SOLUTIONSCAPE:ウェルスマネジメント向け代替投資プラットフォーム

Abstract

The wealth management industry is undergoing a pivotal transformation in embracing alternative and private market investments. Wealth managers, family offices, and HNW/accredited investors are increasing their allocations to alternatives to achieve greater diversification, hedge against inflation, and gain higher returns. Meanwhile, an evolving technology landscape is making alternative investments more accessible, efficient, and customizable.

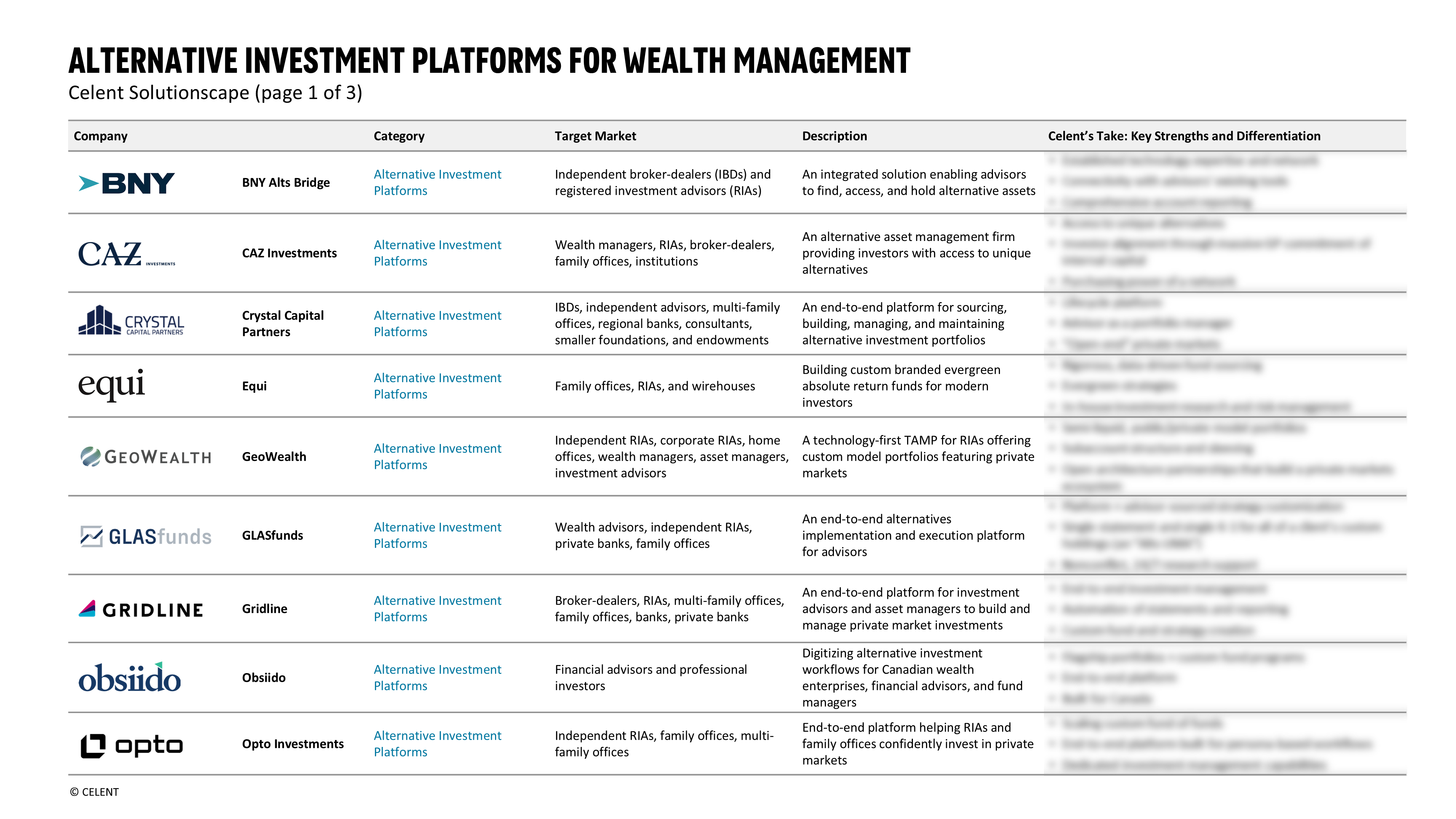

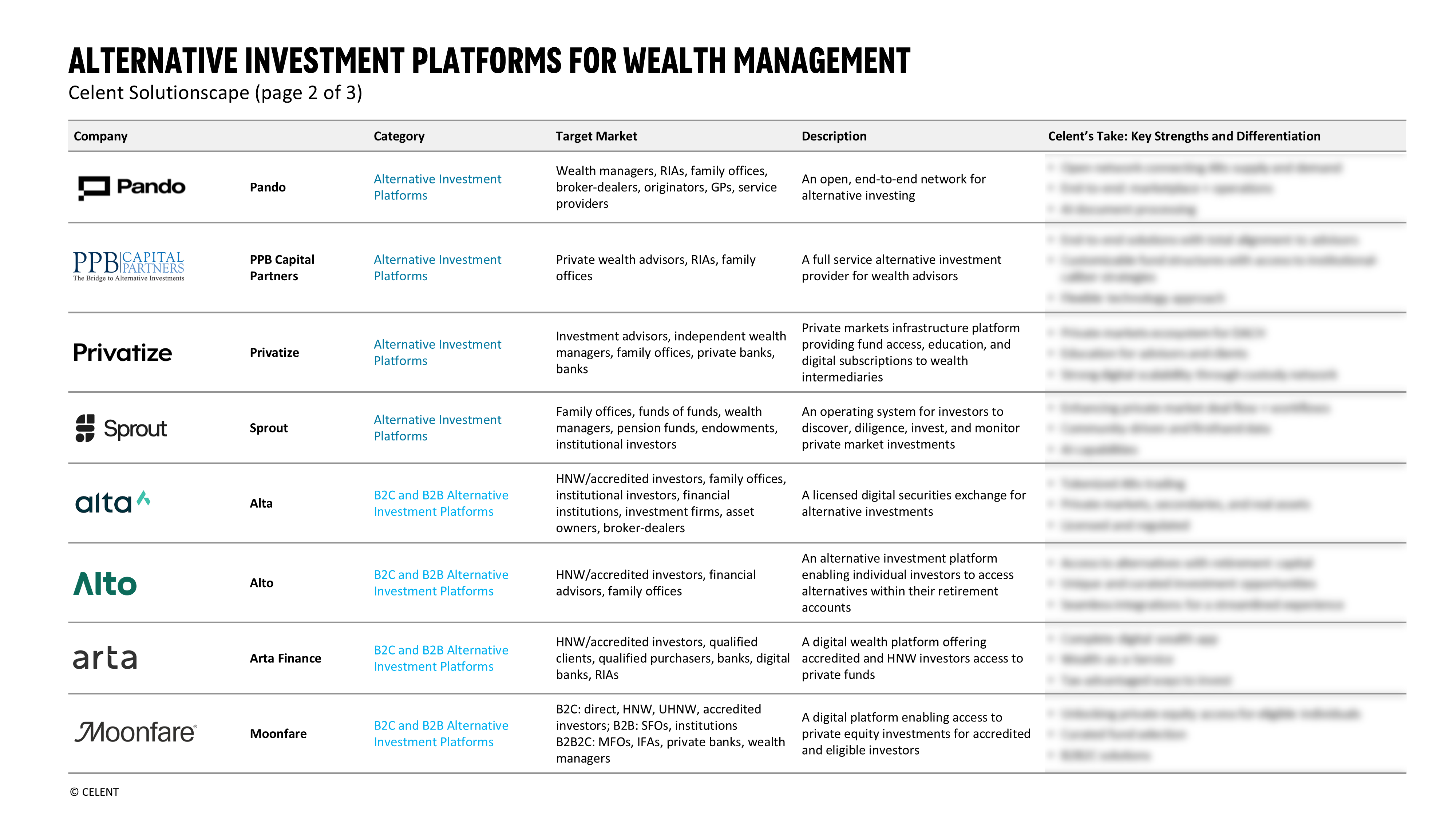

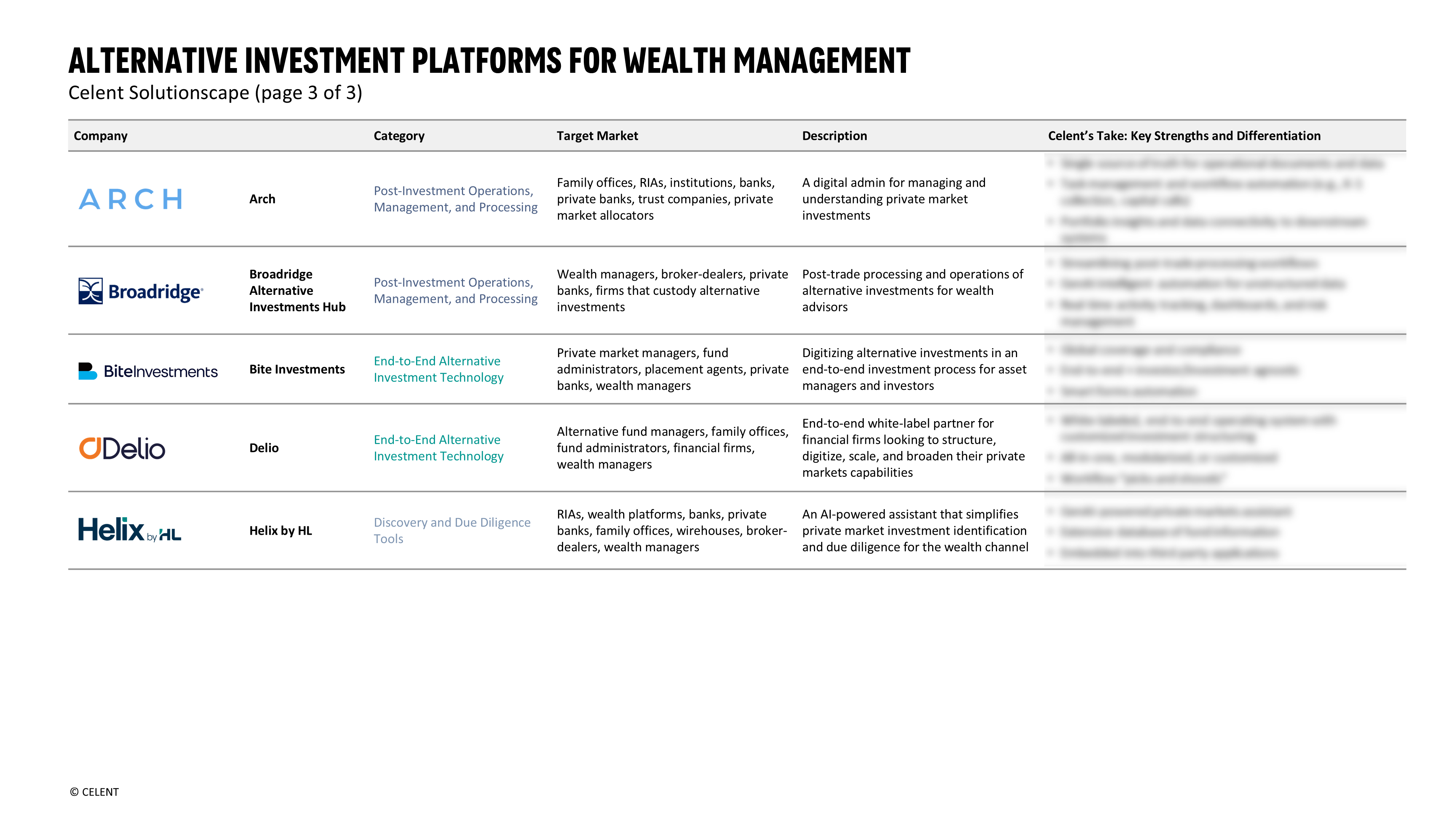

This Celent Solutionscape Report profiles 22 alternative/private market investment platforms and technology providers serving the wealth management channel (wealth management firms, private banks, family offices, RIAs, and HNW/accredited investors). The purpose of this report is to provide an overview of the different solution providers across the alternative investment lifecycle, from pre-investment discovery to subscriptions through post-investment operations. All information is based on Celent interviews with the participating firms and materials provided by the companies.

The following tables describe the 22 solution providers that are enhancing the alternative investment experience for CIOs, financial advisors, operations teams, and individual investors. Below the tables are insights from the report's executive summary on common capabilities and trends surfaced from the 22 companies, which summarize the current state of alternative investment platforms for wealth management:

- End-to-End Platforms for the Entire Investment Lifecycle

- Automation of Workflows for Efficiency and Scale

- Unique Investment Strategies for Diversification and Performance

- Total Wealth: Unifying Traditional and Alternative Investments

Celent subscribers can download and read the entire 90+ report featuring detailed company profiles, comparison tables, and analyst takes on key strengths and differentiation.

End-to-End Platforms for the Entire Investment Lifecycle

Many of the companies profiled in this report are end-to-end investment platforms serving financial advisors across the alternative investment lifecycle. This lifecycle spans pre-investment (education, investment research, sourcing, due diligence), investment (customizing strategies, investor onboarding, subscriptions), and post-investment (performance reporting, tax management, capital calls/distributions).

Example providers include Crystal Capital Partners, Gridline, and PPB Capital Partners, as well as infrastructure providers like Bite Investments and Delio.

What makes end-to-end platforms so important is that they enable wealth management firms and family offices to build, manage, and maintain an entire alternative investment program without worrying about the operational and administrative complexity—all through one platform.

Automation of Workflows for Efficiency and Scale

Alternative investment platforms and tech providers are streamlining operational workflows through intelligent automation, document processing, and AI. Providers are bringing document automation to onboarding, subscriptions, performance reporting, tax management (e.g., K-1s), and capital calls and distributions processing.

Many investment platforms are purpose-built to enhance the workflows of CIOs, financial advisors, and operational teams. Examples include Opto Investments, GLASfunds, and Sprout. Post-investment tech providers specialize in the operational efficiency of reporting, statement consolidation, and tax management (e.g. Arch).

Generative AI brings further innovation to alternative investment workflows. Example providers leveraging GenAI include the Broadridge Alternative Investments Hub, Helix by HL, Obsiido, and Pando.

Unique Investment Strategies for Diversification and Performance

With so many investment platforms to choose from, providers are offering unique investment strategies that differentiate their product offerings. These strategies are intended to bring further diversification, liquidity, and the potential for enhanced returns to clients’ alternative portfolios.

One example is the emergence of semi-liquid and evergreen investment funds that enable opportunities for greater liquidity. Example providers include Equi and Privatize. Another strategy gaining traction is GP stakes, where investors purchase a minority stake in a private equity or private credit firm (e.g., CAZ Investments).

Investment platforms serving both B2C and B2B wealth channels are offering unique investment opportunities, including crypto (e.g., Alto), secondaries (e.g., Moonfare), and tokenized assets (e.g., Alta).

Total Wealth: Unifying Traditional and Alternative Investments

While it is still early, the wealth management industry is starting to see greater synthesis between traditional (public) and alternative (private) investments.

Platforms are strengthening their integrations with downstream reporting and portfolio management systems to enable advisors to view their clients’ total wealth picture of both public and private investments. One example is the newly launched BNY Alts Bridge and its integrations with BNY Pershing’s Wove and NetX360+ platforms.

Providers are now combining public and private investments to create hybrid funds and strategies (e.g., GeoWealth’s unified managed account technology allowing asset managers to create semi-liquid, public/private model portfolios within a single account).

On the B2C side, we’re seeing the combination of private market fund access with public investing and other financial services (e.g., Arta Finance).