ウェルスマネジメントの視点から見た顧客エンゲージメント

The second quarter of 2021 has been generally positive, as highlighted by the remarkable resilience of public companies on the S&P 500, resulting in record earnings. However, large parts of North America and Europe are still recovering from an economic, medical, and social perspective. All this has reaffirmed the permanence of virtual collaboration, warranting further investment in digitization and hybrid advice models. Digitization was a core theme of 2020 but Celent Wealth Management believes that 2021 will be defined by democratization. We see this echoed in the consolidation activity occurring between brokerages and fintechs, leading to greater investor accessibility for Mass Market and Mass Affluent clients. Increased investment in data/analytics, portfolio construction techniques, and digital communication is enabling advisors to deliver on hybrid advice models at scale. At the same time, zero commission, fractional share trading, and automation has allowed for account minimums to come down, appealing to investors of all asset classes.

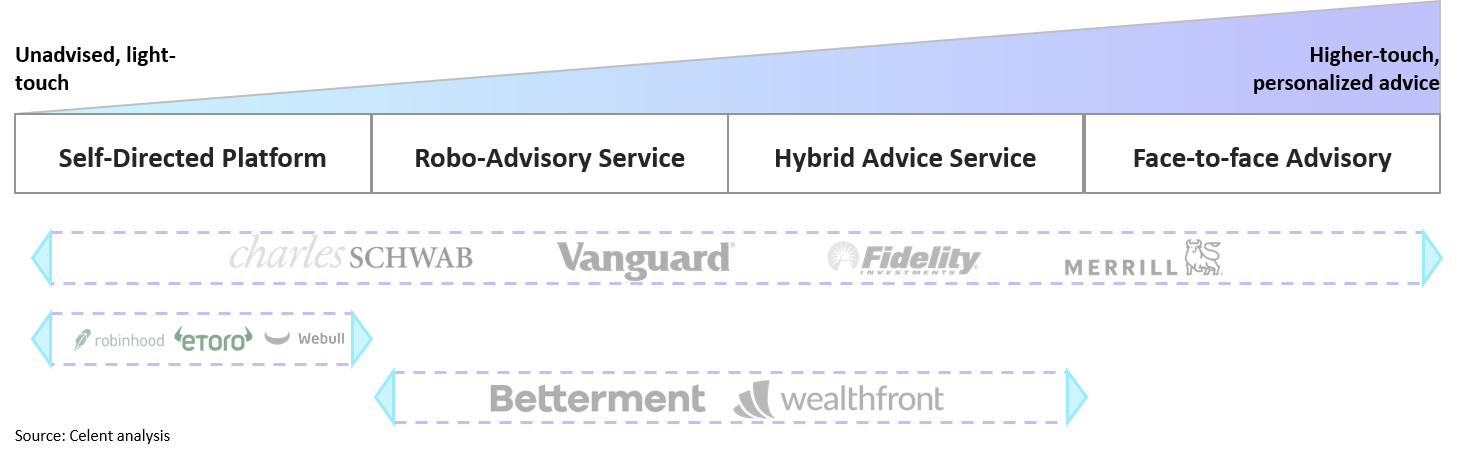

Self-directed, robo-advisory, and incumbent players are taking action by expanding their offerings across the full spectrum of brokerage services. Firms are interested in servicing clients as their assets grow and transition the accounts into higher-margin advisory solutions while benefiting from the net interest revenue as the account grows.

To learn more about brokerage modernization and retail investor democratization, please access my latest report Dawn of the Market of the Apes.