The emerging field of geospatial data and aerial imagery presents a wealth of opportunities for property casualty insurers throughout the entire insurance value chain and can substantially bolster carriers’ overall business performance. From improving the underwriting of business to expediting claims handling and managing natural catastrophe (NatCat), these technologies can serve as a remedy for profitability challenges faced by property casualty insurers.

Although the concept and value of geospatial data and aerial imagery may be simple, comprehending the ecosystem of providers is somewhat nuanced and intricate. Some providers obtain the imagery themselves,others through diverse channels. Some use the data to create models and analyze the data at a NatCat modeling level. Others utilize artificial intelligence (AI) to provide detailed insights on the imagery at a property and peril-specific level. Some focus primarily on the underwriting uses for the data, and others concentrate on claims.

We’ll offer an overview of the current geospatial data and aerial imagery space, classify the various types of offerings, and outline areas where they offer value. We’ve included a comprehensive set of baseline functional capabilities to evaluate, as well as a list of questions to ask, to help you distinguish between the capabilities of solution providers and make informed buying decisions. Lastly, you’ll find a non-exhaustive collection of profiles of the leading solution providers in the industry, as well as their applications in the realms of claims, underwriting, and NatCat response.

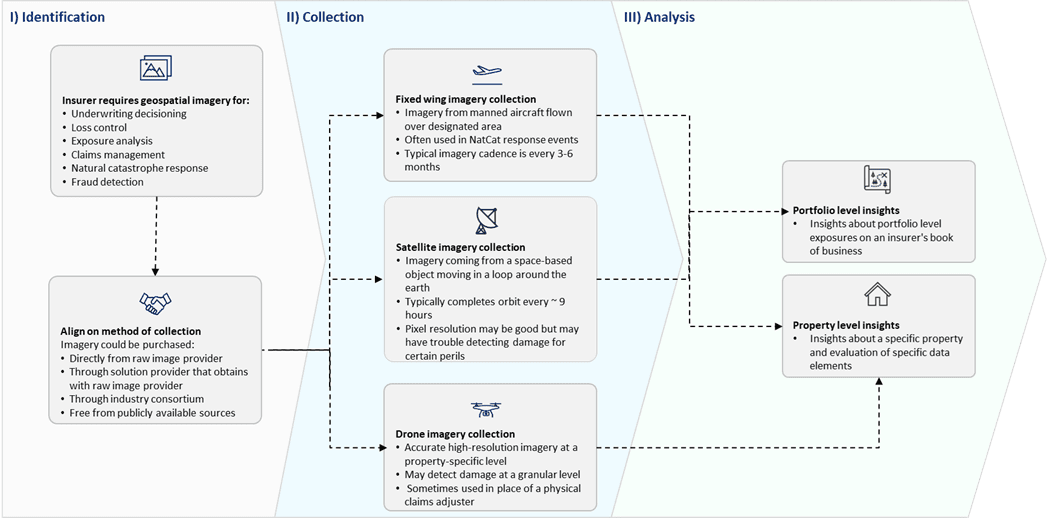

Figure 1: Geospatial Data and Aerial Imagery Workflow

Source: Celent