Wealth management technology budgets are expanding. Wirehouses, banks, IBDs, and RIAs all continue to increase their IT spending to improve operations, scale, and stay competitive.

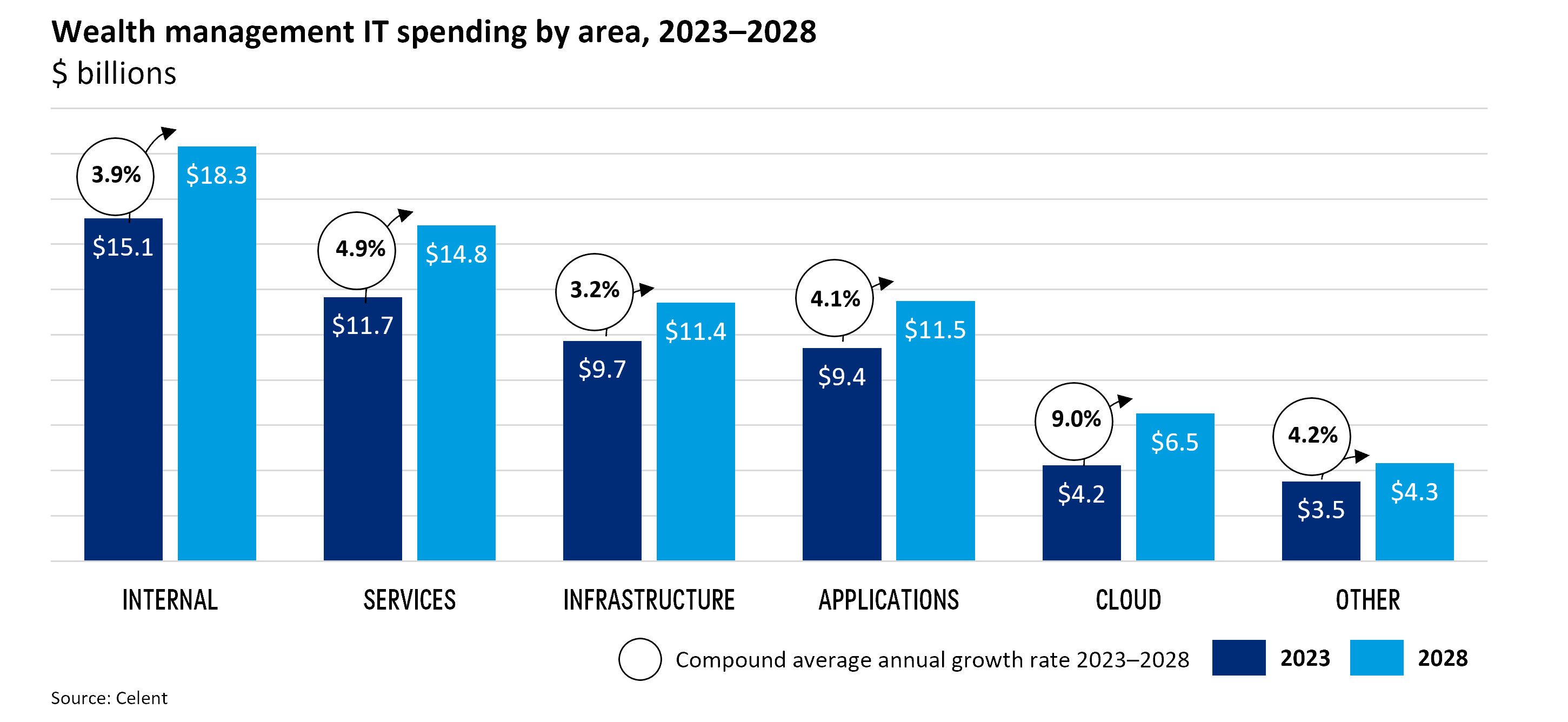

According to our new Wealth Management IT Spending Forecasts by Technology, 2023–2028 report, global wealth management technology spending is projected to grow steadily at a 4.5% CAGR over 2023–2028, reaching $66.9 billion in 2028.

Spending will grow across all technology areas, but only the two fastest growing areas will gain share of total wealth management IT spending through 2028: cloud and services.

Why the strong growth in these areas? Both cloud computing and external services enable cost savings, agility, and scale. See our blog breaking down the key benefits of cloud computing for wealth managers.

Cloud spending will see the strongest growth of any technology area over 2023–2028

Cloud spending includes infrastructure-as-service (IaaS), platform-as-a-service (PaaS), and software-as-service (SaaS). The category will experience the strongest growth of any technology area with a 9.0% CAGR over 2023–2028, albeit coming from a relatively small base.

Cloud will benefit from three gradual shifts in technology spending:

- Internal IT workforce spending will move toward supporting cloud

- Infrastructure spending (e.g., on premise data centers) will move toward IaaS

- Applications spending will move toward PaaS and SaaS

According to the Celent Technology Insight and Strategy Survey (CTISS), 63% of wealth management firms agree they will move more workloads to the public cloud. That said, wealth management still lags other sectors in terms of cloud migration. For example, cloud's share of total IT spending is greater in retail banking and corporate banking than it is for wealth management.

Services spending will outpace other areas and gain share of total IT spending

Services spending is the second-largest spending area throughout the forecast. The category includes spending on external IT services, external infrastructure services, and professional services/consulting. Services will see the second-highest growth in spending behind cloud, with a 4.9% CAGR over 2023–2028.

Growth will be driven by demand for professional services and application services for development, testing, maintenance, and management. Services will also benefit from slight shifts in spend from the infrastructure category.

Services and cloud will be the only two technology areas to gain share of overall IT spending. Wealth managers should assess their own IT spending and compare to the market movements in the forecast. With costs, agility, and scale top of mind for the future, firms should consider similar shifts to cloud and services if they are not already doing so.