Cisco’s Journey to Simplify, Unify, and Secure the Tech Stack and Enterprise: Improving the Client Experience

Takeaways from Cisco Live

“90% of global CIOs say that, with more insight—from visibility, detection, forecasting, etc.,—into network operations, their organization could improve end user experience.” —State of Global Innovation survey, Cisco 2023

I had the fantastic opportunity to attend Cisco Live in Las Vegas, where Cisco highlighted the innovative work it’s doing to deliver on its mission statement and key theme of the event, which was communicated by Chairman and CEO Chuck Robbins: “We securely connect everything to make anything possible.”

Mr. Robbins commented on the essentialness of technology and the fundamental role it plays in organizations’ conversations about strategy, all while navigating an increasingly complex macro environment and world.

The innovation that was rolled out during the three-day event was centered around the following:

·Reimagined applications.

·Powering hybrid work.

·Transforming infrastructure.

·Securing the enterprise.

·Sustainability.

Additional themes included:

·Full-stack observability.

·Simplifying security and applications.

·Unifying experiences.

·Responsibly harnessing and utilizing AI.

The horizontal nature of Cisco granted me the opportunity to sit in on conversations that I, as a wealth management analyst, would typically not encounter in my normal day-to-day conversations. This was one of my favorite parts of attending the conference, because I could see the convergence of industries and technologies playing out in real life. The themes mentioned above have a profound effect on wealth managers, so these ideas are also verticalized into more niche industries, like wealth management. For the purposes of this blog, I will focus on how technology is changing the guest or client experience, which was featured during the opening panel of:

·Ken Martin, Managing Director, Global Sports Media and Entertainment, Cisco

·Jeff Crist, CIO, MGM International

·Matt Pasco, VP IT, Las Vegas Raiders

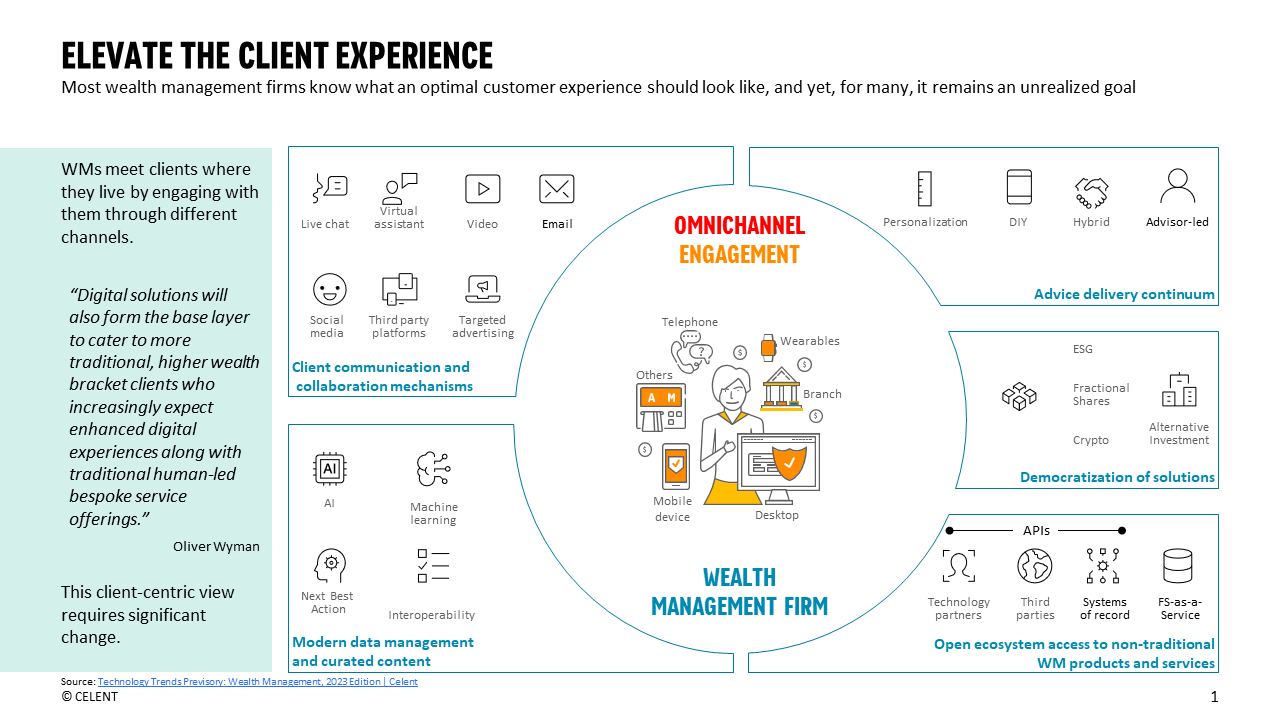

The anchoring thought behind this panel was that people are consuming their experiences (in this case, it was football games and travel) differently than even a decade ago, and technology is the key enabler of this shift in mindsets and behavior. The “hyper”-personalized world that we now live in is the norm for consumer expectations—and the same is true for the wealth management client experience, which we at Celent have been observing and writing about for years. For wealth managers, the client experience is largely impacted by their interactions in adjacent industries. The dominating narrative of personalization and democratization of wealth management is driven by the application of modern technologies, such as APIs, AI/ML, and data-agnostic tech stacks—and there is no going back.

In the case of MGM International, Mr. Crist commented that “the whole (travel and hotel) experience has changed dramatically—it is now a mobile experience,” so the investment into transforming a one-dimensional resort experience into one that is interactive and immersive is effectively nonnegotiable. “Everything is a network, from the point of sale to mobile ticketing to guest interaction within the building, etc.,” was a comment observation from Mr. Martin, which was related to the evolution of attending a football game. But the same can be said and adapted to the wealth management client experience, particularly as the client-advisor relationship and journey has become or is trending toward fully remote or hybrid, with the option for in-person interactions, and the expectation of a personalized and mobile experience are the new norm. In short, organizations are leveraging today’s tech to meet the client where they “live” by engaging with them through different channels.

I recently spoke at INVEST in New York City on the topic of digital client onboarding, and there were two key takeaways that coincide with the Cisco panel:

·Wealth managers are rewriting platforms and processes that have existed for decades to achieve advisor and client efficiency and satisfaction.

·The connectivity and tight integration between each function to support the flow of data is critical, as is the flexibility of the overall system to support advisor-client optionality and hybrid servicing.

An industry statistic states that 90% of today’s data was created in the last two to three years alone. That is an incredible concept when you think about it. The influx of data and the amount of data traffic generated per individual is astonishing. So the competitive advantage for organizations—be it the NFL, MGM, or wealth managers—will come from their ability to rein in and monetize internal and external data. Importantly, the security of an end-to-end platform, data protection, and cybersecurity must be a top priority in today’s data-driven, fast-moving, digital, and complex world. Technology is the great unifier across industries, people, and experiences. Cisco has it right in identifying simplification and security as the core pillars of the next wave of innovation.