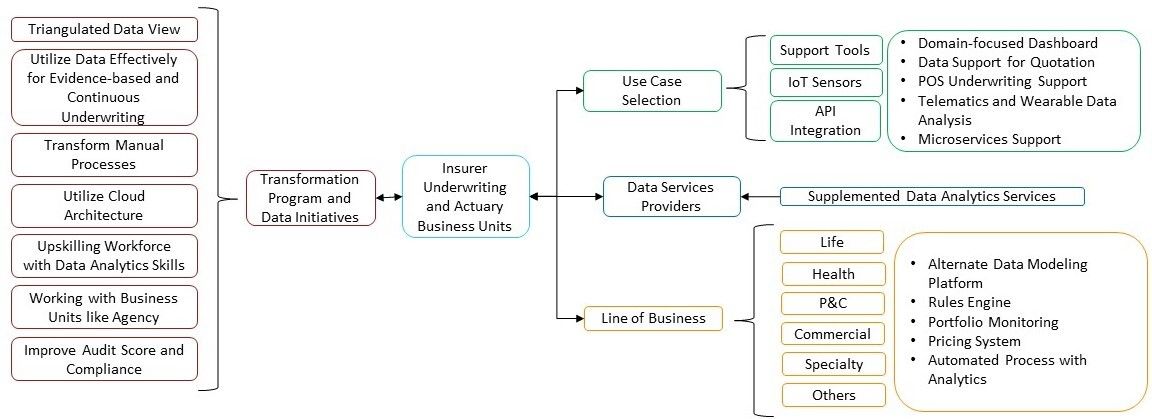

In this report, we look at how data solutions play a role to provide support for actuary and underwriting functions in the insurance value chain. Insurers and technology vendors are looking beyond the front-end distribution function, and to modernize back-end functions such as actuary and underwriting. From an insurer’s perspective, the use of data can provide a more efficient process for underwriting and actuary modeling. From the profiles of vendors who have adopted data, analytics, and AI, the main goal is to provide process efficiency. Data and modeling are the foundation for these solutions. The lines of businesses solutions are usually distinct, i.e., they cater predominantly to the life, health, commercial, or specialty space, with selected use cases such as dashboards for actuarial and accounting functions, agent’s platform with input of underwriting and actuarial data, sensor technologies for underwriting, API-enabled platform with underwriting support, and specialized data services providers.

There are observable needs from an insurer’s point of view regarding transformation and innovation of the underwriting and actuary function. Data initiatives can be the enabler, and insurers need to be aware of the solutions that can support them. We provide a general classification of the solutions available, to offer an initial assessment mapping of vendors’ function to internal needs.