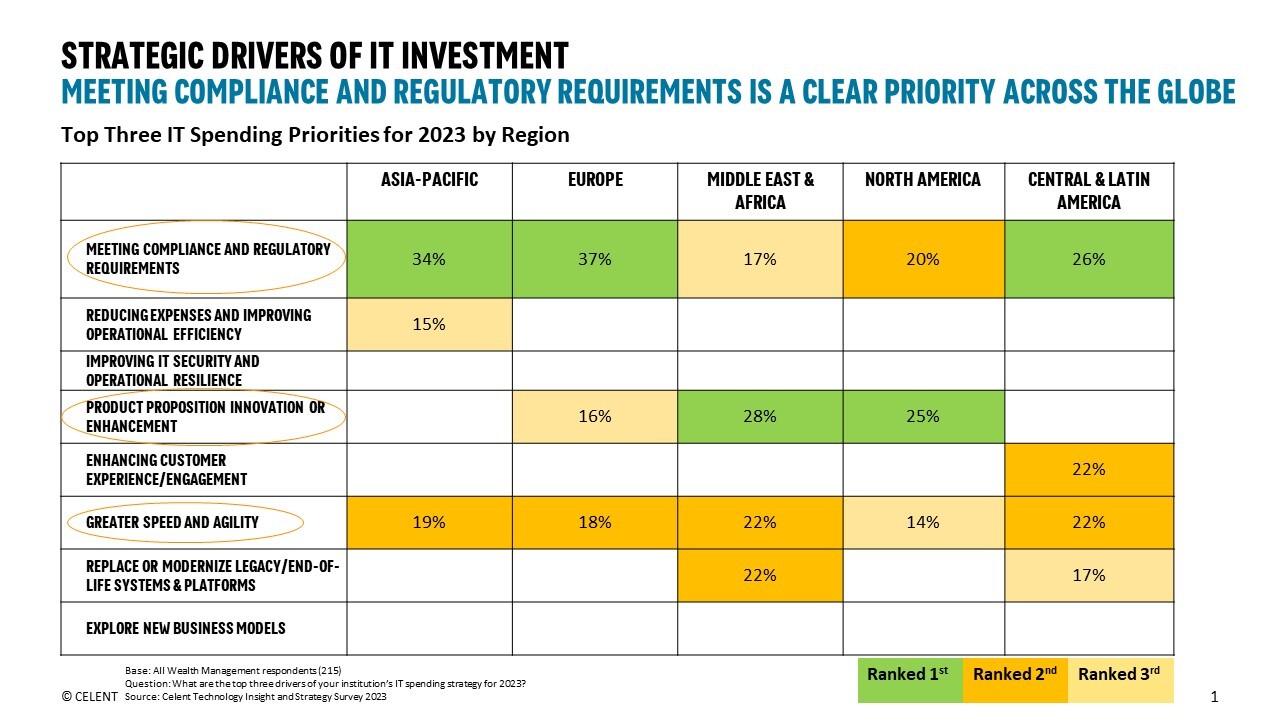

We asked wealth managers, “What are the top three drivers of your institution’s IT spending strategy for 2023?” In summary, wealth managers view operating with speed, agility, and innovation in a compliant ecosystem as the primary IT spending objectives.

The investment management industry continues to face regulatory changes related to new technologies, outdated legislation, and future-focused topics, so it is little surprise that “meeting compliance and regulatory requirements” ranks as the top priority for wealth managers. For example, in the US, the SEC recently approved dozens of proposals to alter existing regulations or create new ones concerning relatively nascent topics like ESG and crypto. Firms have been challenged by the costs associated with staying compliant, along with experiencing delays and lack of transparency around emerging regulation.

As a result, the RegTech universe continues to grow. Solutions that incorporate AI and ML to bring transparency across regulatory complexities such as data management, cross-border KYC/AML, and identity verification, among others, are a notable industry trend. The implications for RegTech revolve around:

·Ease of use and efficiency.

·AI and evolving LLMs will play a significant role in harnessing large data sets in an on-demand environment.

·RegTech providers will continue to invest in AI, ML, and data analytics to alleviate operational inefficiencies and rising costs.

Greater speed and agility ranked as the second most important priority, while product and platform innovation ranked third. Accordingly, organizations are addressing inefficiencies in their operating models, going from monolithic architectures to a more API- or cloud-enabled state that offers them more flexible delivery, better data integration, operational cost savings, scalability, and business resilience. Cloud, for example, has traditionally been viewed as a tool to modernize legacy systems, with the intention of reducing infrastructure costs, but firms are now looking to apply cloud in a more tactical way, such as creating greenfield solutions.

Top Three IT Spending Priorities for 2023 by Region

Adhering to compliance and regulatory requirements is a clear priority for all regions. For APAC, Europe, and Central & Latin America, this is their top priority. For North America, it is second, and for the Middle East & Africa, it is third. For the Middle East and Africa, as well as North America, product proposition innovation or enhancement is their top concern. There is a uniform desire for greater speed and agility, which was ranked as a second priority across all regions except North America, who viewed it as their third priority. What is interesting to highlight is the relative consistency across regions: firms are investing in areas that will drive innovation, with a particular focus on enhancing the technology infrastructure to enable a competitive advantage and achieve broader and more thematic goals like enhancing the client experience.

Speed and agility are entwined with innovative product creation. Again, using cloud as an example, wealth managers are adopting cloud on two different principles: 1) modernizing legacy systems to reduce operational costs, and 2) creating greenfield solutions, such as analytical and customer experience–focused products. Cloud is also being used extensively in the quantum computing space, whose specific use cases for financial services fall into three main categories: targeting and prediction, trading optimization, and risk profiling.

Ultimately, we are seeing a focus on architectural transformation to align with over-arching goals, like optimizing the client experience and carving out a competitive advantage.

You can view the Wealth Management webinar: Technology Priorities 2023: Wealth Management | celent.com and report: Wealth Management IT Priorities and Strategy in 2023 | Celent.