Abstract

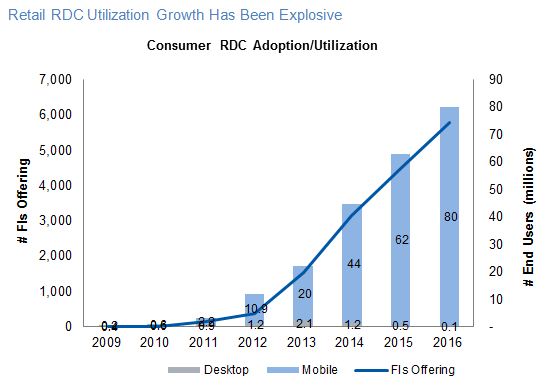

More than 2,600 US financial institutions went live with mobile deposit in the last two years, leading to an estimated 80 million retail users.

Celent has released a new report titled State of Remote Deposit Capture 2017: The Final Stretch. The report was written by Bob Meara, a Senior Analyst with Celent’s Banking practice.

Institutions are wise to offer business mobile deposit, but the expedient path chosen by most banks will likely disappoint. The majority of institutions offering business mobile deposit merely offer a “consumer” solution with higher deposit limits. More capable and appropriate products are available from many vendors, but banks have been slow to embrace them.

The ability of remote deposit capture (RDC) to extract, validate, and manage payments information (payment stubs, invoices, etc.) remains unappreciated. A small minority of banks offer these capabilities, either stand-alone or in concert with lockbox offerings. Those that do are primarily large banks. Despite the well-founded enthusiasm around mobile, boring old commercial desktop RDC deployments continue to grow at a double-digit pace in many banks.

“A surprisingly large opportunity remains for boring old commercial desktop RDC after all these years. Most banks have roughly 10% annual revenue growth in their sights over the short term,” Meara said.

“A more interesting opportunity is with small business, but banks won’t realize the opportunity unless they up their product game,” he added.