AIと生成AIの見分け方

Since the emergence of widely available Gen AI (aka Generative AI) solutions (OpenAI’s ChatGPT, Google’s Gemini, Anthropic’s Claude, Meta’s Meta AI, and others), there has been a fair amount of confusion (in the general media and even in some trade media) between what is “AI” and what is “Gen AI.”

Here is a suggestion of how to distinguish between the two.

Artificial Intelligence (AI) is a set of procedures and capabilities that data scientists use to analyze large sets of data and information to guide decision-making. These procedures and capabilities include machine learning, neural networks, deep learning, and machine vision.

- To distinguish Artificial Intelligence, this blog will use the term Making a Decision AI.

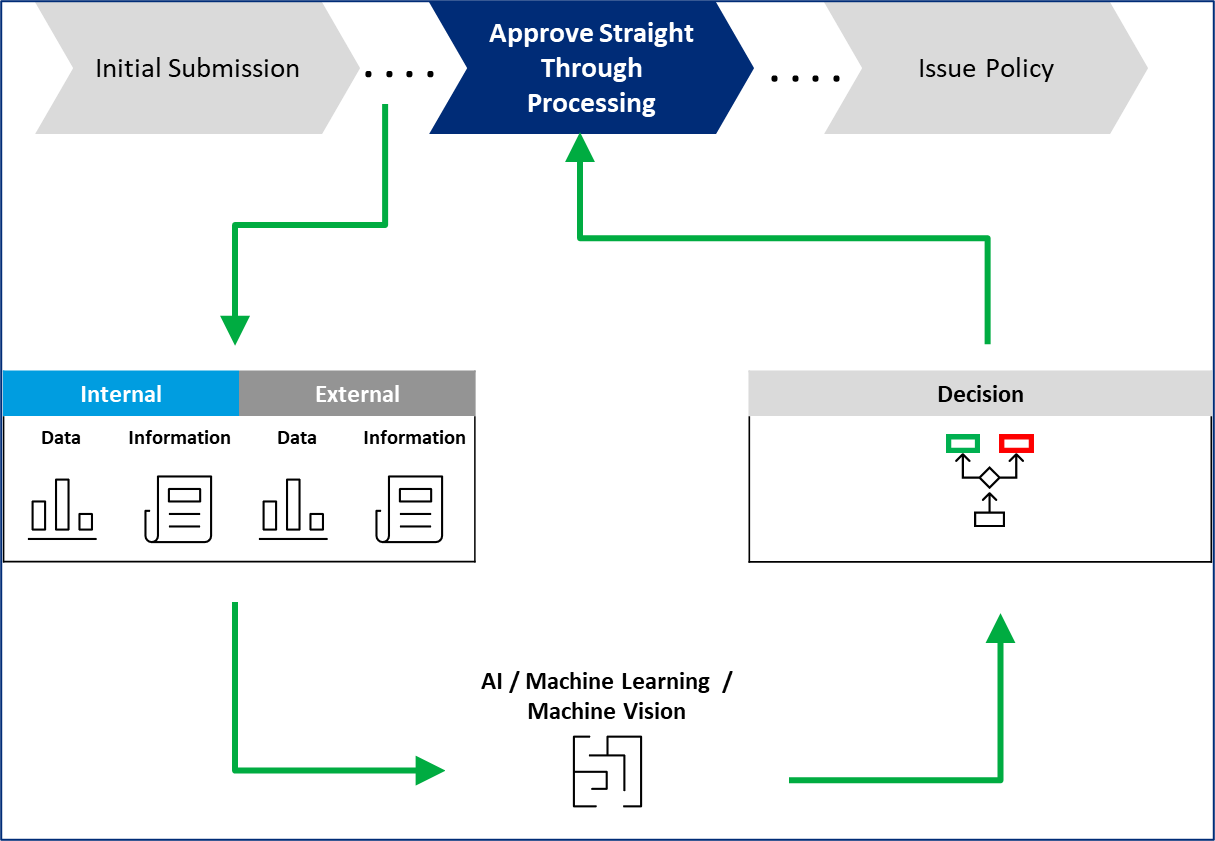

In Figure 1 below, an underwriting group is using Making a Decision AI to determine whether a submission should be straight through processed through the entire underwriting cycle. Various sources of internal and external data and information are analyzed using data science, which in this case leads to a simple “yes, approve straight through processing” decision.

Figure 1. Making a Decision AI

Making a Decision AI could also be used in multiple lower level processes within underwriting. Examples include:

- Determining whether a submission fits into an insurer's appetite

- Analyzing aerial imagery of a property for indications of hazardous material or conditions that would preclude coverage.

Celent has defined Gen AI as “AI systems that can generate new content based on patterns learned from existing data. This can include text, images, music, or other forms of media.”

- To distinguish Gen AI, this blog will focus on the text and data processing capabilities of Gen AI using the term Summarizing and Organizing Gen AI.

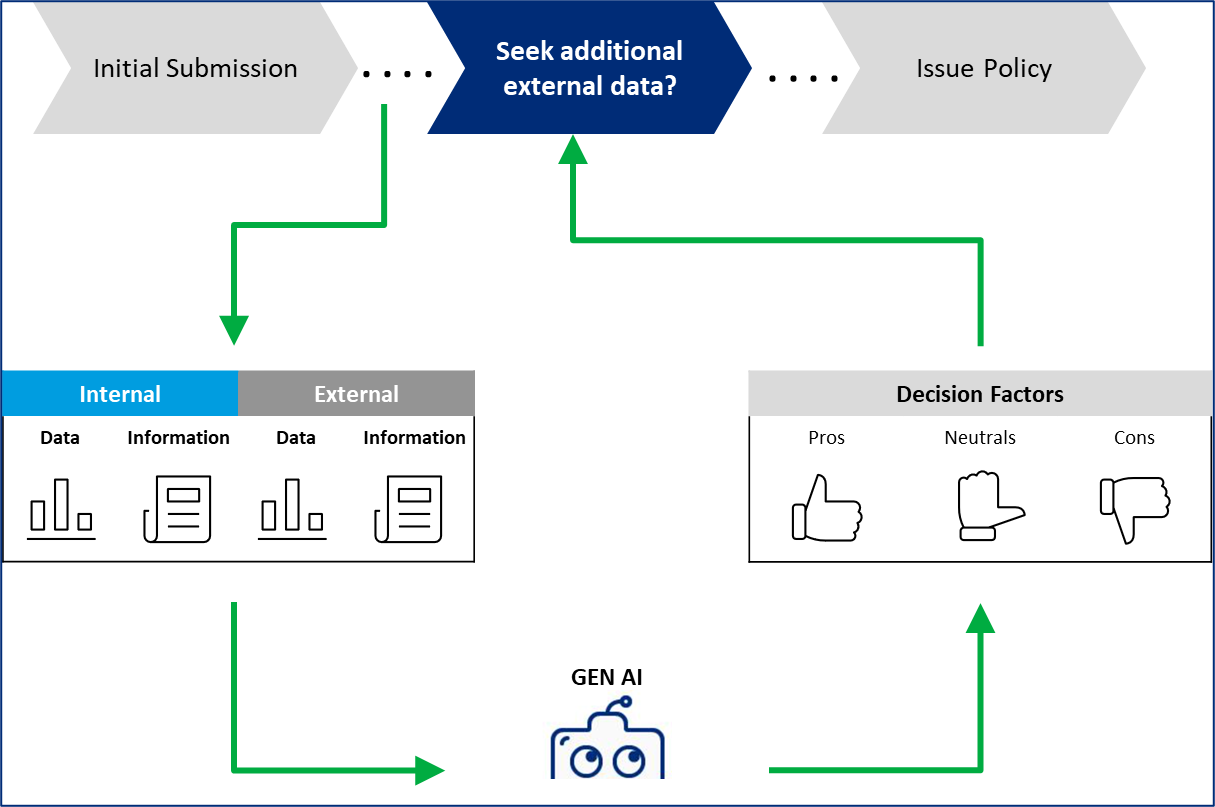

In Figure 2 below, an underwriting group is using Summarizing and Organizing Gen AI to provide a human underwriter with a set of positive, neutral, and negative considerations concerning the advisability of seeking additional external information for a submission. (Accessing such information will likely have financial costs.) To create the positive/neutral/negative set of considerations, a Gen AI system consumes a broad set of currently available internal and external data and information. Making the actual decision (to seek additional external data) remains the responsibility of a human underwriter.

Figure 2. Summarizing and Organizing Gen AI

A well-trained and well-governed Summarizing and Organizing Gen AI system could provide underwriting value in several ways, for example summarizing and organizing:

- Documents in a submission package (loss runs, property addresses, employee counts and types, ownership)

- Internally available data, such as claim experience, location changes during the policy term, or vehicles for renewals

- External data, such as NAICS numbers, D&B reports, and proximity to various environmental hazards

Both Making a Decision AI and Summarizing and Organizing Gen AI can play a value-creating role in multiple insurance processing use cases.

Note: There are other forms of Gen AI which perform other functions: for example, the ability of GitHub Copilot and similar models, which can assist in the creation of program code. These other forms and capabilities are beyond the scope of this blog.