The Pensions Dashboard Initiative in the UK: Opportunities for Financial Service Organisations?

Pension dashboards, also referred to as Pension Tracking Systems (PTSs), have been successfully implemented in multiple European countries, including Belgium, Denmark, Sweden, Norway, and the Netherlands. These systems enable citizens to conveniently monitor their retirement savings from different sources in a single location, with some of them having been operational for over a decade.

The UK’s pensions dashboard program delayed multiple times. The Pensions Dashboard initiative aims to provide individuals with a comprehensive view of their pension savings, including state and private pensions. The dashboard will enable users to access their pension information securely and conveniently, empowering them to make informed decisions about their retirement planning.

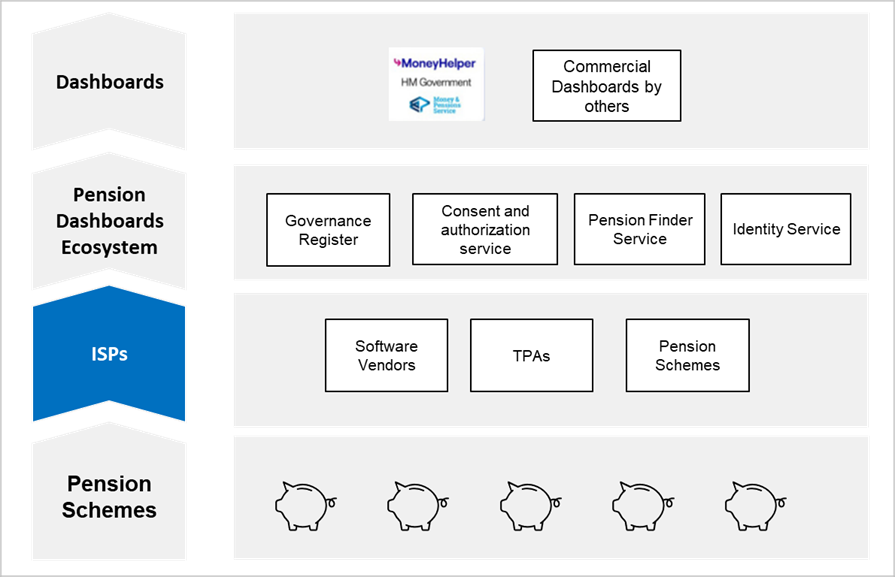

The Pensions Dashboard Programme (PDP) has been responsible for designing and implementing the central digital infrastructure, enabling pension dashboards to function effectively. The PDP is also responsible for developing standards to establish the necessary rules and controls for seamless connectivity to the pension dashboard ecosystem. Alongside the PDP's efforts, the Money and Pensions Service (MaPS) is actively working on creating its own pensions dashboard and accessible to all users seeking to access their pension data once it is available. Other organisations could create commercial dashboards, offering individuals more options for accessing and managing their pension information. Several organisations, including Standard Life and MoneyHub, have already expressed their plans to develop commercial dashboards.

The Pensions Dashboards (Amendment) Regulations 2023 set a legal connection deadline of 31 October 2026, by which all occupational pension schemes in scope need to be connected to the pension dashboards ecosystem. The Financial Conduct Authority (FCA) states the same obligation for personal and stakeholder pensions in its Pensions Dashboards Rules for Pension Providers.The largest master trust schemes with 20,000 or more members are expected to connect by 30th April 2025, while smaller occupational pension schemes with 100-124 members have until September 30, 2026, to complete their connection.

Implementing a pension dashboard brings specific responsibilities and duties for pension schemes. One of the primary duties is to ensure the accurate and timely provision of pension data to the dashboard. Pension schemes are required to securely share relevant information about an individual's pension savings, including their contributions, investment performance, and projected retirement income. This duty is crucial in enabling individuals to have a comprehensive and up-to-date view of their pension schemes in one centralised platform. Pension schemes must also prioritise data protection and security, safeguarding personal and sensitive information against unauthorised access or misuse. Additionally, pension schemes must provide clear and understandable information to individuals, helping them make informed decisions about their retirement planning.

There will be two ways that trustees or managers and pension scheme providers may opt to connect to the pension dashboard ecosystem –

- Using an in-house technical solution by building their direct connection or

- Buying the services of an Integrated Service Provider (ISP) or third-party administrator and connecting through them.

The ISP acts as a central hub, connecting various stakeholders and systems in the pension industry. It facilitates the seamless exchange of data and information between pension providers, employers, and individuals. The ISP ensures that pension data is securely and accurately transmitted, allowing individuals to access a consolidated view of their pension information through the dashboard. Additionally, the ISP provides essential services such as data validation, cleansing, and enrichment to ensure the accuracy and reliability of the information presented on the dashboard. By serving as a trusted intermediary, the ISP enhances transparency, efficiency, and accessibility in the pension industry, empowering individuals to make informed decisions about their retirement savings. There are many ISPs in the market, such as Intellica, Equisoft/itm, Civica, Bravura, Dunston Thomas, Heywood, Origo, etc.

Opportunities for Financial Service Organizations:

The Pension Dashboard initiative presents several opportunities for financial service organisations, particularly in developing commercial pension dashboards. Here are some key opportunities:

- Building Commercial Dashboard: While the government is spearheading the creation of a public pension dashboard, there is room for developing commercial dashboards. The rich data accessible through pension dashboards can be a goldmine for financial service providers. By analysing this data, organisations can gain insights into customer behaviour and preferences, enabling them to offer more personalised and targeted financial products and services.

- Building Trust and Customer Loyalty: Pension dashboards are anticipated to boost individuals' involvement with their pensions, enabling financial service organisations to effectively engage with customers by providing valuable information and advice. Leveraging the Pension Dashboard, these organisations have the opportunity to build trust and reinforce customer relationships. By offering a secure and user-friendly dashboard, they can enhance the overall customer experience and foster loyalty among their clientele.

- Personalised Retirement Planning: Commercial pension dashboards can provide additional features and tools to help individuals with retirement planning. These may include retirement income calculators, investment advice, and options for consolidating pension pots.

- Value-added Services: Financial organisations can offer value-added services through pension dashboards. These may include access to financial education resources, retirement planning seminars, and personalised recommendations based on individual circumstances.

- Collaboration Opportunities: The Pension Dashboard initiative encourages collaboration among pension providers, fintech companies, and other financial service organisations. Organisations can leverage their expertise and resources to develop innovative solutions and expand their market reach by partnering with stakeholders.

In summary, this initiative has the potential to bring about significant changes in how individuals engage with their pensions, offering financial service organizations an opportunity to lead the way in developing innovative, customer-centric solutions that will shape the future of retirement planning in the UK.