Bridging the Trust-Brokerage Divide: The Movement Toward a Common Advisory Platform

The discrete integration models offered by the platforms profiled in this report represent distinct takes on the best way to supercharge advisor capacity.

Key research questions

- What are the requirements of trust-brokerage integration?

- How has digitization affected wealth management operations?

- Is one type of integration model better than the others?

Abstract

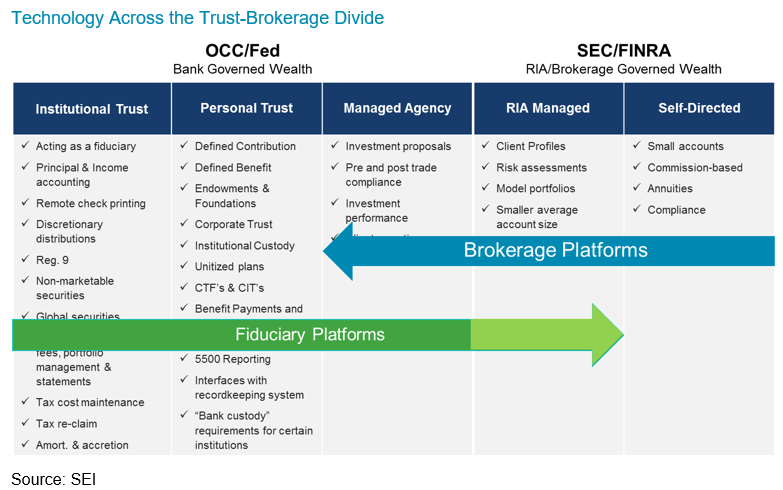

Clients view investments they hold within an institution as a whole, not in terms of separate brokerage, trust, and bank channels. This report looks at how institutions can leverage new types of middle and back office technology to reach beyond the vertical technology structures that exist today and develop integrated platforms that enable a consistent, cross-channel experience.

Efforts to consolidate trust and brokerage operations on a shared advisory platform are designed to redress misalignment between client needs and the traditional wealth management servicing model. Unlocking the potential of this model will require the dissolution of organizational silos, the harmonization of fragmented delivery channels, and responsiveness to the demands of new stakeholders.