次世代クレジットスコアリングがまもなく米国の住宅ローン融資に導入される

The Entire Industry Ecosystem Must Work Together

Consumer credit scoring has existed for decades. It evolved from being a custom analytic product used within financial institutions to being a generic score broadly distributed through credit bureaus with a similar score available directly to consumers for personal financial management. The FICO Score is the best-known generic credit score, especially in the United States, where all three major consumer reporting agencies, Experian, Equifax, and TransUnion (the CRAs) began distributing it in 1991 to financial institutions, utilities, and other entities.

FICO Scores Became a US Mortgage Industry Standard

In 1995, Fannie Mae and Freddie Mac—two US government-sponsored enterprises (GSEs)—adopted the FICO Score in the conforming mortgage market. In Celent’s view, it became a de facto US mortgage industry standard for two main reasons: 1) the lengthy mortgage supply chain of brokers, loan officers, lenders, correspondents, warehouse lenders, servicers, investors, and guarantors benefitted from the use of a single, consistent score throughout the lending supply chain, and 2) the FICO Score performed very well at predicting default risk in conjunction with human underwriting and automated underwriting systems.

Industry Standardization Led to Stagnation

During the past two decades credit scoring data, analytics, credit report reason codes, and scores were all enhanced to improve in their ability to predict loan default.In addition, custom scores were built for specific industries such as auto, mortgage and small business lending.Within the mortgage industry, however, industry adoption did not keep pace with advances in scoring due to the need to recalibrate new score performance with prior score performance, and the need for the industry to move in unison in adoption.The industry was slow to adopt new scores available from FICO, in addition to scores from VantageScore, LLC, which entered the US credit scoring market in 2006. The CRAs created VantageScore as an alternative to the FICO score for all types of retail loans, but its progress was slowest in the mortgage lending sector where FICO remained the defacto standard.

The benefits of industry standardization remain but have not materially increased. There is a strong argument to say that the benefits have decreased because the industry is not taking advantage of new data and better analytics to make better decisions across the entire industry supply chain.

The Enterprise Credit Score and Credit Reports Initiative

In response to the desire of many industry participants to make better decisions, the Federal Housing Finance Agency’s (FHFA) proposed an Enterprise Credit Score and Credit Reports Initiative (the Initiative) during the Spring of 2023. The FHFA is an independent agency established by the Housing and Economic Recovery Act of 2008 (HERA) and is responsible for the effective supervision, regulation, and housing mission oversight of the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac), and the Federal Home Loan Bank System.

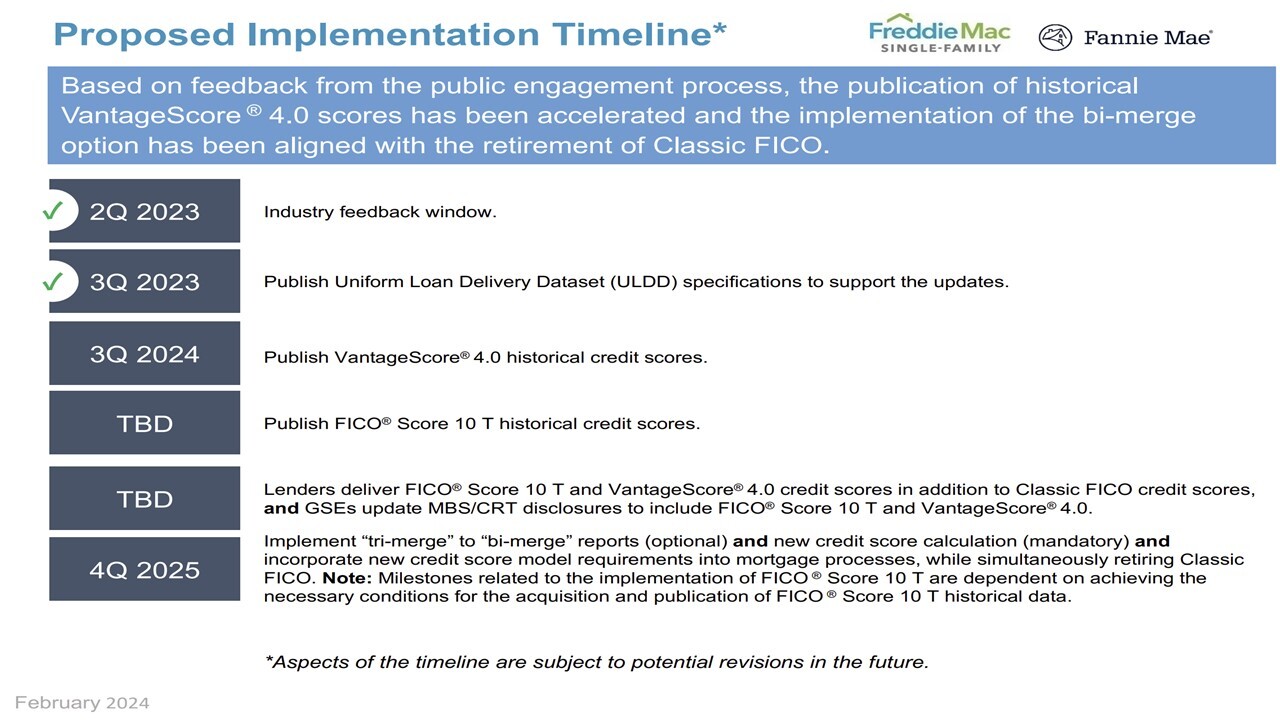

The initiative has two fundamental components: 1) introduction of two new scores to the mortgage lending / underwriting process (FICO 10T and Vantage Score 4.0) called the Credit Score Models Update and 2) offering mortgage industry flexibility to use two-bureau credit report merges in place of current tri-merge, called the Credit Report Update (October 2023). Figure 1 reproduces the FHFA’s most recent implementation timeline for the Initiative.

Figure 1: FHFA Proposed Implementation Timelines for New Credit Scores and Credit Report Policy Change

Source: FHFA Enterprise Credit Score and Credit Reports Initiative, Partner Playbook (February 29, 2024).

While the Initiative focuses on lenders, the entire mortgage lending industry must implement a variety of policy, process, training and technology changes to adopt the new credit scores. The biggest change of all is incentivizing and motivating an entire industry to adopt the new scores when there are large transformation costs.

The Role of Technology

The upcoming credit reporting and credit scoring changes are far reaching and impact many lending processes and technology systems across loan origination, secondary marketing, servicing, and capital markets. The impacts include the need to collect new data fields; collect and differentiate multiple credit report scores and score types; and perform analytic calculations and compliance tests. Industry participants will also need to recalibrate many types of analytic models for loan underwriting, pricing, financial risk management, portfolio risk management, and operational staffing.

Future Proofing for Ongoing Change

Celent’s technology report Next Generation Retail Loan Origination Systems: Shifting to the Enterprise and Cloud to Modernize Front- and Back-Office Systems, focuses on the modern composable, open integration, cloud-based loan origination systems needed to adapt to the Initiative and other data, analytic, and decisioning system changes on retail loan origination.

In addition, the report—which is based on Celent technology surveys, client and vendor interviews, case studies, and Celent expertise—addresses how lenders can realize speed and efficiency gains from true cloud native LOS, reduce technical debt inherent in multiple legacy LOS, and consolidate specialized LOS built for specific lines of business (auto, credit card, personal, and home equity lending) into fewer systems.

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss the credit scoring initiative or loan origination systems. If you are a client email me or your relationship manager to set up a call.