Payments and the Internet of Things: Opportunities and Challenges

Abstract

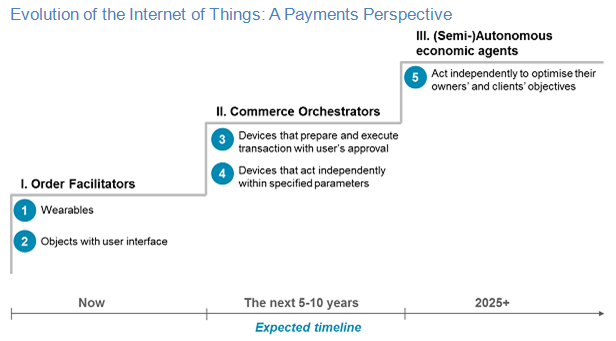

The Internet of Things will change how commerce and transactions are conducted, and in turn will require changes in payments.

Celent has released a new report titled Payments and the Internet of Things: Opportunities and Challenges. The report was written by Zilvinas Bareisis, a Senior Analyst with Celent’s Banking practice.

For the Internet of Things (IoT) to deliver on its promise, payments capability will be crucial. As devices and entire platforms (e.g., cars) connect to the Internet, they become conduits for commerce transactions and require payments capability. IoT will change how commerce and transactions are conducted, and in turn will require changes in payments. How can the industry address the challenges and capture the opportunity?

IoT represents a big opportunity to deliver on the promise of connected commerce, and payments will be a key enabler. However, many challenges need to be addressed first to ensure ubiquity and security of IoT payments. Diverse partnerships are being formed between payments companies, device manufacturers, and various specialist players to enable connected commerce transactions. IoT offers banks more ways to engage the customers and understand them even better, which banks can monetize through cross-selling, better risk and collateral management, and new products.

“IoT takes contextual commerce to an entirely new level, as connected devices start facilitating customer orders, orchestrating commerce transactions, and ultimately acting as independent economic agents,” commented Bareisis.

“There are many payments and commerce orchestration-related challenges to be addressed, from authentication and security to tailored liability framework. And, as always, creating genuine value for customers, rather than doing something just because technology is available, will be what differentiates successful banking IoT propositions from expensive failures,” he added.