コーポレートバンキングにおける新時代の人材戦略の構築

Retooling relationship managers to be trusted advisors

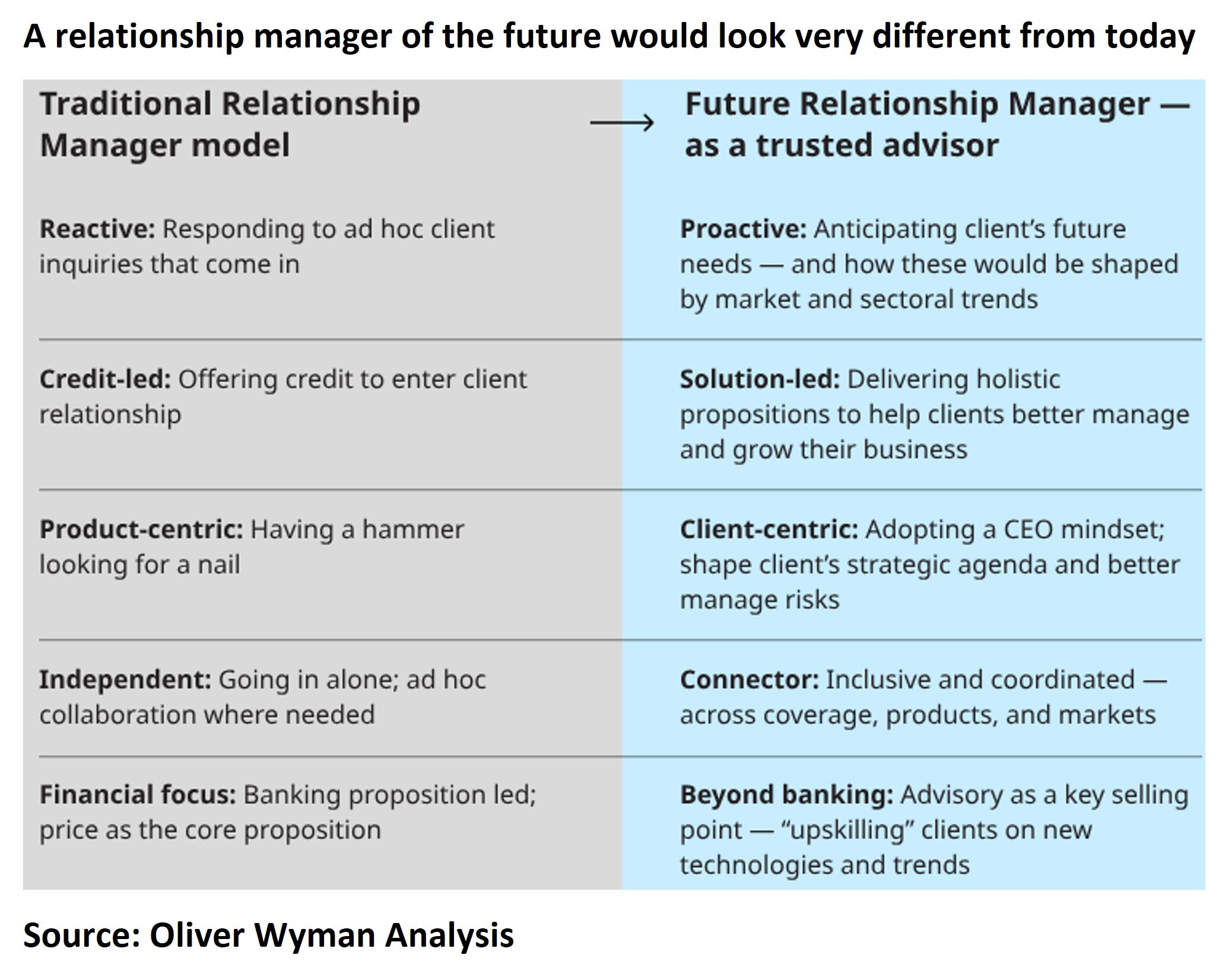

Oliver Wyman’s recent insight, “Building A New Age Talent Strategy In Corporate Banking”, concludes that in today's rapidly changing business environment, bankers and their corporate clients must move beyond a transactional relationship and develop a true partnership. The demand for customized solutions tailored to specific industries is increasing due to global trends such as digitization, supply chain disruptions, and sustainability. Corporate clients now expect their banks to act as strategic long-term partners and provide access to best-in-class products and services. The traditional credit-led relationship between relationship managers (RMs) and corporate clients is becoming outdated.

To remain relevant, RMs must retool their approach and become trusted advisors. Being a trusted advisor involves understanding the client's business and the larger ecosystem in which it operates. It requires staying informed about sectoral and market trends, such as sustainability and digital connectivity and proactively advising clients on how these trends will impact their future business and needs.

In order to build strong and lasting client relationships, it is important for banks to train their relationship managers to become strategic advisors. This is especially crucial in today's rapidly changing financial landscape, where geopolitical tensions and the need for decarbonization are becoming more prominent. Clients will rely on their banks for guidance in navigating these complexities. By equipping relationship managers with the skills of strategic advisors, banks can position themselves as valuable partners in helping clients understand and address the financial implications of geopolitical shifts and decarbonization efforts.