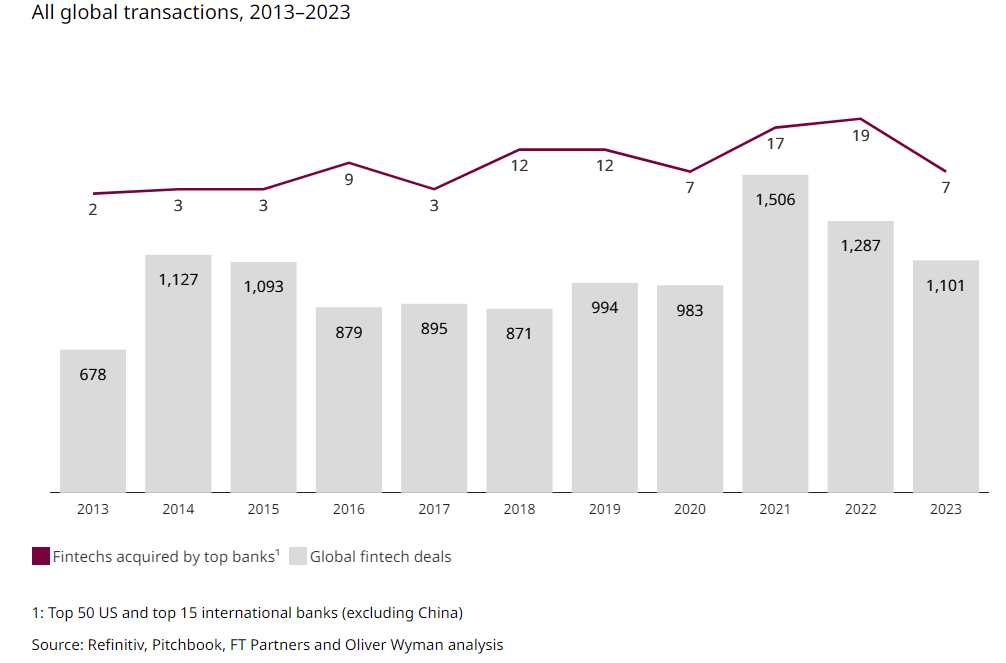

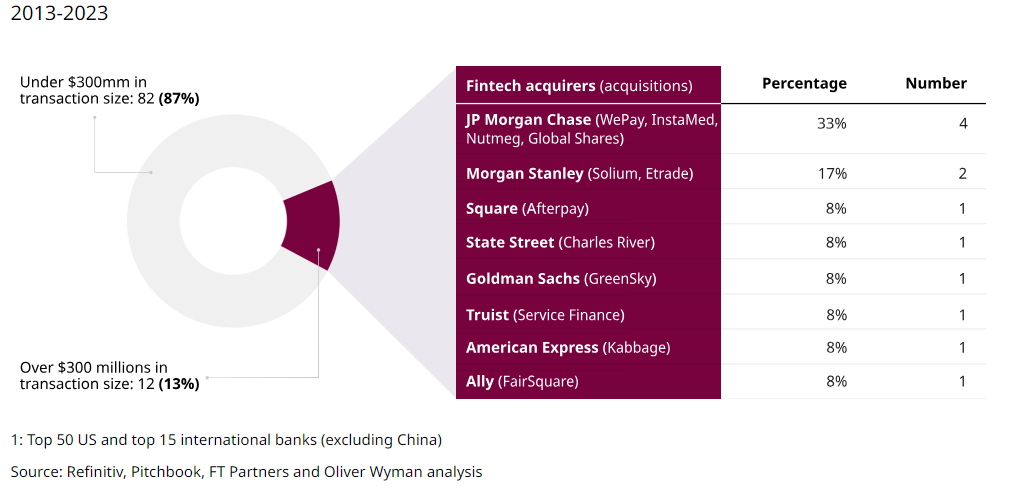

A new report by Oliver Wyman found that top banks made up less than 1% of all fintech acquirers (see figure 1) over the last ten years, and that fintech acquisitions in the “wealth and capital markets” category by banks made up 18% of their overall fintech acquisitions in the same period (see figure 2). Only 13% fintech acquisitions by top banks were over the $300 million in transaction size, and anaylis of the findings shows only one, State Street’s acquisition of Charles River Systems, a provider of management management front office tools and solutions, falls under the capital markets space.

Figure 1: Top banks make up less than 1% of all fintech acquirers

Figure 2: Few fintechs acquisitions by top banks were over $300 million

Deal sizes for fintech acquisitions by banks are generally small, with only 13% of transaction over $300 million in size (a figure cited by experts as the dividing line between major and minor fintech deals). Larger deals in the wealth and capital markets space included State Street’s acquisitions of Charles River for $2.6 billion announced July 2018, Morgan Stanley’s acquisition of E*Trade for $13 billion announced February 2020 and JP Morgan Chase’s acquisition of Nutmeg, a UK digital wealth manager for a reported ~£973 million, announced June 2021. The research found that overall, most deals focused on tuck-in capabilities easier to integrate into the bank.

The research grouped acquired fintech capabilities into five main categories, with wealth and capital markets combined as one category, making up 18% of the overall fintech acquisitions by banks in the last decade.The group of banks analysed included the top 50 US and top 15 international banks excluding China.

The report noted that while all acquisitions are risky, Oliver Wyman believes the current environment provides an opportunity for banks to explore strategy fintech M&A.Adding, there are fintech deals worth exploring to acquire capabilities essential to organic growth in future, and banks that fail to succeed in traditional banking MA may be able to generate value through successful navigation of the fintech market.

In the full report Oliver Wyman examines the last decade of fintech growth and expansion through the lens of M&A between banks and fintechs, combining transaction analysis with expert insight from startup founders, bank corporate development executives and fintech investment bankers. The result is a deal-driven look at bank acquisitions of fintech over the trailing 10 years. The paper illustrates the key considerations for both banks and fintechs as the evolve through a shifting landscape.

The new report, “A Comprehensive Analysis of Bank-Fintech M&A: How Bank-Fintech Synergy can Drive M&A Success”, can be accessed here.