There is no denying the wealth management market is telling us that planning software is a must have. Turnkey Asset Management Platform’s (TAMPs) have opened their wallets to bring the leading (either new or old) financial planning software into their ecosystems.

Big news[1] hit yesterday with InvestCloud, which is on quite the journey,[2] announcing the acquisition of Advicent, the parent company of planning software NaviPlan. This is the latest in a spree of acquisitions of planning software this year. Since Celent published on the planning space last summer, three firms profiled in our reports (Voyant, Apprise Labs, and NaviPlan) have been acquired. (See North American and Canadian versions as well as our Solution Brief on Voyant)

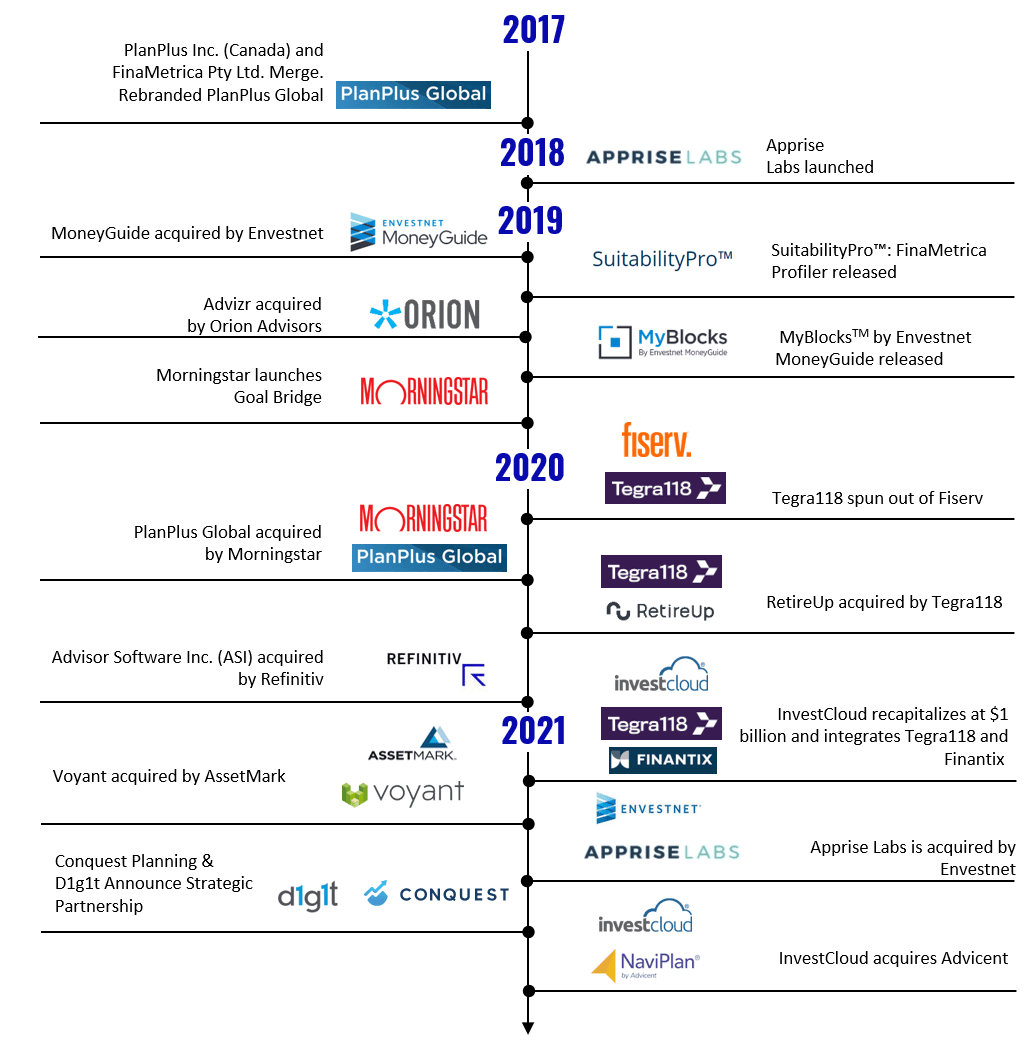

Given the buzz around the planning space, I had to update a figure we created in the August report.

So why all the acquisitions? As covered in the reports, planning functionality continues to be pushed to the center of an advisor’s value proposition. With digital engagement here to stay, firms must adjust how they interact with their clients. What better way to do this than reviewing your client’s financial plan with them digitally? Advisors see tremendous value through these engagements. Another aspect these firms have in common is the prolific use of APIs, which support strong growth potential and short integration timelines for the acquiring firms.

The acquirers will continue to invest to improve streamlining planning components, client self-serve and analytical capabilities. Additionally, acquirers are positioned to monetize the immense amount of data that flows through the planning engines. Be sure to keep an eye on how firms are assessing opportunities to utilize this data to augment advisor-client engagement.

So, who’s next on the acquisition list?

[1]After four-year turnaround effort, Angela Pecoraro finally sells Advicent to rollup ravenous InvestCloud to complete 'writing-on-the-wall' deal

[2] In February, InvestCloud hit unicorn status when it recapitalized and integrated with Tegra118 and Finantix