生成AIの活用:ポートフォリオの構築を加速

2024/08/06

アドバイザーおよび個人投資家向け

Abstract

- 生成AIを含むAI技術は、ポートフォリオ構築の効率性と有効性を大きく向上させる可能性を秘めているが、使用する際には対処すべき規制上および倫理上の重要な考慮事項がある。

- ウェルスマネジャーは、今後2年間のうちにミドルオフィス (具体的には、ビジネスインテリジェンス・アナリティクス部門と投資部門) は生成AIによる影響を最も受けることになると考えている。これらはアドバイザーが意思決定を行う部門であることから、短期的に予想される影響が平均的に最も高い。こうしたユースケースの上位には、業務管理や投資リサーチのための情報分析およびAIアシスタントが含まれている。しかし、AIエージェントを導入すれば、これは自ら行動を起こすことができるため、ワークフローを再考して最適化する機会が得られる。こうしたユースケースがポートフォリオの構築において生まれようとしている。

- カスタマイズされたポートフォリオは、現在の投資家が期待しているアプローチの中核にあるものであり、こうした期待は隣接業界で高まっているパーソナライズされた商品に対する期待と一致している。データ管理戦略の向上とテクノロジーの進歩により、カスタマイズされたポートフォリオの実現可能性と拡張性は向上している。

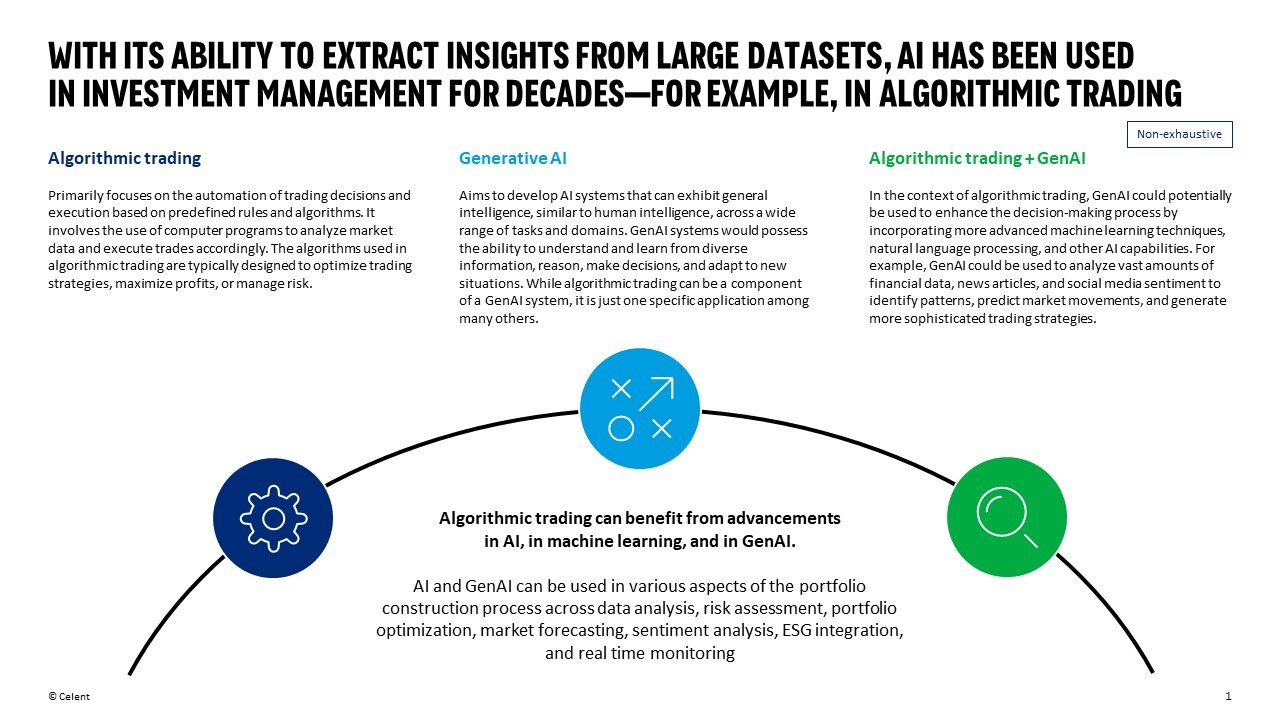

- 大規模なデータセットから知見を抽出する能力を持つAIは、アルゴリズム取引などの投資管理で何十年も前から利用されてきた。こうした中、生成AIはポートフォリオ構築の未来を形成する上でますます重要な役割を果たすと期待されている。しかし、生成AIを使って個人投資家に金融面の助言を提供するというアイデアはまだ概念的なものであり、ユースケースが生まれている段階である。

- 生成AIの活用にあたっては、規制上のハードルと倫理的配慮に対処するのが重要である。さらに、生成AIは多くの分野で優れているが、特定のユースケースでは、従来の統計モデルやAIモデルを含む他の確立されたモデルのパフォーマンスの方が生成AIを上回る可能性があるということを認識することも重要になる。

- AI technologies, including Generative AI, have the potential to greatly enhance the efficiency and effectiveness of portfolio construction. However, there are important regulatory and ethical considerations that need to be addressed.

- Wealth managers believe the middle office is where GenAI will have the greatest impact in the next two years– specifically in business intelligence and analytics and investment functions. These areas have the highest average expected impact ratings for the near-term, likely because they are where advisor decision-making takes place. Top uses cases include information analysis and AI assistants for practice management and investment research. However, AI agents can act, creating an opportunity to reimagine and optimize workflows; use cases are emerging in portfolio construction.

- Customized portfolios is a core expectation for today’s investor, which aligns with their expectations in adjacent industries for personalized products. Customized portfolios are more attainable and scalable due to improved data management strategies and advancements in technology.

- With its ability to extract insights from large data sets, AI has been used in investment management for decades, for example, in algorithmic trading. GenAI is expected to play an increasingly valuable role in shaping the future of portfolio construction but using GenAI to provide financial advice to retail investors is still conceptual. Uses cases are emerging.

- Regulatory hurdles and ethical considerations are significant. Additionally, GenAI excels in numerous areas, but it is important to acknowledge that other well-established models, including traditional statistical models and AI models, may outperform GenAI in certain use cases.