DIMENSIONS: 北米のコーポレートバンキングにおけるITの課題と優先事項:2024年版

Abstract

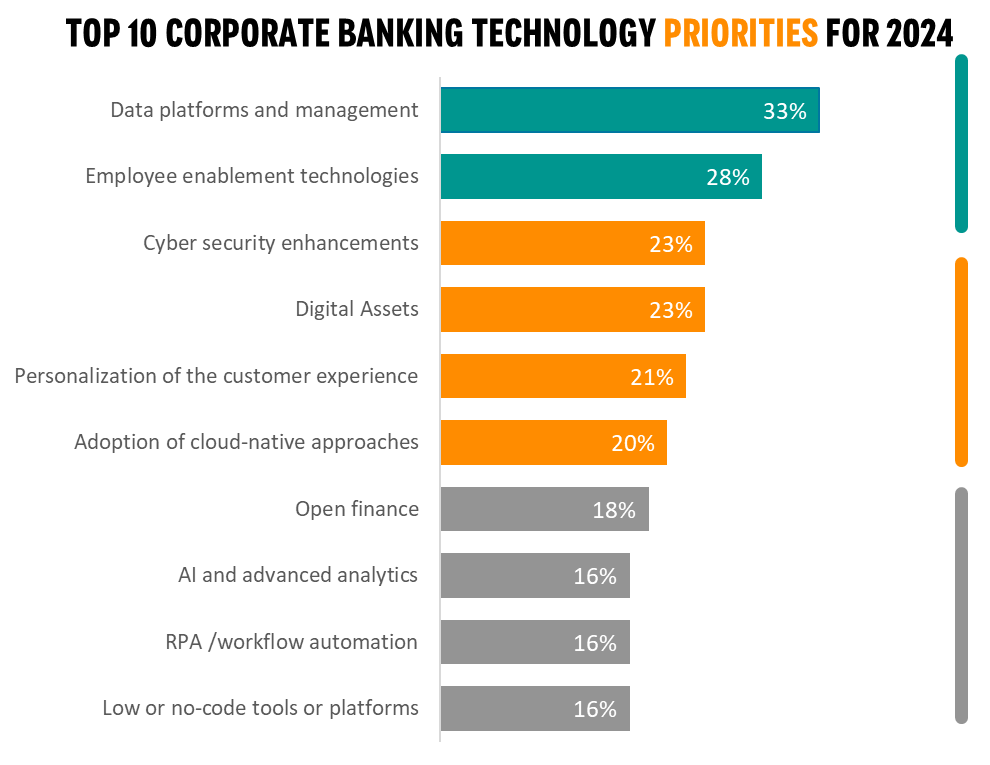

Celent’s overarching theme for corporate banking in 2024 is that future success rests on faster, safer, smarter innovation. Banks must deliver technology solutions faster, within a solid risk framework, and leveraging the capabilities of AI. The question is - do bank’s investments align to the key technologies, and the product priorities that will power growth in North America?

Corporate Banking IT spending continues to grow – even accelerate in most regions – from 2023 through to 2025. Some of these increases will be eroded by inflation, and there is also a clear trend to focus investments to improve how the bank is run rather than toward innovation and growth initiatives. Top level drivers of investment remain relatively unchanged as banks wrestle with compliance and mandate obligations and try to modernize their application and infrastructure real estate.

To understand exactly what this means for the industry, Celent has completed its Dimensions: IT Pressures and Priorities survey for 2025. The views of over 200 corporate banking industry executives worldwide were catured. In this North America edition, over 60 banks of all sizes in in the United States and Canada highlight exactly which technologies, product investments and strategic priorities lead their agendas.

Key findings include:

- Compliance and regulatory mandates is the overall top driver of technology priority

- 60% of technology budgets are allocated to "keeping the lights on" and running the bank

- 70% of banks are confident about their open ecosystem strategy

We recorded a corresponding webinar for the global trends in this research on May 16. You can watch it on-demand today.

Related Research

Dimensions: Corporate Banking IT Pressures and Priorities 2024

Build for Today, but Design for Tomorrow: Modern Architecture for Corporate Banking

Corporate Banking IT Spending Forecasts by Technology, 2023-2028

Technology Trends Previsory Webinar: Corporate Banking; 2024 Edition

Technology Trends Previsory: Corporate Banking 2024 Edition

Corporate Banking Global IT Priorities and Strategy in 2023